ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Corporate tax avoidance boosts companies’ bottom lines, and this benefits the owners of corporate stocks, which are mostly concentrated in the hands of the well-off. The cost of corporate tax dodging is borne by everyone, in several different ways.

Bloomberg Tax: HILL TAX BRIEFING: Extenders, Tax Law Fixes Make Year-End Deal

December 17, 2019

Corporate Tax Bills: Profitable U.S. companies in 2018 paid an average effective tax rate of 11.3%, far lower than the statutory 21% rate, according to a report released yesterday by the Institute on Taxation and Economic Policy. Nearly 100 companies, including Amazon.com Inc., didn’t pay federal income taxes on their 2018 U.S. income, according to the report. Read […]

Democracy Now!: Report: 91 Fortune 500 Companies Effectively Paid No Federal Taxes in 2018

December 17, 2019

A new study reveals how 91 of the Fortune 500 companies effectively paid no federal taxes in 2018. The study by the Institute on Taxation and Economic Policy shows how Amazon, Starbucks, Chevron, Duke Energy, Halliburton and others paid an effective federal tax rate of zero percent or less. Link

Bloomberg Tax: Tax Perk to Boost Investment May Work—For Small Businesses

December 17, 2019

The 2017 tax law allowed businesses to use full expensing, or 100% bonus depreciation, for both new and used assets, a benefit that begins phasing out in 2023. Republicans heralded it as a provision that would lead to a flood of new business investment that would buoy economic growth. But some say it incentivizes investment […]

Washington Examiner: Amazon, Netflix, and Starbucks Paid $0 in 2018 Federal Income Taxes

December 16, 2019

A new study by the Institute on Taxation and Economic Policy found that many of America’s largest corporations paid $0 in federal income taxes under the first year of President Trump’s tax law in 2018. Notable corporations in the study included Amazon, Netflix, Starbucks, Delta, Halliburton, and General Motors. Read more

Yahoo Finance: 91 Profitable Fortune 500 Companies Paid $0 in Taxes in 2018 under Trump’s Tax Law

December 16, 2019

Matthew Gardner, senior fellow at ITEP and lead author of the report says that what companies doing is “entirely legal”, but that they can avoid paying taxes thanks to tax breaks. “A whole host of tax breaks in the code collectively have this pernicious effect,” Gardner said. But he added, though legal, “this doesn’t exonerate […]

Des Moines Register: Richest Iowans Saw Most of the Benefit from 2017 Tax Cuts, Study Finds

December 16, 2019

No group in Iowa benefits more from the 2017 federal tax cuts than the wealthiest 1%, according to a new research paper from the left-leaning Iowa Policy Project. With an average annual income of $1 million, each member of that group receives tax cuts worth about $35,000 a year. In all, they receive a quarter of the total […]

The American Independent: 91 Major US Companies Paid Zero Federal Taxes Last Year Thanks to the GOP Tax Law

December 16, 2019

A total of 91 of the largest companies in the United States paid zero dollars in federal income taxes in 2018 under the tax law passed by Donald Trump and his Republican allies in Congress. A new analysis released by the Institute on Taxation and Economic Policy (ITEP) on Monday found that Fortune 500 companies were able […]

Tulsa World: 91 Big Companies Paid No Federal Taxes Last Year. And Others Paid Less Than New, Lower Rates for Firms

December 16, 2019

“Profitable American corporations in 2018 collectively paid an average effective federal income tax rate of 11.3 percent on their 2018 income, barely more than half the 21 percent statutory tax rate,” said the report from Institute on Taxation and Economic Policy. Read more

Common Dreams: Amazon, Chevron, and Starbucks Among 91 Fortune 500 Corporations That Paid $0 in Federal Income Taxes in 2018: Report

December 16, 2019

More than 90 large, profitable corporations on the Fortune 500 list effectively did not pay a penny in federal income taxes in 2018, according to a new report published Monday by the Institute on Taxation and Economic Policy. ITEP examined financial filings from 379 Fortune 500 companies that reported a profit in 2018, the first year President […]

CNBC: These 91 Companies Paid No Federal Taxes in 2018

December 16, 2019

Nearly 100 Fortune 500 companies effectively paid no federal taxes in 2018, according to a new report. The report from the Institute on Taxation and Economic Policy, a left-leaning think tank, covers the first year following the Tax Cuts and Jobs Act championed by President Donald Trump, which was signed into law in December 2017. Read more

Axios: 91 Fortune 500 Companies Paid No Federal Income Tax in 2018

December 16, 2019

91 Fortune 500 companies paid no federal income taxes on their U.S. income last year, according to a report released Monday by the Institute on Taxation and Economic Policy. Why it matters: Some of the companies that paid no federal income tax last year still made billions of dollars — and they include some of the country’s biggest names, […]

Washington Post: Corporations Paid 11.3 Percent Tax Rate Last Year, in Steep Drop Under President Trump’s Law

December 16, 2019

About 400 of America’s largest corporations paid an average federal tax rate of about 11 percent on their profits last year, roughly half the official rate established under President Trump’s 2017 tax law, according to a report released Monday. The 2017 tax law lowered the U.S. corporate tax rate from 35 percent to 21 percent, […]

Chicago Tribune: What Happens to the Weed Black Market when Recreational Marijuana Goes Legal Jan. 1? ‘I See It Opening the Door to More Clients,’ One Dealer Says.

December 16, 2019

Stores selling recreational marijuana will be allowed to operate between 6 a.m. and 10 p.m., though operating hours vary by dispensary. Whether stores truly are convenient will depend on how many are allowed to open and where they can locate, said Carl Davis, research director at the Washington, D.C.-based Institute on Taxation and Economic Policy. […]

SF Gate: These Bay Area Companies Paid Zero Federal Taxes in 2018

December 16, 2019

A new report by the Institute on Taxation and Economic Policy discovered that 91 of Fortune’s top 500 corporations paid no federal income taxes in 2018 — and many actually got money back. The report studied the first year companies were under the Tax Cuts and Jobs Act, signed by President Donald Trump in 2017. The act […]

Fox Business: Many Fortune 500 Companies Paid Half of Trump’s Lower Corporate Tax Rate in 2018: Study

December 16, 2019

President Trump’s sweeping 2017 tax reform law substantially lowered the corporate tax rate, yet a large proportion of Fortune 500 companies paid an effective rate that was nearly half of what was expected of them, new research shows. A number of companies — including Amazon to Starbucks and Chevron — appear to have evaded federal income taxes entirely in […]

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

Fortune 500 Companies Avoided $73.9 Billion in Tax Under First Year of Trump Tax Law

December 16, 2019 • By Matthew Gardner

A comprehensive examination of Fortune 500 companies’ financial filings in 2018, the first year of the Tax Cuts and Jobs Act, finds that the law did nothing to curb corporate tax avoidance, with 91 companies paying $0 in taxes on U.S. income in 2018 and profitable companies overall paying a collective effective tax rate of 11.3 percent, which is barely more than half the 21 percent rate established by the tax law, the Institute on Taxation and Economic Policy (ITEP) said today.

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

Washington Post: A New Report Hands Democrats a Major Weapon Against Trump

December 16, 2019

There is probably no more glaring example of President Trump’s massive betrayal of the economic populist nationalism that infused his campaign than the 2017 tax law. It isn’t just that he signed a massive tax cut that showered most of its benefits on the very highest earners after vowing to take on financial elites. It’s […]

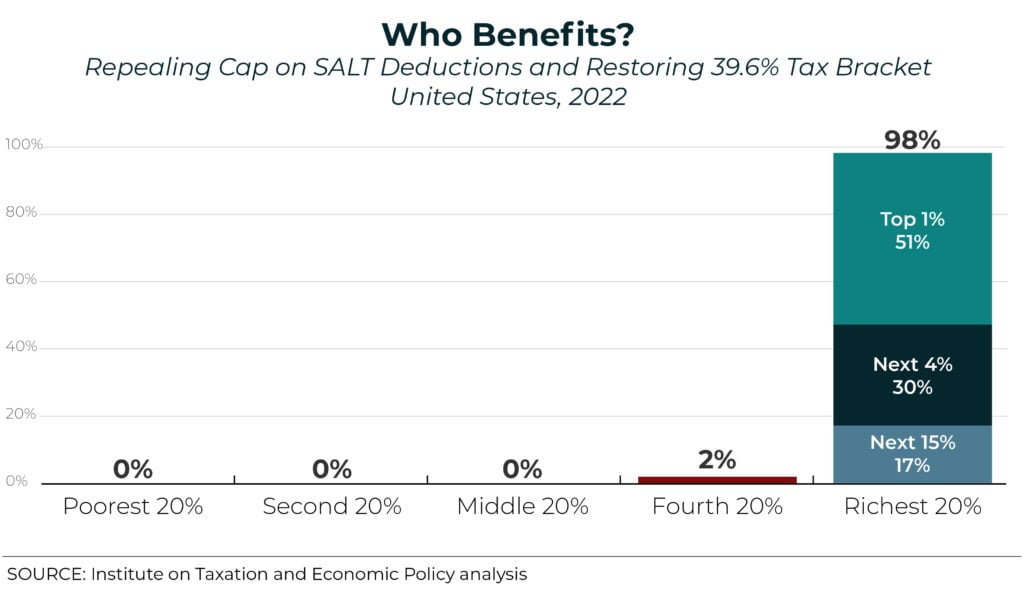

NJ Spotlight: Pascrell, Other House Dems, Introduce Bill to Scrap Federal SALT Cap

December 12, 2019

For example, a new report from the Center on Budget and Policy Priorities estimated that 80% of the benefit of a SALT-cap repeal would go to just the top 5% of tax filers. That followed up on a report released last year by the Institute on Taxation and Economic Policy that estimated 60% of the benefits would […]

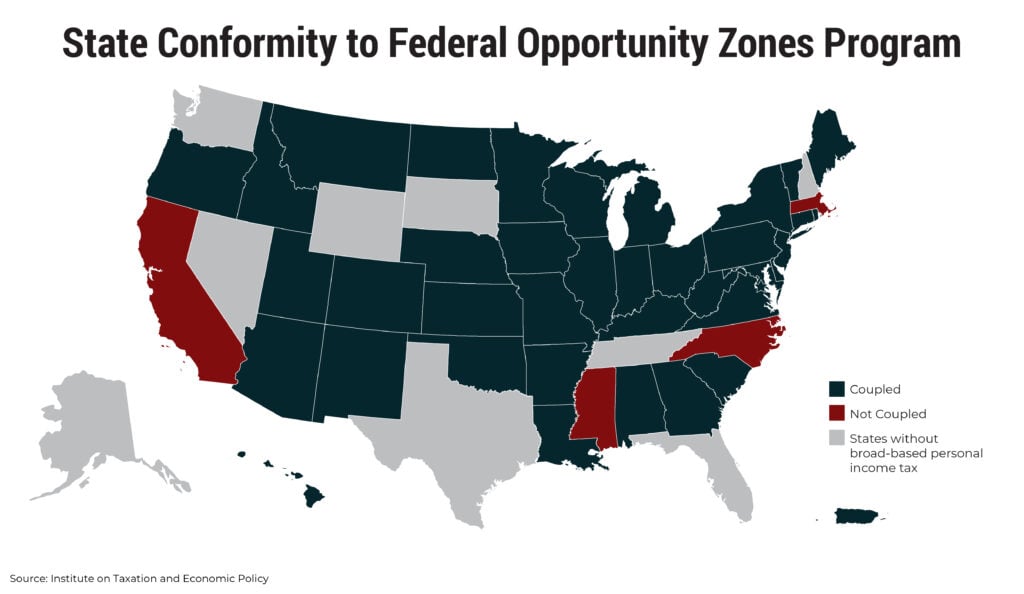

New ITEP Reports Call for the Repeal of Opportunity Zones and Urge States to Decouple

December 12, 2019 • By Lorena Roque

Two new ITEP reports lay bare the irreparable flaws of the federal Opportunity Zones program, created by the Tax Cuts and Jobs Act signed into law by President Trump in 2017.

Opportunity Zones Bolster Investors’ Bottom Lines Rather than Economic or Racial Equity

December 12, 2019 • By Lorena Roque

This policy brief provides an overview of how opportunity zones are designed and highlights some of the flaws of the policy, including the detrimental impact opportunity zones have on communities of color.

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

House Democrats’ Latest Bill on SALT Deductions Would Mean Bigger Tax Cuts for the Rich

December 11, 2019 • By Steve Wamhoff

ITEP estimates show that if the House Democrats' proposal was in effect in 2022, it would have a net cost of $81 billion in that year alone. The estimates also show that 51 percent of the benefits would go to the richest 1 percent of taxpayers in the U.S. Clearly, lawmakers concerned about the SALT cap need to go back to the drawing board.