ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Nike’s Tax Avoidance Response Does not Dispute It Paid $0 in Federal Income Tax

April 19, 2021 • By Matthew Gardner

It was (allegedly) P.T. Barnum who first said “there’s no such thing as bad publicity.” But the public relations professionals at the Nike Corporation clearly disagree with this maxim. Last week, after multiple media outlets, including the New York Times, wrote about ITEP’s conclusion that Nike avoided federal corporate income taxes under the Trump tax law, the company contacted these news organizations to… change the subject.

Policy Matters Ohio: House Budget chooses tax cuts over more support for key public programs

April 15, 2021

The 2022-23 state budget presents Ohio lawmakers with an opportunity to rebuild communities so all people, no matter what they look like or how much money they have, can thrive and succeed. But instead of using all available options to support communities, the Ohio House Republican majority proposed a budget that would cut income taxes […]

California Budget & Policy Center: Promoting Racial Equity Through California’s Tax and Revenue Policies

April 15, 2021

Legacies of historical racist policies and ongoing discrimination in areas such as education, employment, and housing have barred many Californians of color from economic opportunities. As a result, Californians of color — particularly Black, Latinx, and American Indian Californians — are less likely to have high incomes and to have built enough wealth to be […]

Jacobin: Never Trust a CEO Who Says They Want to Help

April 15, 2021

Meanwhile, at least twelve corporate members of the Business Roundtable paid nothing in federal taxes last year, according to the advocacy group Patriotic Millionaires’ review of data compiled by the Institute on Taxation and Economic Policy. Read more

Washington Post: Biden proposals may not guarantee all Fortune 500 corporations pay federal income taxes, experts say

April 15, 2021

Of the 55 corporations that did not pay federal income taxes in 2020, only five had more than $2 billion in net income, according to the report by the Institute for Taxation and Economic Policy, a left-leaning think tank. That means the overwhelming majority of them would not be subject to the book tax. Matt […]

Washington Post: Opinion: Americans are liberals on taxes, living under a conservative system

April 15, 2021

When you combine all the kinds of taxes people pay, you see the system is almost flat. As this report from the Institute on Taxation and Economic Policy shows, in 2018, Americans in the middle of the income distribution paid 25.4 percent of their income in taxes, while those in the top 1 percent paid […]

Los Angeles Times: Column: California Democrats have a chance to flex some muscle and work to restore deductions for taxpayers

April 15, 2021

Standard deductions were nearly doubled and so were child credits. Importantly for many upper-middle-class Californians, the alternative minimum tax was significantly lowered. The Institute on Taxation and Economic Policy reports that if the caps were eliminated, half the savings for California would go to the richest — the top 1%. Read more

NC Policy Watch: Some simple truths about the taxes corporations pay and Biden’s proposal blow the whistle on them

April 14, 2021

Discovery No. 1 one is that almost no major U.S. corporation, certainly not those that do business overseas, actually pays the 21% corporate tax rate, set by law. In fact, on average, Fortune 500 companies pay about half that much – 11.3% according to the non-profit Institute for Taxation and Economic Policy and Taxation, working […]

The News-Gazette: Jim Dey | Once scourge of rich, governor’s now their defender

April 14, 2021

That’s one reason why, in his letter to Biden, Pritzker & Co. ignored higher earners, complaining that “middle class Americans are struggling under this federal tax burden.” That’ s just not so, according to the left-leaning Institute on Taxation and Economic Policy. It concluded that “62 percent of the benefits would go to the richest […]

City & State (NY): Correcting disinformation about the excluded workers fund

April 14, 2021

Technically, no employee in New York pays into unemployment as it’s a tax on employers, but their employment is what leads to the pay-ins. While it’s impossible to know whether every person who will receive benefits has paid state, local or federal taxes, the available research shows that the majority of undocumented immigrants do pay […]

NC Policy Watch: New report: NC tax policy promotes racial inequities in numerous ways

April 14, 2021

North Carolina’s tax code and budget are wrought with such policy choices, which can result in racist outcome that worsen barriers to well-being for people and communities of color, according to new data from the Institute on Taxation and Economic Policy (ITEP). The greater tax load carried by Black, Indigenous, and Latinx residents has been […]

Nonprofit Quarterly: Pressure to Tax Corporations Rises as Infrastructure Gaps Come into Full View

April 14, 2021

The bottom line: As research conducted by the Institute on Taxation and Economic Policy (ITEP) illustrates, at least 55 major US corporations that had a combined total of $40.5 billion in profits paid $0 in federal corporate taxes. If they had paid the current corporate tax rate of 21 percent, their tax bill would come […]

420 Intel: Considering Opportunities for the Upcoming Federal Taxation of Cannabis

April 14, 2021

According to the Institute on Taxation and Economic Policy, “state and local excise collections on retail cannabis sales surpassed $1 billion for the first time in 2018.” This rapid growth is aligned with the acceptance of medical and recreational cannabis, and the efforts states are putting in to help discourage purchasing cannabis from unlicensed and […]

Common Dreams: Jayapal Calls for Crackdown on Wealthiest After IRS Chief Says Tax Evasion Costs US $1 Trillion a Year

April 14, 2021

Furthermore, another recent study by the Institute on Taxation and Economic Policy (ITEP) showed that 55 U.S. corporate giants paid $0 in federal income taxes last year, and 26 of them haven’t paid a dime for the past three years—a time period in which the GOP’s “morally and economically obscene” tax cuts for corporations and […]

The Cap Times: Plain Talk: It’s time to fix America’s infrastructure — and make corporations help pay for it

April 14, 2021

The Institute on Taxation and Economic Policy, a Washington-based research group that keeps tabs on such things, reported earlier this month that at least 55 of America’s largest corporations paid no federal income taxes last year. While the 2017 Trump administration’s tax “reform” reduced the federal corporate tax rate from 35% to 21%, dozens of […]

Wealth Management: What CRE Opportunities Await if the American Jobs Plan is Enacted?

April 14, 2021

Some in corporate America are critical of Biden’s proposed plan because it would be paid for raising the corporate tax rate from 21 percent to 28 percent. Nevertheless, corporations would still pay less under this proposal than they paid prior to the Trump Administration’s 2017 tax cuts and the benefits of infrastructure improvements to corporate […]

Willamette Week: Nike’s Tax Bill in Oregon Is a Secret. We Asked Three Analysts to Make an Estimate.

April 14, 2021

The breakdown of that percentage among states is impossible to know, [Matthew Gardner, ITEP Senior Fellow] says, especially considering not every state has the same single-factor corporate tax structure that Oregon has: “We cannot say how much of [Nike’s] income, or that tax, is attributable to Oregon.” Read more

Arizona Center for Economic Progress: Arizona’s regressive tax policy contributes significantly to economic and racial injustice

April 13, 2021

Tax policy plays a role in the fight for economic and racial justice. The type of tax and how it is structured matters. A new report issued by the Institute for Taxation and Economic Policy (ITEP), Taxes and Racial Equity , explains how historical and contemporary policy choices have resulted in tax codes that maintain […]

The Commercial Appeal: FedEx CEO: Don’t raise corporate taxes to pay for Biden’s infrastructure plan

April 13, 2021

The Institute on Taxation and Economic Policy published the report earlier this month, saying FedEx had an effective tax rate of minus -12.8% from 2018 to 2020. The report cited a provision in the CARES Act bill passed in the COVID-19 pandemic’s early stages, along with the 2017 Tax Cuts and Jobs Act passed under […]

CNBC: New $3,000 Child Tax Credit to Start Payments in July, IRS Says

April 13, 2021

About 83 million children live in households that would benefit from the expansion of the child tax credit, according to a study from the Institute on Taxation and Economic Policy. In addition, the poorest 20% of families would see income increase by more than 37% during the year that the policy is in place. Read […]

North Carolina Justice Center: State Tax Policy Is Not Race Neutral

April 13, 2021

North Carolina’s tax code and budget are wrought with such policy choices, which can result in racist outcomes that worsen barriers to well-being for people and communities of color, according to new data from the Institute on Taxation and Economic Policy (ITEP). The greater tax load carried by Black, Indigenous, and Latinx residents has been […]

What to Expect from Biden and Congressional Democrats on Tax Increases for Individuals

April 8, 2021 • By Steve Wamhoff

The Biden administration has already provided details on its corporate tax proposals and in the next couple of weeks is expected to propose tax changes for individuals. Meanwhile, congressional Democrats have some ideas of their own. What should we expect?

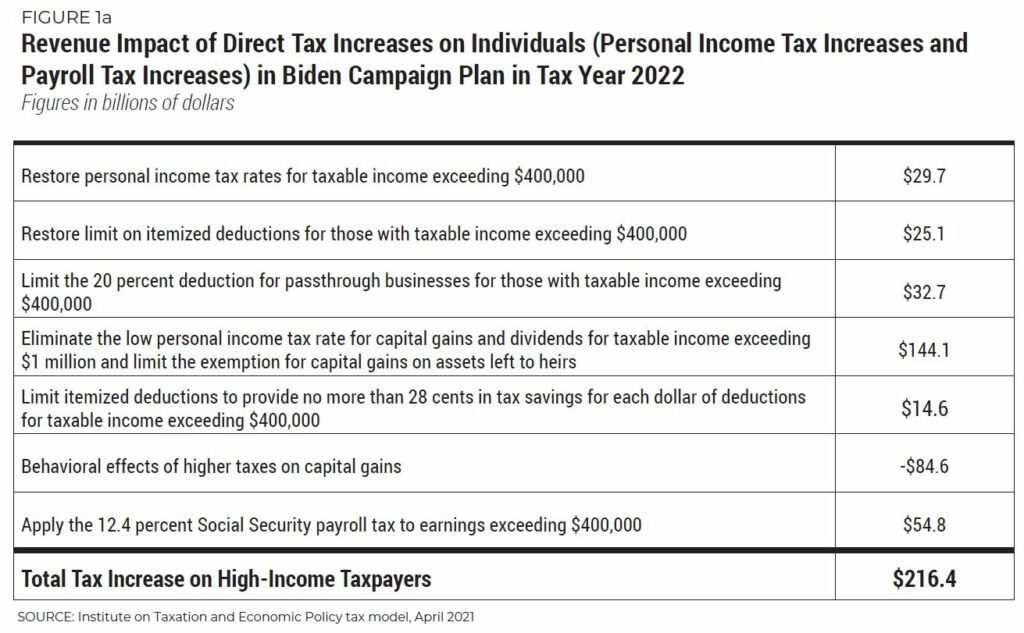

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

The High Cost of Corporate Tax Avoidance (Webinar)

April 8, 2021 • By Amy Hanauer, ITEP Staff, Matthew Gardner

When communities thrive, so do corporations. But when profitable corporations build their empires by exploiting the tax code, it is workers, the environment and our communities—not CEOs or shareholders—that are harmed. Amazon posted its highest U.S. profit ever for 2020, an unprecedented year defined by a pandemic. Yet the company sheltered more than half its profits from corporate taxes—legally. While the company may be one of the most recognizable tax avoiders, it's not an outlier.