ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Rather than being known for its pioneering pharmaceuticals, Mylan is increasingly becoming infamous for its pioneering tax avoidance strategies. In 2015, Mylan used an inversion to claim that it is now based in the Netherlands for tax purposes. It is a Dutch company only on paper because ownership of the company was mostly unchanged and it continues to operate largely out of the United States. This maneuver has allowed the company to avoid millions in taxes on its earnings in the U.S. and abroad. But that’s not the end of Mylan’s innovation when it comes to tax planning. A new…

The GOP Health Plan Cuts Medicaid to Lower Taxes for the Richest 3 Percent

June 16, 2017 • By Alan Essig

The bill passed by the House of Representatives last month to repeal the Affordable Care Act (ACA) is the most unpopular legislation in decades. Lawmakers should reverse course and take the necessary time to put together legislation that would preserve or, better yet, improve access to health care. But this isn’t likely to happen because at its core, the American Health Care Act isn’t truly health care reform. It is tax cuts that disproportionately benefit the rich shrouded in legislative provisions that would weaken the existing health care law.

Which States Benefit from the Tax Cuts in the GOP Health Plan?

June 15, 2017 • By Steve Wamhoff

Congressional Republicans’ plans to repeal the two largest tax increases on individuals that were enacted as part of the Affordable Care Act (ACA) would disproportionately benefit residents of Connecticut, New York, the District of Columbia and 10 other states. The remaining states would receive a share of the tax cuts that is less than their share of the total U.S. population.

One of the supposed selling points of the House GOP’s “Better Way” tax plan is that it will make the tax system so simple that you could do your taxes on a postcard. The reality, however, is that their promised postcard is a deception that would require numerous additional pages of worksheets to fill out. A better solution to making tax preparation simpler is called “return-free filing.” It does not just reduce your work to filling out a postcard, it could eliminate it altogether.

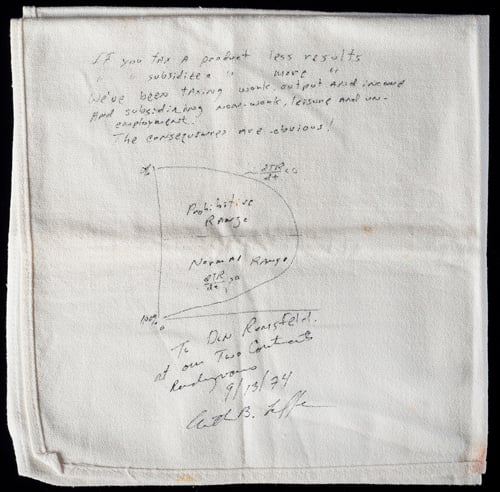

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

Steve Wamhoff

June 8, 2017 • By ITEP Staff

Steve is ITEP’s director of federal tax policy. In this role, he is responsible for setting the organization’s federal research and policy agenda. He is the author of numerous reports and analyses of federal tax policies as well as in-depth policy briefs that outline how the federal income tax and corporate tax code can be overhauled to improve tax fairness.

PBS News Hour: How Much Do the Poor Actually Pay in Taxes? Probably More Than You Think.

June 8, 2017

“All told, those in the bottom fifth of earners pay almost a fifth of their income in taxes. According to the Institute on Taxation and Economic Policy, the lowest-income quintile — those making less than $19,000 a year — pay almost 11 percent of their income in state and local taxes. Working people, even if […]

Kansas City Star: Kansas Tax ‘Experiment’ Offers Lessons to the Nation, Analysts Say

June 7, 2017

“An analysis by the Institute on Taxation and Economic Policy found in 2015 that taxpayers in the bottom 40 percent saw an overall increase in their taxes under Brownback when the 2015 sales tax increase is included.” Read more

The Atlantic: Can America’s Farms Survive the Threat of Deportations?

June 6, 2017

“Pete points out that the undocumented community is a net contributor to taxes. It’s true: A recent report by the Institute on Taxation and Economic Policy found that undocumented immigrants contribute billions of dollars to state and local taxes across the country. Deporting them, Pete added, will only hurt Americans. “If they just stopped contributing […]

Charleston Gazette-Mail: Senate Tax Plan is Upward Redistribution

June 3, 2017

“Some West Virginia Senators are singing a similar tune as Reagan with their tax plan. While they say their plan is a tax cut for everyone, the facts say otherwise. According to a recent analysis by the Institute on Taxation and Economic Policy, the Senate tax plan would increase taxes for most West Virginia households […]

Politifact: Richest 1 Percent Pay Lowest Rate of State and Local Taxes in Wisconsin?

June 2, 2017

McCabe, who says he is not a member of any political party, cited a 50-state analysis of state and local taxes published in January 2015 by the Institute on Taxation and Economic Policy, a left-leaning research organization based in Washington, D.C. Experts told us it is the only recent report of its kind on state […]

A truly populist budget would seek to ensure that middle- and low-income families have the resources that they need to get ahead, that the wealthy and corporations are paying their fair share in taxes, and that our country is making the public investments we need to ensure full employment and improve productivity over the long term. The Congressional Progressive Caucus’s (CPC) 2018 budget proposal would make real progress on all of these fronts.

Los Angeles Times: School vouchers don’t just undermine public schools, they undermine our democracy

May 31, 2017 • By ITEP Staff

Administration officials have suggested what amounts to a “back door” way to increase the reach of vouchers: tax credits for corporations and the rich who contribute to third-party voucher funds. The nation’s School Superintendents Assn. looked at states where such credits are already in place and found that, in some cases, the donors have been able to […]

Congressional Hearing Highlights Problems with the Border Adjustment Tax

May 25, 2017 • By Richard Phillips

The debate over the so-called border adjustment tax (or BAT) took center stage this week when the House Ways and Means Committee held its first hearing on the topic. Despite strong support by the House Republican leadership and the Chairman of the Ways and Means Committee, Rep. Kevin Brady, the proposal faced an onslaught of criticism during the hearing from invited witnesses and members of both parties.

23 Million Uninsured Americans Is Too Great a Cost to Finance Tax Cuts for the Rich

May 24, 2017 • By Richard Phillips

The cost to give $1 trillion in tax cuts to the wealthy and corporations is 23 million uninsured Americans by 2026. This is the bottom-line take away from the much-awaited Congressional Budget Office (CBO) score of the American Health Care Act, which House Republicans rushed through the chamber and narrowly passed (217-213) in early May.

Tax Avoiding Companies Well Represented at Tax Reform Hearing

May 18, 2017 • By Richard Phillips

Today the House Ways and Means Committee will hold its first tax reform hearing of 2017, which marks the official opening of the tax reform debate in Congress. True tax reform, if the committee sought to achieve it, could create more jobs and ensure companies are paying their fair share by cracking down on the massive offshore tax avoidance that companies engage in. Unfortunately, the panel of witnesses for today’s hearing is largely made up of representatives of various major corporations that are beneficiaries of the loopholes in our current corporate tax laws. Given this, it seems likely that these…

South Carolina’s Gas Tax Deal: Could Have Been Worse, Could Have Been Better

May 12, 2017 • By Dylan Grundman O'Neill

South Carolina lawmakers this week raised the state’s gas tax for the first time in 28 years, a time period that tied for the third-longest in the nation. While the increase was meaningful and hard-fought, the final result remains flawed in ways that could have been easily remedied or avoided. The biggest positive of the […]

State Rundown 5/10: Spring Tax Debates at Different Stages in Different States

May 10, 2017 • By Meg Wiehe

This week saw a springtime mix of state tax debates in all stages of life. In West Virginia and Louisiana, debates over income tax reductions and comprehensive tax reform are full of vigor. Other debates that bloomed earlier are now settled, such as Florida‘s now-complete budget debate and the more florid debates over gas taxes […]

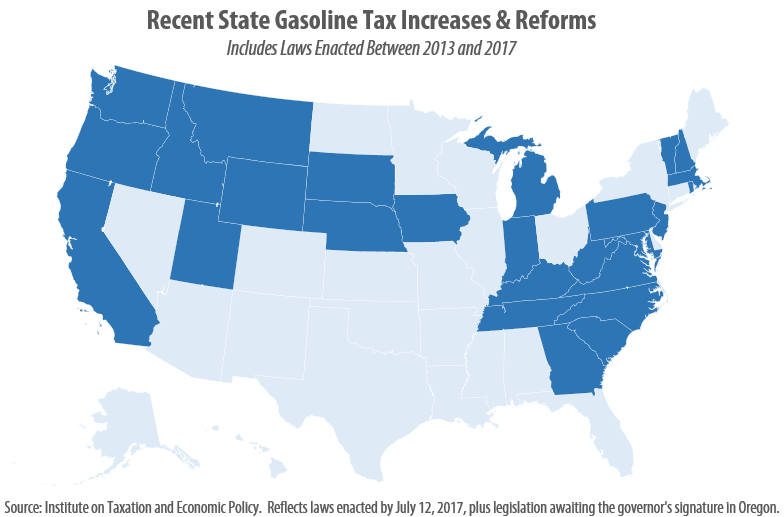

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

Representative John Delaney’s Bills Take the Wrong Approach on Funding Infrastructure

May 9, 2017 • By Richard Phillips

Lawmakers across the political spectrum recognize the need for additional spending to maintain and upgrade our nation’s transportation infrastructure. According to the Federal Highway Administration, there is a backlog of $836 billion in needed repairs and improvements to roads and bridges and an additional $90 billion backlog of public transit projects. Maryland Democratic Representative John […]

President Donald Trump’s tax sketch released in late April is the starting point for federal tax reform discussions. For now, the sketch includes too few details to properly analyze its revenue and distributional impacts, but based on limited information, corporations and the wealthy stand to benefit most. Below are resources ITEP has produced on tax […]

Two states are on the verge of embracing a tried and tested anti-poverty policy, the Earned Income Tax Credit (EITC). In the past two weeks, lawmakers in both Hawaii and Montana passed EITC legislation, which governors in both states are expected to sign. Once officially enacted, these states will join 26 other states and the […]

Nebraska Vote Is Latest Defeat for Tax-Cut “Trigger” Gimmick

May 4, 2017 • By Dylan Grundman O'Neill

Nebraska lawmakers had a long and contentious tax-cut debate this session but ultimately chose the wise path and rejected attempts to give a massive tax cut to the wealthy at the expense of the state’s schools, other public services, low- and middle-income families, and property tax payers. Tax cut efforts in Nebraska last year ended […]

The Foreign Account Tax Compliance Act – or FATCA – is a financial disclosure and transparency law designed to crack down on international tax evasion by U.S. taxpayers who hold financial assets offshore. This law, passed in 2010 as part of the Hiring Incentives to Restore Employment (HIRE) Act, provides the Internal Revenue Service (IRS) […]

Foreign Account Tax Compliance Act (FATCA): A Critical Anti-Tax Evasion Tool

May 2, 2017 • By Richard Phillips

For years, a subset of the well-to-do and well-connected have been able to exploit the intricacies of our global financial system to shelter their income and investments from taxation. The U.S. government took a stand against this type of willful tax evasion with the passage of the Foreign Account Tax Compliance Act – or FATCA – enacted as part of the Hiring Incentives to Restore Employment (HIRE) Act of 2010.