ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Trump’s Executive Order on Social Security Payroll Taxes Is a Mess

August 17, 2020 • By Steve Wamhoff

President Trump’s executive order that would supposedly allow workers to delay paying Social Security taxes, along with his related public statements, have created a situation that is bizarre even by 2020 standards.

Action (lack thereof) on Economic Aid Reflects Longstanding Anti-Government Agenda

August 14, 2020 • By Amy Hanauer

The biggest danger we face right now is that politicians will fail to get this health crisis under control and Americans will continue to die. The second biggest danger is that elected officials will fail to help families and communities, leading to foreclosures, evictions, and impoverishment—and also torpedoing the economy. With their inaction this week, the Senate seems determined to do both. Hold on everyone, we’re in for a sickening ride.

IRS Rule Leaves the Door Open for Private/Religious School Voucher Donation Schemes, Broader SALT Cap Workarounds

August 12, 2020 • By Carl Davis

An IRS regulation released last Friday sanctions a widely derided tax dodge that allows profitable businesses to avoid taxes by sending money to private and religious school voucher funds. It also leaves the door open to a brand of state and local tax (SALT) cap workaround that previously appeared to be on its way out.

Massachusetts Budget and Policy Center: Supporting Racial Equity and a Robust Recovery with a Corporate Income Tax Rate Increase

August 10, 2020

By returning the state corporate income tax to pre2010 rates, the Commonwealth could raise $375 million to $500 million a year to help fund a racially equitable, economically just, and robust recovery. As is now clear, low-income communities and communities of color have been hurt far more deeply by the COVID-19 pandemic than wealthier and […]

Between the Lines: Amazon Q2 Report Hints It Will Avoid Taxes on This Year’s Record Profit Haul

August 5, 2020 • By Matthew Gardner

The House Judiciary Committee last week held an antitrust hearing to scrutinize Amazon and other tech companies’ growing dominance. A look at the online retail giant’s new quarterly report and past tax avoidance reveals why lawmakers should be equally concerned about how the tax system allows dominant, profitable corporations to avoid most or all federal tax on their profits. Amazon, yet again, is poised to pay little or no federal income tax on its record profits, and it appears likely to do so using entirely legal tax breaks for stock options and research and development.

Sorry, States: GOP Senate Ignores Need for Federal Relief to State and Local Governments

July 31, 2020 • By Meg Wiehe

During the Great Recession, the most ambitious state revenue-raising efforts closed just 10 percent of shortfalls and most states relied heavily on federal aid and budget cuts to balance their budgets. Of course, states can and should turn to progressive revenue-raising options now, but as the pandemic rages on, the extent of this crisis will become too significant for states and localities to handle on their own. The federal government should step in to help.

Biden’s Minimum Corporate Tax Proposal: Yes, Please Limit Amazon’s Tax Breaks

July 29, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

A large majority of Americans want corporations to pay more taxes and Democratic presidential candidate Joe Biden has several proposals to achieve that. The newest idea is to require corporations to pay a minimum tax equal to 15 percent of profits they report to shareholders and to the public if this is less than what they pay under regular corporate tax rules. A recent article in the Wall Street Journal quotes several critics of the proposal, but none of their points are convincing.

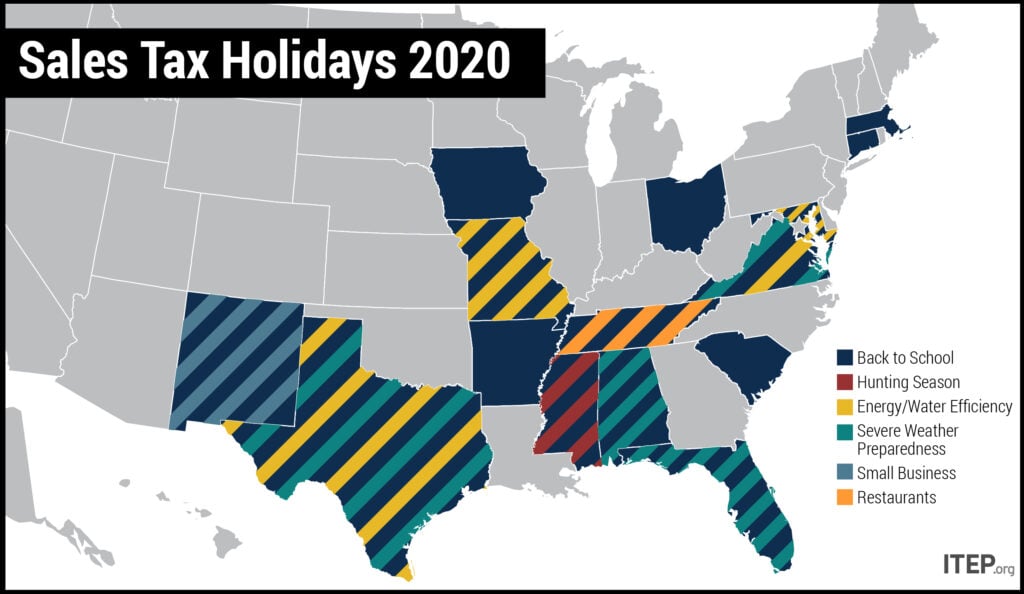

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

A Cautionary Tale on Sales Tax Holidays During a Pandemic

July 29, 2020 • By Dylan Grundman O'Neill

Sixteen U.S. states will hold “sales tax holidays” this year. As ITEP’s newly updated brief explains, these events offer dubious benefits at significant public expense even in normal years, problems which are only amplified in the context of the COVID-19 pandemic.

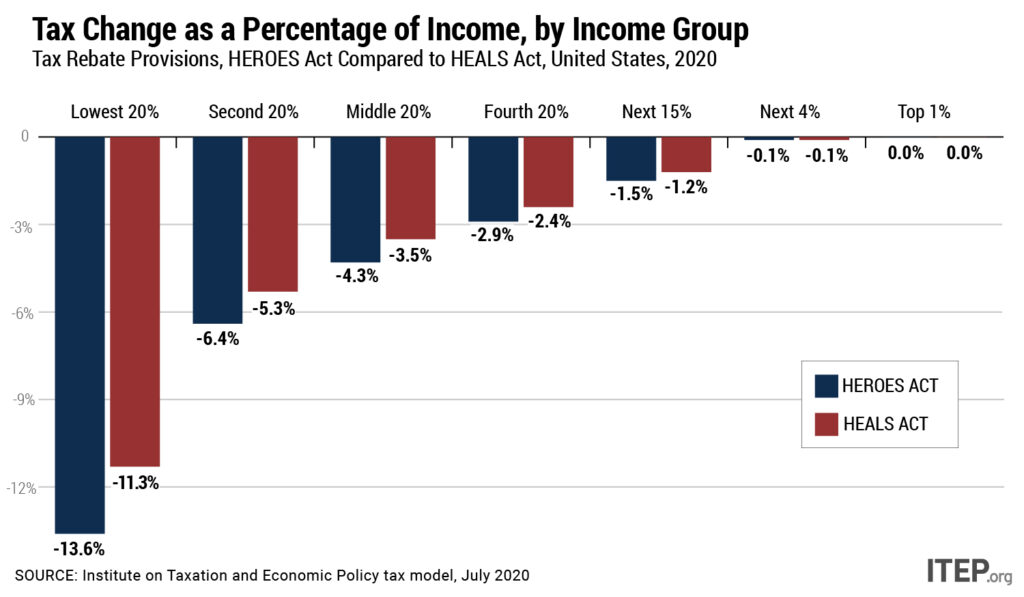

Americans are demanding policy that meets the needs of this urgent moment. There are now competing proposals from the U.S. House and Senate: One is a reasonable response to the staggering crisis we’re in. One is not.

A Tax Loophole You Could Drive a Food Truck Through: Senate GOP Proposes Full Deductibility of Business Meals

July 28, 2020 • By Matthew Gardner

After weeks of being in no particular hurry to assemble a new COVID-19 economic relief package, the Senate GOP has released its plan. It includes the “Supporting America’s Restaurant Workers Act,” which would allow business owners to write off 100 percent of the cost of their restaurant meals through the end of 2020. The two most obvious questions to ask about such a plan are “why” and “why now?” Republican lawmakers have not offered sensible responses to either because they have none.

New Analysis Compares HEROES Act and HEALS Act, Disaggregates Data by Race and Income

July 28, 2020 • By ITEP Staff, Jessica Schieder, Meg Wiehe, Steve Wamhoff

The Health, Economic Assistance, Liability Protection and Schools (HEALS) Act released by Senate Republicans Monday includes a tax rebate that is slightly more generous than the one provided under the March CARES Act, but fails to correct most of the earlier act’s problems. House Democrats addressed these shortcomings in the May HEROES Act, a better starting place for negotiations over the next round of COVID-19 relief. ITEP has analyzed both acts to provide a detailed comparison of how the tax rebate provisions would affect families across the income spectrum and by race. Both measures would provide cash payments to a…

Treasury Secretary Mnuchin to Unemployed Workers: Don’t Worry, Get a Bank Loan

July 24, 2020 • By Jenice Robinson

In an explanation that can only be called richsplaining, Treasury Secretary Steve Mnuchin on Thursday suggested that Congress’s delay in approving expanded unemployment benefits was no problem because banks would extend loans to people in the meantime.

Media contact Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy (ITEP), regarding the pending Republican plan for phase IV COVID-19 relief. Details are emerging about the plan, which Senate leadership has not formally released. “Republicans are struggling to agree on the next round of COVID relief […]

Biden Proposes to Fund Child Care and Elder Care by Shutting Down Tax Breaks for Real Estate Investors

July 21, 2020 • By Steve Wamhoff

On Tuesday, Democratic presidential candidate Joe Biden announced a $775 billion proposal to expand care options for children and elderly people, suggesting that the cost would be at least partly offset by paring back tax breaks for real estate investors. Bigtime real estate investors are simply unaccustomed to operating without government subsidies provided through the tax code.

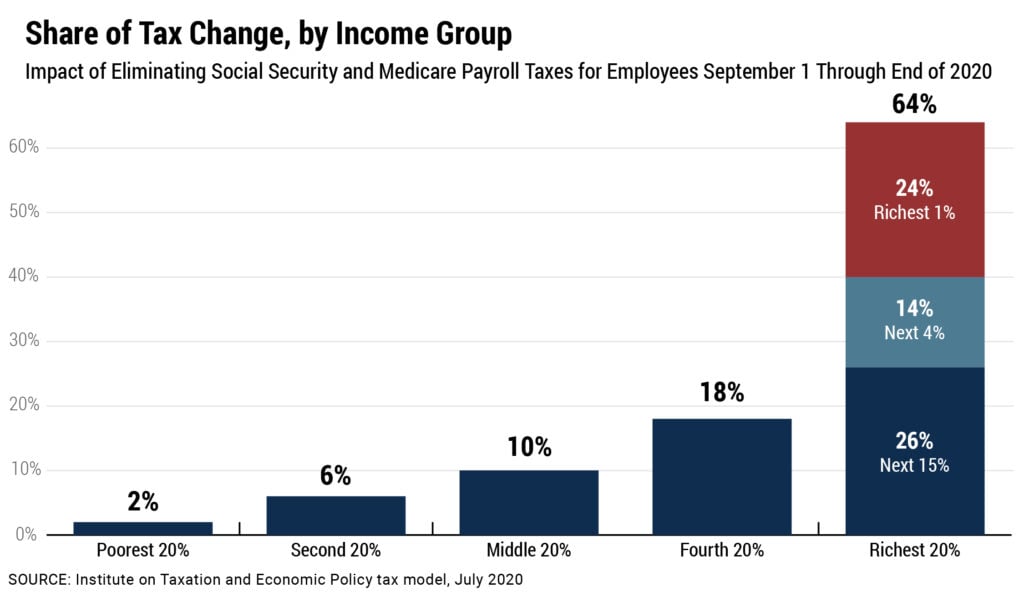

While the White House hasn’t clarified what it is proposing, we know that a payroll tax cut would not be well-targeted. In a new report, ITEP estimates the effects of suspending Social Security and Medicare payroll taxes for employees and employers from September 1 through the end of the year. We find that 64 percent of the benefits would go to the richest 20 percent of Americans while 24 percent of the benefits would go to the richest 1 percent.

New Analysis: Payroll Tax Cut Would Cost $336 Billion, Benefit Top 1 Percent Most

July 21, 2020 • By Steve Wamhoff

Media contact Temporarily eliminating all federal payroll taxes through the end of the year would cost $336 billion, deliver 64 percent of its benefits to the richest 20 percent of households and fail to provide help to unemployed workers who are struggling most due to the economic downturn, the Institute on Taxation and Economic Policy […]

An Updated Analysis of a Potential Payroll Tax Holiday

July 21, 2020 • By Jessica Schieder, Matthew Gardner, Steve Wamhoff

ITEP estimates that if Congress and the president eliminated all Social Security and Medicare payroll taxes paid by employers and employees from Sept. 1 through the end of the year, 64 percent of the benefits would go the richest 20 percent of taxpayers and 24 percent of the benefits would go to the richest 1 percent of taxpayers, as illustrated in the table below. The total cost of this hypothetical proposal would be $336 billion.

Bloomberg: Virus Surge Hits Budgets of States Most Vulnerable to Shutdowns

July 17, 2020

As the two states have each surpassed nearly 600,000 confirmed cases combined, with daily new cases in the tens of thousands, governors in Florida and Texas are considering scaling back their economies amid enormous pressure. Their initial hesitancy to shut down may have fueled the recent surges according to some reports. Yet, experts say that […]

SALT Cap Repeal Has No Place in COVID-19 Legislation: National and State-by-State Data

July 17, 2020 • By Steve Wamhoff

The Trump-GOP tax law enacted at the end of 2017 includes a $10,000 cap on the amount of state and local taxes (SALT) that people can deduct on their federal tax returns, and this is one of the few limits the law places on tax breaks for high-income people. Unfortunately, it is also the provision that some Democrats are most determined to remove.

New Prosperity Now Report Identifies Upside-Down Tax Incentives

July 15, 2020 • By Jessica Schieder

Ahead of this year’s delayed Tax Day, our partners at Prosperity Now released a powerful report providing a comprehensive overview of many of the ways our federal tax system privileges wealth over work, while also lifting up several provisions which could serve as a template for improving progressivity within the tax code. The report makes […]

Salon: “Stunningly Tone-Deaf”: Ivanka Trump Criticized for Urging Jobless Americans to “Find Something New”

July 14, 2020

Roughly two-thirds of the temporary payroll tax cut would flow to the richest 20% of Americans, while the poorest 40% would get only 6% of the benefit, according to the Institute for Taxation and Economic Policy. Such tax breaks are “insufficiently targeted and largely meaningless to those who’ve lost their jobs and are no longer […]

The Epoch Times: Biden’s Progressive Tax Proposal Raises Rates on Wealthy and Corporations

July 14, 2020

“It’s probably one of the most progressive tax plans we’ve seen from a presidential nominee from one of the two major parties in many, many years,” Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy told the Epoch Times. Unlike Sens. Bernie Sanders and Elizabeth Warren, Biden has not advocated for […]

Law 360: State And Local Tax Policy To Watch In The 2nd Half Of 2020

July 14, 2020

As states grapple with refilling their coffers in response to the COVID-19 pandemic, tax policy debates in the second half of 2020 could center on revisiting conformity to the federal code and a consideration of broad-based tax proposals. Additionally, some states are contemplating wading into untested legal waters by taxing digital advertising, while practitioners are […]

Urban Milwaukee: Labor Leaders Slam Trump for Betraying Working People

July 14, 2020

By Democratic Party of Wisconsin The tax law Trump pushed through was a boon for large corporations, including those in Wisconsin like Kimberly Clark, that used the handout to shutter their facilities, issue stock buybacks, and lay off workers instead of creating jobs and increasing wages. Read more