ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Press-Republican: Cuomo Loses Opening Round in Fight Against New Tax Law

October 6, 2019

The Institute on Taxation and Economic Policy, a national think tank, projected in late 2017 that more than 70 percent of New York taxpayers would end up paying less in federal taxes as a result of the code revisions. Cuomo, though, has maintained the capping of the SALT deduction would motivate some wealthy earners to […]

The Fiscal Times: Would a Warren/Sanders Wealth Tax Kill the Economy?

October 3, 2019

Steve Wamhoff, director of federal tax policy at the liberal Institute on Taxation and Economic Policy, said Wednesday cited the public investments that could be financed with revenues from the wealth tax, providing the economy with a much-needed boost. “Industrialized nations with thriving economies all over the world collect far more in tax revenue and […]

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

Urban Institute: Are States Betting on Sin? The Murky Future of State Taxation

October 1, 2019

“Sin taxes” are often viewed as budget saviors, though they play a rather small role in state budgets. Although states raise revenue from sin taxes, policymakers should be mindful of these taxes’ limitations. Absent policy changes (such as increased tax rates), long-term growth for sin tax revenue has often been weak and limited. Moreover, greater […]

Marketplace: The Stock Market Is Not the Economy

September 30, 2019

“The stock market is a market where stocks, a type of investment that represents ownership in a company are traded,” said Jessica Schieder, a federal tax policy fellow at the Institute on Taxation and Economic Policy. “The stock market is where people make bets on what’s going to happen in the economy.” Listen

CNBC: New York Judge Dismisses Blue State Suit Over SALT Tax Deductions

September 30, 2019

Whether the final rule will ultimately deter people from donating to these funds remains to be seen. “If you’re really passionate about private school vouchers in Georgia, you donate and you still get 100% of your donation back,” Carl Davis, research director at the Institute on Taxation and Economic Policy, told CNBC earlier. “You just […]

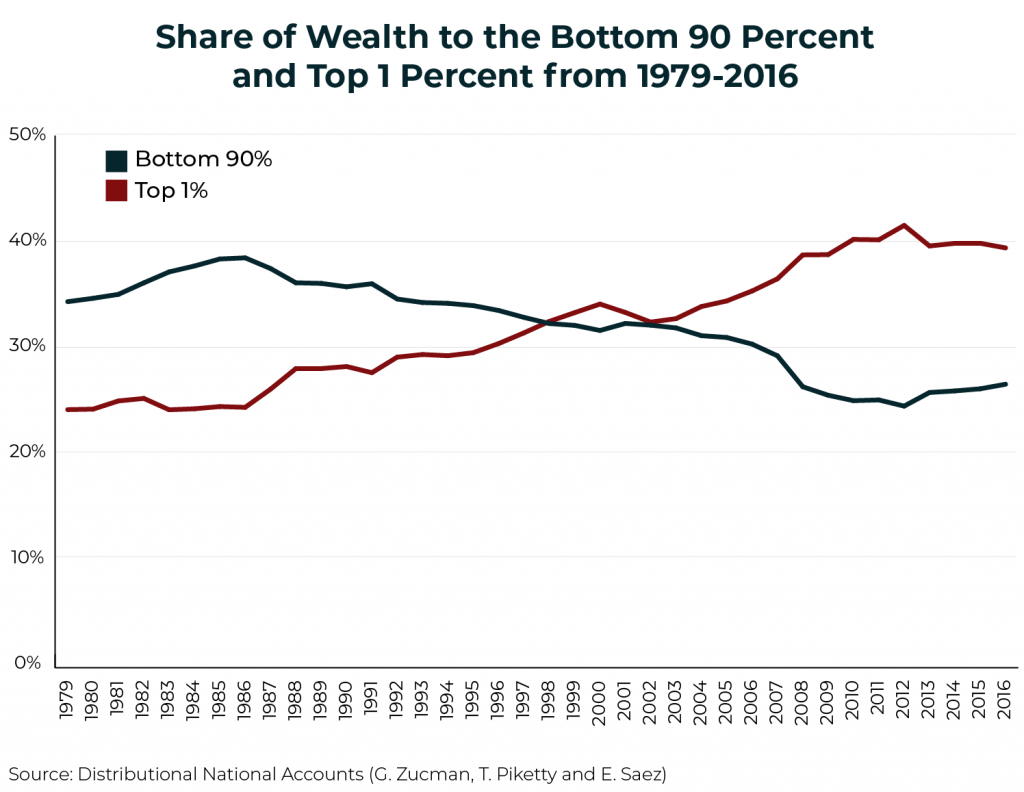

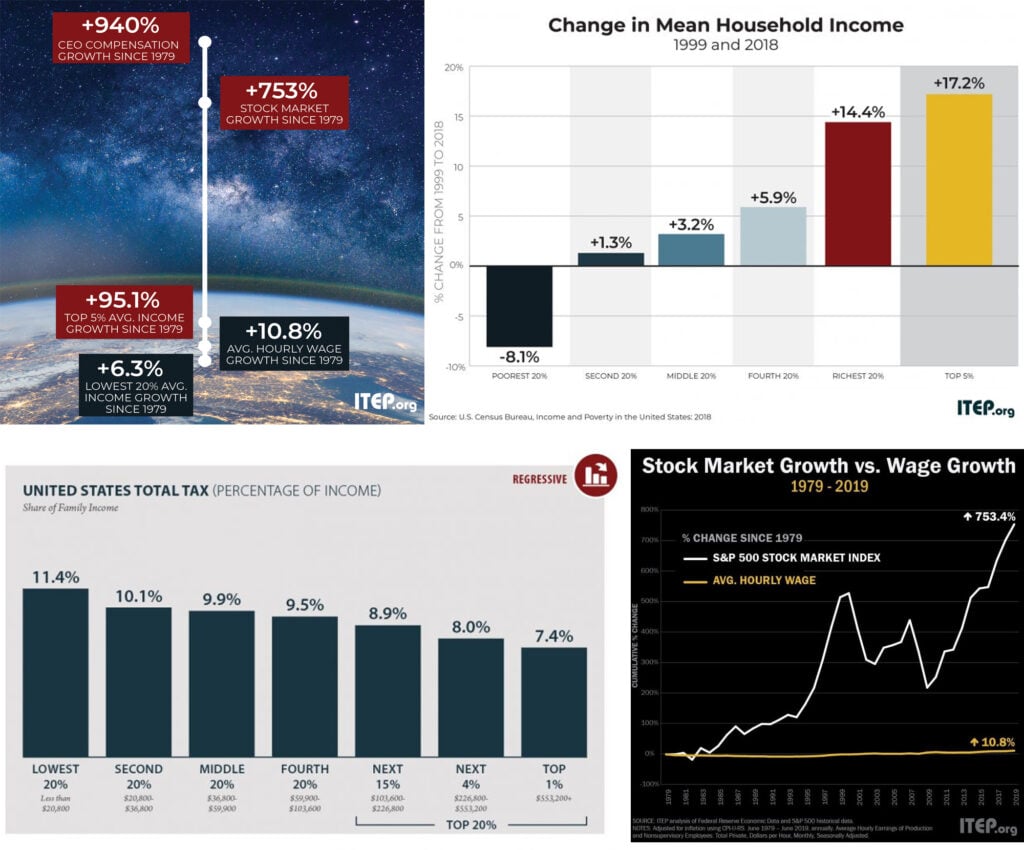

The Nation’s Income Inequality Challenge Explained in Charts

September 27, 2019 • By Stephanie Clegg

Income inequality has reached its highest level since the U.S. Census Bureau began tracking the measure more than 50 years ago, according to recent data. While recent Census data show modest increases in median household income and average hourly wages—numbers anti-tax politicians and pundits have used to deny rising inequality—a deeper look at some of the latest numbers reveals a decades-long trend of widening economic inequality.

A Well-Designed Carbon Tax Could Curb Emissions, Offset Costs for Many Families

September 26, 2019 • By Carl Davis

A well-designed carbon tax package—that is, levied at a sufficiently high rate and paired with equitable offsets for lower- and middle-income families—could improve both our environment and the fairness of our tax system.

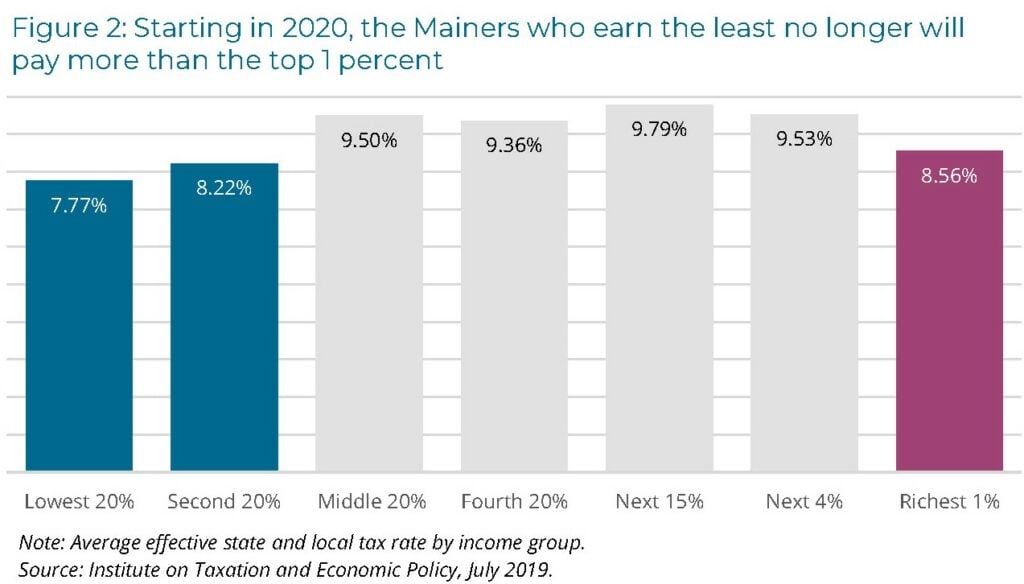

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

Reducing the Cost of Child Care Through State Tax Codes in 2019

September 26, 2019 • By Aidan Davis

The high cost of quality child care is a budget constraint for many working families and particularly daunting for parents who are working but earning low wages. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. This policy brief surveys the advantages and disadvantages of the circuit breaker approach to reducing property taxes.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2019

September 26, 2019 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Wealth Tax Proposals from Warren and Sanders: What You Should Know

September 25, 2019 • By Steve Wamhoff

Earlier this year, Sen. Elizabeth Warren proposed a federal wealth tax on a handful of U.S. households with the highest net worth. Sen. Bernie Sanders has just announced his own wealth tax proposal, which is similar to Warren’s. A few other presidential candidates say they support the concept although they have not provided any details. Here's what you need to know about the potential for a federal wealth tax.

Business Roundtable Members’ Social Responsibility Pledges are Easily Made, and Easily Broken

September 20, 2019 • By Matthew Gardner

It was this side of last month that the Business Roundtable made headlines by announcing its new vision of the purpose of a corporation. More than 180 corporate leaders signed the statement, which declared corporations will prioritize the communities in which they work—instead of shareholder value. But for some corporations, the Business Roundtable statement is yesterday’s news, and they are commencing with business as usual.

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.

Julián Castro Provides the Latest Proposal to Expand Refundable Tax Credits

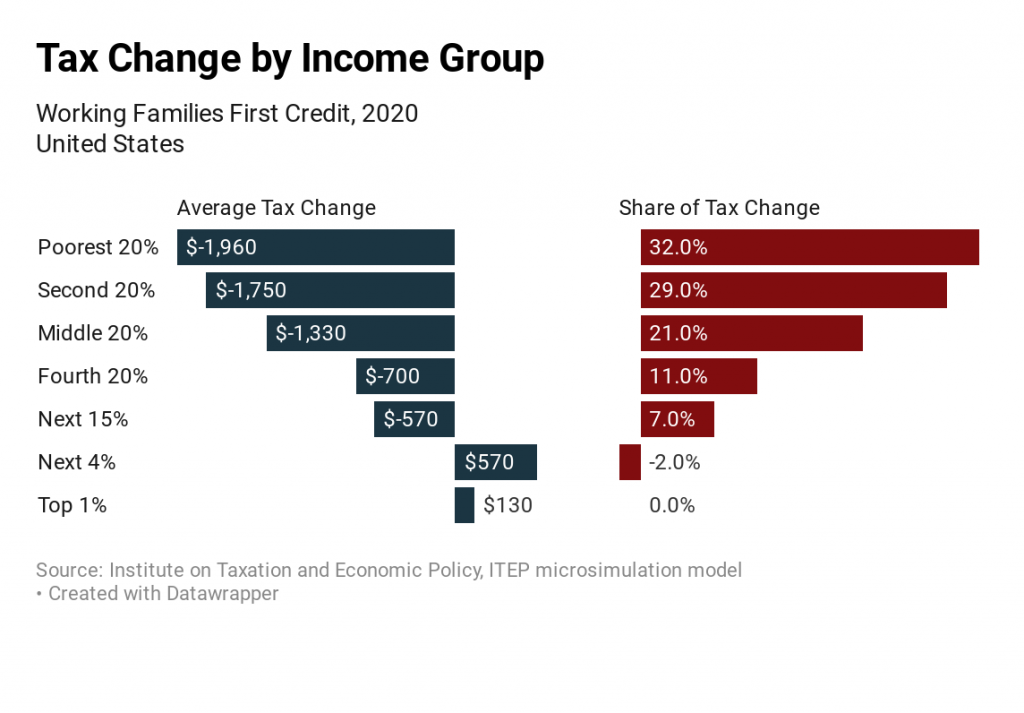

September 17, 2019 • By Steve Wamhoff

New estimates from ITEP show that Julián Castro’s refundable tax credit proposal would mostly benefit the bottom 60 percent of households and would have a cost ($195 billion in 2020) that places it roughly in the middle of the different tax credit proposals that Democrats have offered over the past several months.

The Working Families First Credit proposal would increase the CTC from $2,000 to $3,000 and remove the limits on refundability that prevent many lower-income families from receiving the entire credit and expand the EITC by increasing the rate at which earnings are credited and it would provide a larger increase for childless workers. View the distributional analysis.

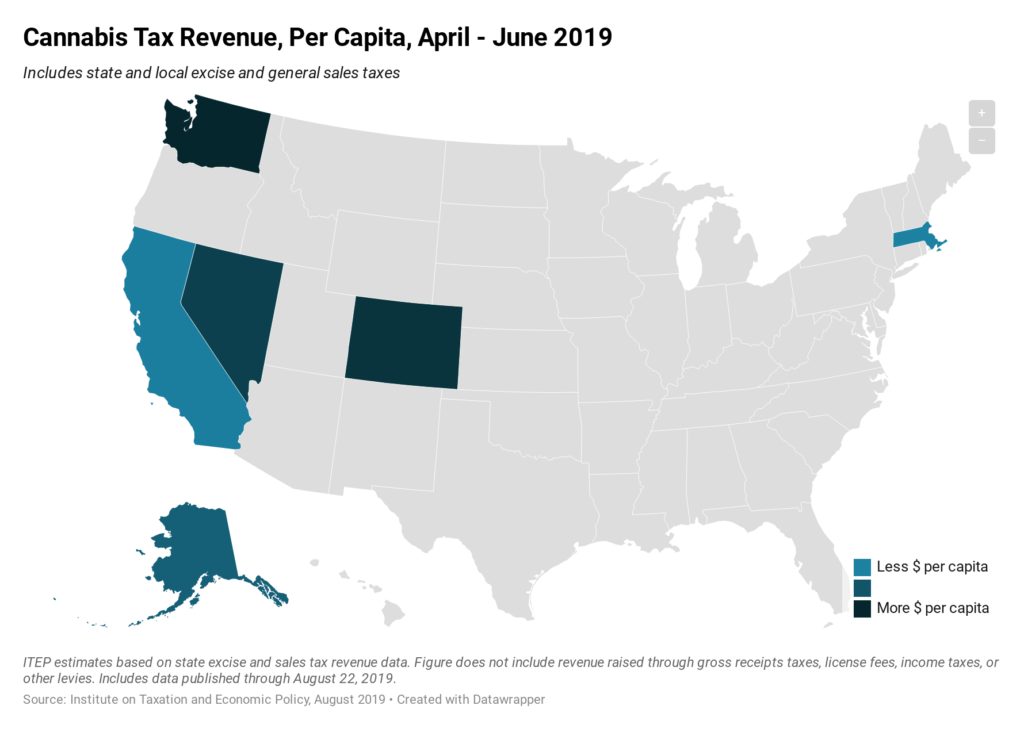

Seven states currently allow for the legal, taxable sale of recreational cannabis. The above map shows per capita revenue collections from excise and sales taxes on cannabis during the second quarter of 2019, the most recent period for which data are available in every state. The most lucrative cannabis market in the country, from a tax revenue perspective, is in Washington State where the 46 percent combined tax rate applied to cannabis is the highest in the country. Collections in California and Massachusetts, by contrast, remain low as these states are still in the early stages of establishing their legal…

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and address economic inequality. This new video from ITEP makes the case for a federal wealth tax.

Why Are Ideologues Trying to Downplay Poverty and Economic Inequality?

September 12, 2019 • By Jenice Robinson

Our elected officials should pause and check the pulse of the nation. The public is aware of the great income divide and likely isn’t keen on an agenda that would use sleight of hand to “reduce” poverty and spend less on domestic programs—particularly when that agenda is in tandem with using the tax code to further boost income for the wealthy.

Sen. Wyden’s Anti-Deferral Accounting Proposal Could Be a Game-Changer

September 12, 2019 • By Steve Wamhoff

Today, Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee, fulfilled a promise he made several months ago to release a proposal that could fundamentally transform how the U.S. taxes capital gains of the wealthy. The paper he released today proposes “anti-deferral accounting” to ensure that wealthy people are taxed on all of […]

Senator Releases Plan That Would Increase Capital Gains Tax Rates, Close Loopholes

September 12, 2019 • By Alan Essig

Following is a statement from Alan Essig, executive director for the Institute on Taxation and Economic Policy, on the paper released today by the Senate Finance Committee’s ranking Democrat, Ron Wyden, calling for anti-deferral accounting, which could dramatically reform the way the U.S. taxes capital gains.

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

September 12, 2019 • By Steve Wamhoff

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting