ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

1964: Unconditional War on Poverty; 2018: Unconditional War on the Poor

August 15, 2018 • By Misha Hill

During his first State of the Union address in January 1964, Lyndon Baines Johnson declared a War on Poverty in response to a national poverty rate of more than 19 percent. The legislative result of this war was an early education program, expanded funding for secondary education, job training and work opportunity programs and the […]

In this illustrated breakdown of the Tax Cuts and Jobs Act (TCJA) and Tax Cuts 2.0, ITEP staff examine TCJA's role in growing income inequality, broken promises from corporations pledging to invest tax savings into workers and wages, and the embarrassment of riches flowing to the wealthiest Americans as a result of these “middle-class tax cuts.”

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Itchy Tax Trigger Finger: Tax Foundation Says Aim Toward Foot

August 6, 2018

Accounting for all the possible curveballs the future economy might throw at our state is impossible. That’s why legislators bother coming together every year to assess our budget and make choices based on the best available, most current information. One dubious new style of tax change, “tax triggers”, attempts to base major future tax and revenue changes only on the information we have today. Tax triggers are dangerous and generally work by automatically kicking in a tax cut when revenue or some other metric reaches a certain level.

Indiana Institute for Working Families: The Status of Working Families in Indiana: 2018 Report

August 1, 2018

Indiana faces a choice of whether to continue down a southward-leading path of low-road policies, or to rebuild its economy for Hoosier families. By adopting a policy agenda for working families that improves Indiana’s jobs with higher wage and labor standards; strengthens protections for Hoosier families including repairing the safety net and crafting consumer and job safeguards; and increases economic mobility through improved access to education, rebalancing the state’s regressive tax and budget structure, and focusing economic development on strengthening Hoosier families and communities, Indiana can reclaim its place as a leader in the Midwest and in the nation.

Cleveland.com: Changes Needed in Ohio’s Tax Policy (Opinion)

July 15, 2018

The Institute on Taxation & Economic Policy has examined the major state tax changes since 2005. For the top 1 percent, who make at least $480,000 a year, the tax cuts average $40,790 annually. Middle-income Ohioans on average have not received a cut, while those in the poorest fifth, earning less than $22,000, got an average increase of $140.

American Federation of Teachers: A Decade of Neglect–Public Education Funding in the Aftermath of the Great Recession

July 15, 2018

“A Decade of Neglect: Public Education Funding in the Aftermath of the Great Recession,” details the devastating impact on schools, classrooms and students when states choose to pursue an austerity agenda in the false belief that tax cuts will pay for themselves.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

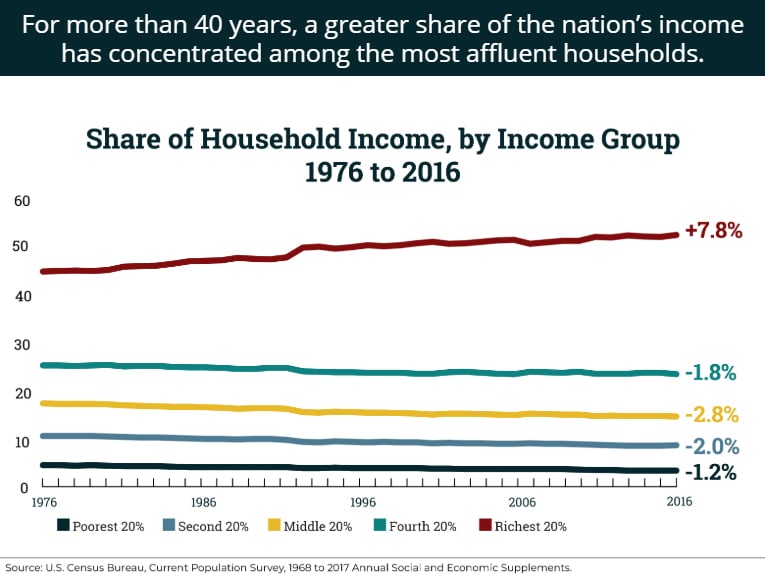

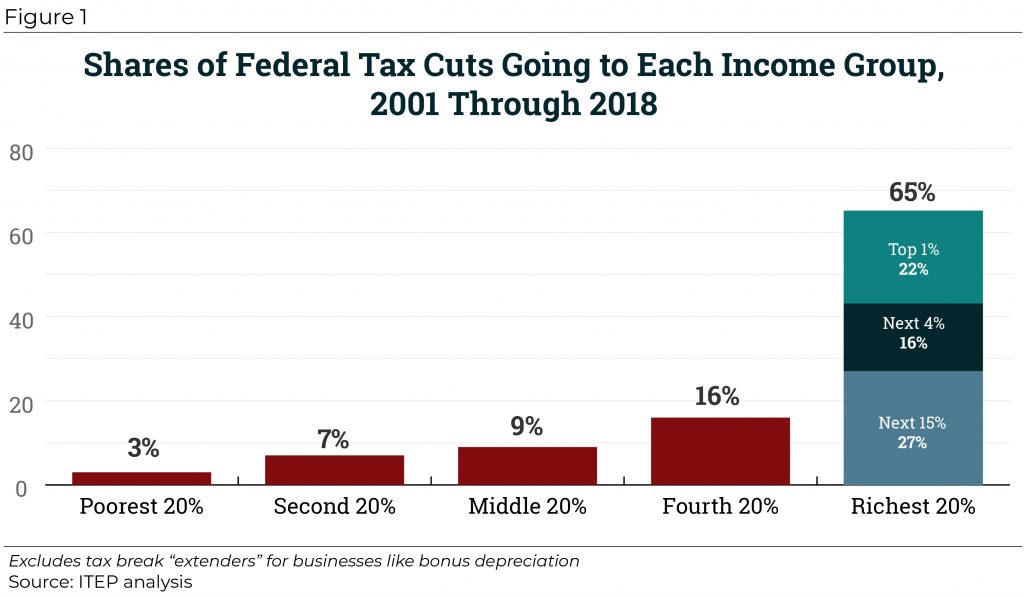

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Building on Momentum from Recent Years, 2018 Delivers Strengthened Tax Credits for Workers and Families

July 10, 2018 • By Aidan Davis

Despite some challenging tax policy debates, a number of which hinged on states’ responses to federal conformity, 2018 brought some positive developments for workers and their families. This post updates a mid-session trends piece on this very subject. Here’s what we have been following:

Ah, summertime – a season synonymous with sunshine, backyard barbecues and mercury rising. Outside of our day jobs analyzing tax policy, we occasionally take a break from our screens to reconnect with the written and spoken word. However you enjoy your summer downtime – visiting your childhood home, lounging at the lake, planning the ultimate […]

Washington Post: N.J. Approaches a Government Shutdown as Democrats Feud Over Tax on Millionaires

June 28, 2018

New Jersey is just days away from a government shutdown over a plan to raise taxes on the rich that has divided Democrats and revealed the political difficulty of raising funds for the party's ambitious social spending goals.

The Other SALT Cap Workaround: Accountants Steer Clients Toward Private K-12 Voucher Tax Credits

June 27, 2018 • By Carl Davis

On May 23, 2018, the IRS and Treasury Department announced that they “intend to propose regulations addressing the federal income tax treatment of certain payments made by taxpayers for which taxpayers receive a credit against their state and local taxes.” They made the announcement in response to new “workaround tax credits” enacted in New York […]

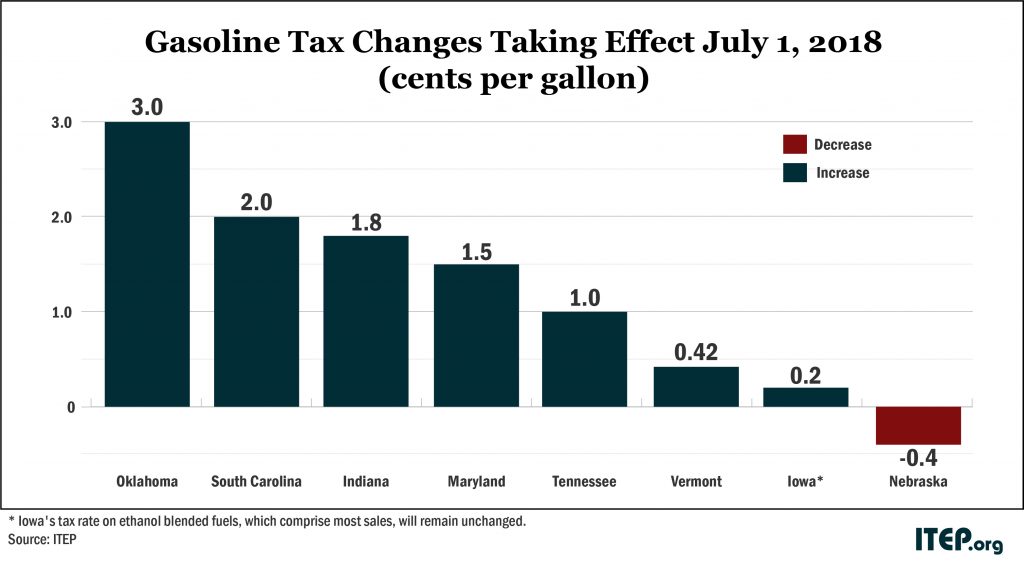

Gas Taxes Rise in Seven States, Including an Historic Increase in Oklahoma

June 26, 2018 • By Carl Davis

A rare sight is coming to Oklahoma. The last time the Sooner State raised its gas tax rate, the Berlin Wall was still standing, and Congress was debating whether to ban smoking on flights shorter than two hours. Fast forward 31 years, and Oklahoma is finally at it again. On Sunday, the state’s gas tax rate will rise by 3 cents and its diesel tax rate by 6 cents. Both taxes will now stand at 19 cents per gallon—still among the lowest in the country. But Oklahoma isn’t the only state where gas taxes will soon rise.

Scene: Policy Matters Ohio Proposes State Income Tax Overhaul to Help Low- and Middle-Income Ohioans

June 26, 2018

After presenting the recommendations contained within a new report Tuesday morning, Policy Matters Ohio researcher director (and the report's lead author) Zach Schiller was asked whether or not Ohio, a "center-right state," would realistically support a tax code overhaul that proposed taxing Ohio's wealthiest at a higher rate.

Policy Matters Ohio: Overhaul: A plan to rebalance Ohio’s income tax

June 25, 2018

Policy Matters proposes the following changes to the state income tax […] This would generate almost $2.6 billion a year, including the cost of expanding the EITC, according to analysis by the Institute on Taxation and Economic Policy (ITEP). Read more here

South Dakota v. Wayfair Decision Brings Overdue Fairness to Retail Sales Tax

June 21, 2018 • By Carl Davis

Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy, regarding the Supreme Court’s decision in South Dakota v. Wayfair. Mr. Davis has authored numerous policy briefs regarding how online retailers that fail to collect sales taxes deprive states of necessary sales tax revenue and maintain an unfair advantage over bricks and mortar retailers.

All Bets are Off: State-Sponsored Sports Betting Isn’t Worth the Risk

June 13, 2018 • By Misha Hill

Many state legislators and regulators are considering expanding state-sponsored gambling by allowing betting on major league sports games. But the revenue states could bring in isn’t worth the risk.

Oklahoma Policy Institute: On Immigration Rhetoric, Consider the Facts

June 13, 2018

These undocumented Oklahomans currently contribute about $85 million in state and local taxes per year, according to our best estimates. They pay sales tax directly when they purchase goods and services, just like the rest of us, and they pay property taxes through owning a home or paying rent. Although they are not technically eligible […]

Lottery, Casino and other Gambling Revenue: A Fiscal Game of Chance

June 12, 2018 • By ITEP Staff

Cash-strapped, tax-averse state lawmakers continue to seek unconventional revenue-raising alternatives to the income, sales, and property taxes that form the backbone of most state tax systems. However, gambling revenues are rarely as lucrative, or as long-lasting, as supporters claim.

Oklahoma Policy Institute: To Improve Public Safety and Insurance rates, Allow Undocumented Oklahomans to Drive Legally

June 8, 2018

Oklahoma’s approximately 95,000 undocumented immigrants are a force in Oklahoma’s economy, accounting for about 1 in 30 members of the workforce and contributing roughly $85 million in state and local taxes annually. But despite their positive economic contributions, undocumented residents face arrest and/or deportation for doing something that many Oklahomans do every day: driving. Read […]

Center for American Progress: The 7 States Suing to End DACA Would Be Harmed by a Victory in Court

June 5, 2018

Through their employment, DACA recipients are contributors to their localities and states as wage earners and taxpayers. A 2017 state-by-state study by the Institute on Taxation and Economic Policy showed that the 1.3 million young undocumented immigrants receiving and immediately eligible for DACA contribute significantly to state and local taxes at an estimated $2 billion […]

Oregon Center for Public Policy: Legislature Leaves Oregon Largely Defenseless Against Corporate Abuse of Tax Havens

June 5, 2018

The repeal of Oregon’s tax haven law flowed from the legislature’s response to the far-reaching tax law passed by Congress at the end of 2017. The federal law required corporations to pay taxes, at a reduced rate, on more than $2 trillion in profits they held abroad. The federal tax law also put in place provisions intended to deter future shifting of corporate profits to avoid taxes.

CNBC: Donate to charitable funds and nab a tax break in these states — for now

June 4, 2018

How the IRS will ultimately proceed remains to be seen, but experts agree that the agency may take a closer look at programs with generous tax credits. “It’s when you get up and above a 70 percent tax credit — that’s when taxpayers start to view these as not being charitable programs at all but […]

The Commonwealth Institute: On Federal Tax Changes, Virginia Should Continue to Conform

June 4, 2018

Although some filers would pay more in state taxes under conformity, many of the highest-income filers – the top one percent – will receive large state tax cuts. This is in addition to also receiving a large federal tax cut. Recent analysis of the effects in Virginia shows that the top 1 percent will receive […]