ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

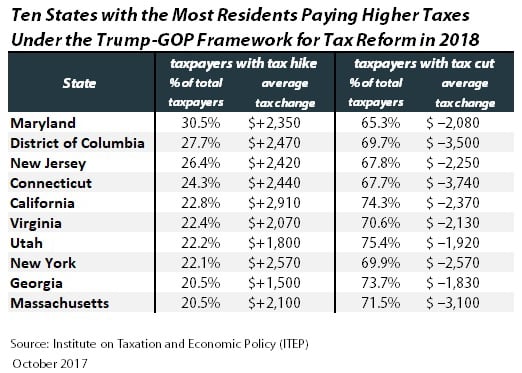

As our report on the Trump-GOP tax framework explained, in nine states plus the District of Columbia, more than a fifth of households would pay higher taxes under the framework.

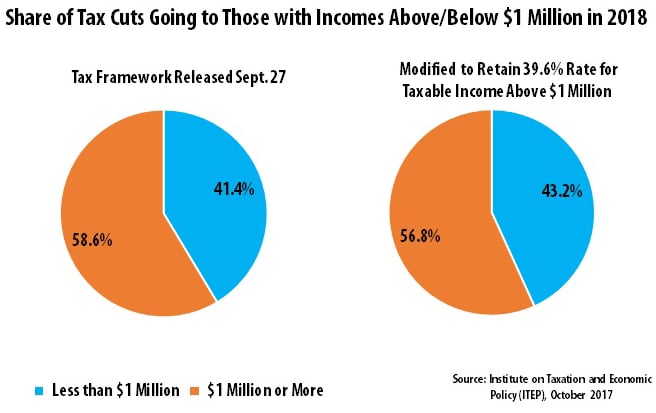

GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent

October 24, 2017 • By Steve Wamhoff

The Trump-GOP taxframework would reduce the top personal income tax rate from 39.6 percent to 35 percent, but now lawmakers are discussing keeping the top personal income tax rate at 39.6 percent for those with taxable income of more than $1 million. This modification would barely change the proposal’s overall impact.

The Jig Is Up: Republican Budget Resolution Finally Admits That Deficit Will Soar Under GOP Tax Plan

October 20, 2017 • By Alan Essig

For some lawmakers, annual deficits matter a lot—unless the nation is paying for tax cuts for the wealthy via deficit spending. Last night, Republican lawmakers demonstrated that previous grandstanding about the nation’s debt is much ado about nothing. The Senate approved a budget resolution on a party-line vote that would 1. fast-track legislation adding $1.5 trillion to the deficit over 10 years by cutting taxes, and 2. make it easy to enact this measure without a single Democratic vote.

Real tax reform would mean raising more revenue to make public investments and increasing the progressivity of the tax code. Many conservatives strongly disagree with this and insist that a substantial tax cut for the wealthiest Americans will grow the economy. Rather than engage in this policy debate based on policy ideals and principles, President Trump, other White House officials and GOP leaders have peppered their sales pitch for tax cuts with false claims about the amount of taxes that Americans pay and the effect the current GOP tax proposal would have on the tax system.

The Corporate Tax Code is in Dire Shape, But Trump-GOP Plan Would Make It Worse

October 18, 2017 • By Richard Phillips

Just how bad has the corporate tax code gotten? The newest edition of Offshore Shell Games, a joint report by the Institute on Taxation and Economic Policy (ITEP) and U.S. PIRG, outlines the massive scale of the offshore tax avoidance undertaken by U.S. multinationals. It’s well known that Fortune 500 companies have accumulated a stash of $2.6 trillion in earnings offshore, which has allowed them to avoid an estimated $752 billion in taxes.

This study explores how in 2016 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s biggest corporations benefit the most from offshore tax avoidance schemes.

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

Trump (Sort of) Used Our Data on Corporate Tax Avoidance, But He Missed the Point

August 31, 2017 • By Matthew Gardner

On Wednesday, reporters waiting to write about President Trump’s much-ballyhooed tax reform speech in Missouri received a fact sheet from the White House informing them that, “Fortune 500 corporations are holding more than $2.6 trillion in profits offshore to avoid $767 billion in Federal taxes, according to the Institute on Taxation and Economic Policy.”

Institute for Policy Studies: Corporate Tax Cuts Boost CEO Pay, Not Jobs

August 30, 2017

To investigate this claim, this report is the first to analyze the job creation records of the 92 publicly held U.S. corporations that reported a U.S. profit every year from 2008 through 2015 and paid less than 20 percent of these earnings in federal income tax. Did these reduced tax rates actually lead to greater employment within the 92 firms? The data we have compiled give a definitive — and sobering — answer.

GOP Leaders Tout Corporate Tax Cuts at Boeing and AT&T, Companies that Already Have Single-Digit Tax Rates

August 23, 2017 • By Matthew Gardner

House Speaker Paul Ryan plans to visit a Boeing factory in Washington State tomorrow to promote the GOP’s ideas for tax reform, which include a deep cut in the corporate tax rate, while House Ways and Means Chairman Kevin Brady is bringing the same message today to employees of AT&T in Dallas. What is unclear is how much lower taxes for these companies can possibly go.

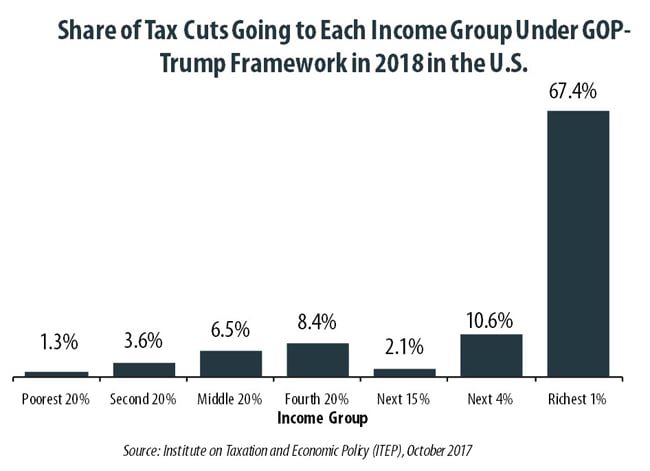

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

How to Think About the Problem of Corporate Offshore Cash: Lessons from Microsoft

August 4, 2017 • By Matthew Gardner

For a corporation with deeply American roots, Microsoft seems remarkably unable to turn a profit here. Against all odds, the Redmond, Washington-based company continues to claim that virtually all its earnings are in foreign countries. Microsoft’s latest annual report, released earlier this week, shows that over the past two years, the company enjoyed worldwide income of almost $43 billion. It claims to have earned just 0.3 percent of that—$128 million—in the United States.

Trump Administration May Make Corporate Inversions Great Again

August 4, 2017 • By Richard Phillips

During the presidential campaign, Donald Trump called out companies engaging in corporate inversions saying that one proposed inversion was “disgusting” and that “politicians should be ashamed” for allowing it to happen. Despite this rhetoric, the Trump Administration is considering rolling back critical anti-inversion rules as part of its broad regulatory review of recently issued Treasury Department regulations.

Comment Letter to Treasury on Earnings Stripping Regulations

August 4, 2017 • By ITEP Staff

The following letter was submitted to U.S. Treasury as per their request for comment in Notice 2017–38 on Section 385 regulations.

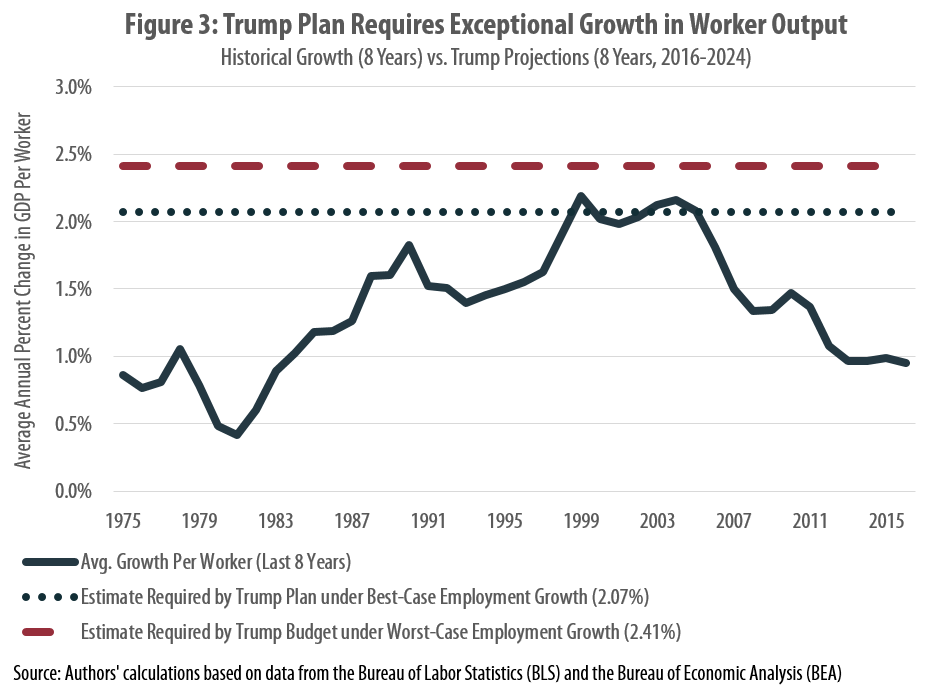

Art Laffer and Stephen Moore’s Misleading Case for the Trump Tax Cuts

July 28, 2017 • By Nick Buffie

Art Laffer and Stephen Moore recently penned an op-ed in the Wall Street Journal in which they called on state and local policymakers to support the Trump tax cuts. They claimed that the Trump plan would provide a significant boost to state and local tax revenues, thereby allowing states with large budget deficits to “regain fiscal health.” State and local lawmakers should not be fooled by these claims. The reality is that Trump’s tax cuts are more likely to worsen state and local fiscal health than improve it.

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

GOP Will Have to Radically Depart from Previous Proposals to Meet Its Tax Reform Goals

July 27, 2017 • By ITEP Staff

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding GOP leadership’s tax reform goals released today. The tax reform goals outlined in the letter will not be achieved if the GOP pursues pending Trump Administration and House tax proposals. “First was a so-called health reform bill […]

GOP Leaders in Congress and the White House Set Out Goals for Tax Reform that Their Plans Fail to Meet

July 27, 2017 • By Alan Essig

Today Republican leaders in Congress and officials from the White House released a joint statement on tax reform, claiming that “the single most important action we can take to grow our economy and help the middle class get ahead is to fix our broken tax code for families, small business, and American job creators competing at home and around the globe.” Unfortunately, the proposals they have put forward so far do not address any such goals.

Reviving U.S. Manufacturing, One Cheesecake Factory at a Time

July 27, 2017 • By Matthew Gardner

In the latest example of how the tax code has been abused and distorted, the Cheesecake Factory is claiming the manufacturing tax deduction, apparently for manufacturing cheesecakes, burgers, and other treats.

Tax Avoidance: Nike “Just Did It” Again, Moving $1.5 Billion Offshore Last Year

July 21, 2017 • By Matthew Gardner

The Nike Corporation’s annual financial disclosure of income tax payments is always notable for two recurring trends: the Oregon-based company’s steady shifting of profits into offshore tax havens, and Nike’s apparent effort to conceal how it’s achieving this tax avoidance. This year’s report, released earlier this week, is no exception.

Trump Tax Proposals Would Provide Richest One Percent in Alabama with 49.2 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Alabama would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,393,900 in 2018. They would receive 49.2 percent of the tax cuts that go to Alabama’s residents and would enjoy an average cut of $83,090 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

FedEx Pays Just 7.5% of Its Profits in Taxes While Pushing for a Lower Corporate Tax Rate

July 18, 2017 • By Matthew Gardner

The latest annual financial report released by shipping giant FedEx is yet another reminder that where you stand often depends on where you sit. The report shows that last year FedEx paid a 7.5 percent federal income tax rate on nearly $3.6 billion of U.S. pretax income and this low rate is due in part to accelerated depreciation, a provision in the tax code that allows the company to write off capital investments faster than they wear out. It’s not surprising, then, that FedEx’s leadership is currently promoting a tax plan that would drop the company’s statutory tax rate even…

This letter outlines ITEP’s two broad objectives for meaningful federal tax reform and discusses six recommendations that would achieve them.

What do terrorists, opioid and human traffickers, corrupt government officials and tax evaders have in common? They all depend on the secrecy provided by anonymous shell corporations to allow them to finance and profit from their crimes. Momentum is building in the House and Senate to pass legislation that would strike against illicit finance in the United States and around the world by bringing an end to the anonymity provided by U.S. incorporation.