ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Promoting Greater Economic Security Through A Chicago Earned Income Tax Credit: Analyses of Six Policy Design Options

September 12, 2019 • By Lisa Christensen Gee

A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families. ITEP produced a cost and distributional analysis of six EITC policy designs, which outlines the average after-tax income boost for families at varying income levels. The most generous policy option would increase after-tax income for more than 1 million working families with an average benefit, depending on income, ranging from $898 to $1,426 per year.

New Report: A Chicago EITC Would Benefit up to 1 Million Chicago Families

September 12, 2019 • By Lisa Christensen Gee

Media contact Report outlines policy options for Chicago Resilient Families Initiative Task Force Recommendations A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families, the Institute on Taxation and Economic Policy (ITEP) and Economic Security for Illinois said today. […]

The Half Sheet: Over 1 Million Virginia Taxpayers Expected to Miss Out on Refund Checks

September 11, 2019

If everything goes according to schedule, Virginia’s tax department will begin issuing $110 refund checks – $220 for joint filers – to Virginia taxpayers beginning next week and continuing through the first half of October. The checks are the result of tax legislation signed into law earlier this year. Unfortunately, not every tax filer will […]

Census Numbers Show the Power of the Tax Code to Direct Resources to Low-Income Families

September 10, 2019 • By Jessica Schieder

Refundable federal tax credits, including the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), lifted 7.9 million people out of poverty in 2018. This latest analysis from the U.S. Census Bureau demonstrates the power of federal programs to alleviate poverty and help low-income families keep up with the increasing cost of living.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

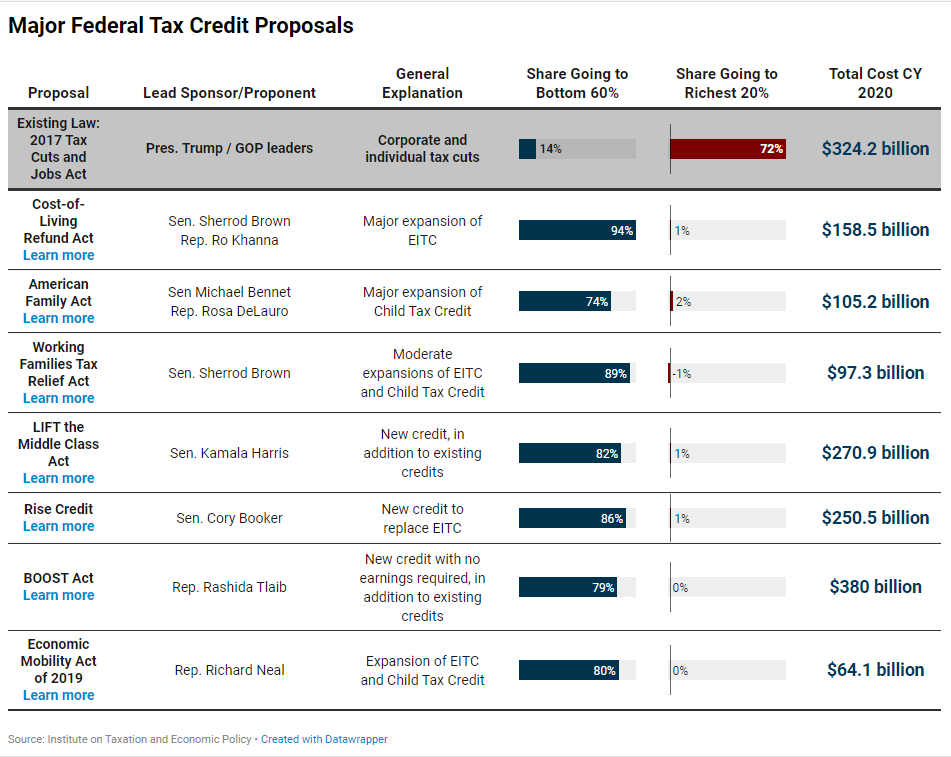

In 2019, several federal lawmakers have introduced tax credit proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have an annual household income of $70,000 or less.

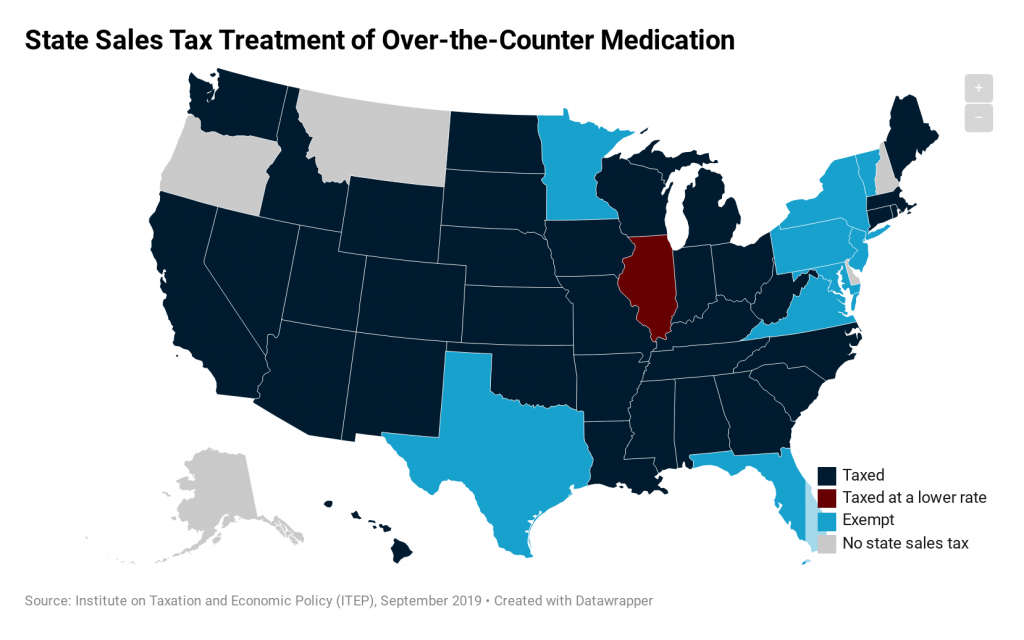

While most states levy general sales taxes on items that consumers purchase every day, those taxes often contain carveouts for some necessities such as rent, groceries, and medicine. Prescription drugs, for instance, are currently exempt from state sales tax in 44 of the 45 states levying such taxes (Illinois is the only exception, charging a […]

MECEP: NEW REPORT: Maine reaches new milestone on the road to tax fairness

September 4, 2019

Starting in 2020 and for the first time in decades, the Mainers who earn the least will no longer pay a larger share of their income to state and local taxes than those who earn the most, according to a policy brief published today by the Maine Center for Economic Policy.

Erika Frankel

September 3, 2019 • By ITEP Staff

Erika brings more than 25 years of information management, project management, and development experience in non-profit, government, and commercial environments to the Data and Model Team. She redesigned the platform for ITEP's flagship microsimulation model, allowing ITEP to respond more quickly to a wider range of policy proposals and changes.

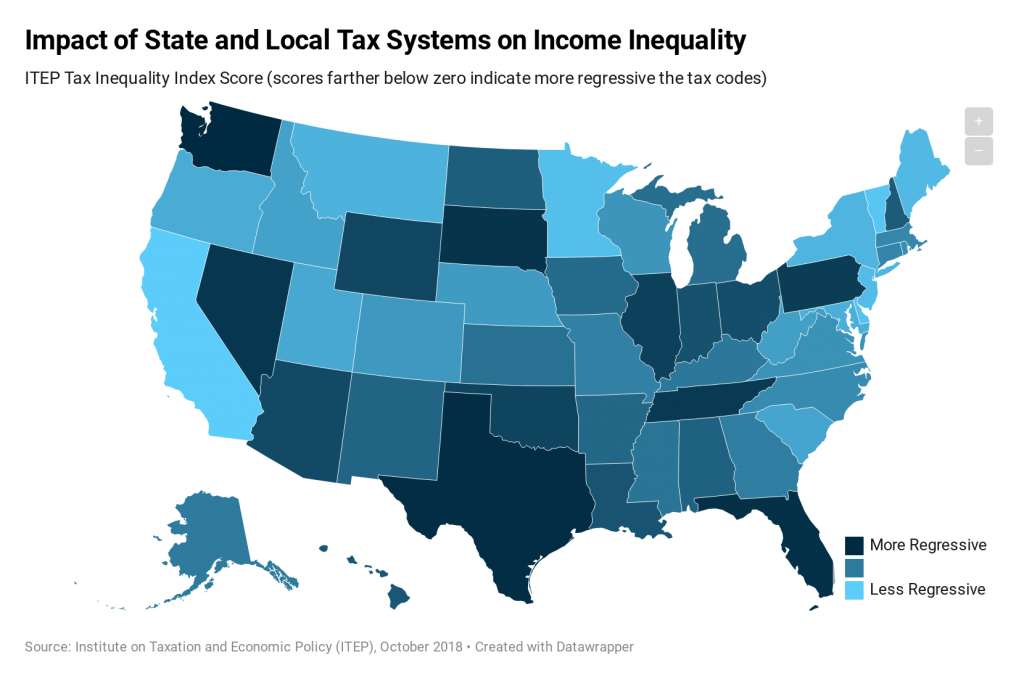

The vast majority of state and local tax systems exacerbate the economic divide by taxing low- and middle-income families at higher rates than the wealthy. This map distills an exhaustive analysis of state and local tax codes into one key number, the ITEP Tax Inequality Index, to show the degree to which each state’s tax […]

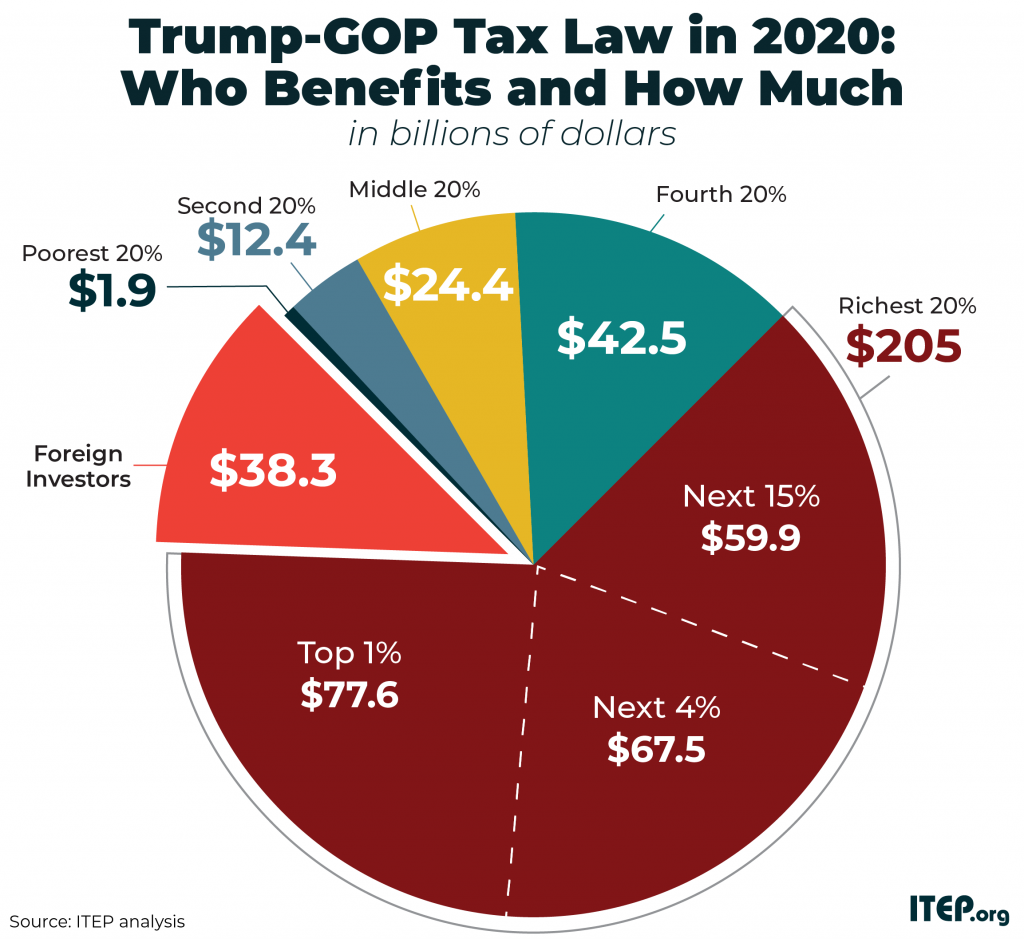

DESPITE CONTRARY CLAIMS, NUMBERS SHOW TRUMP TAX LAW STILL FAVORS THE WEALTHY GOP leaders continue to misrepresent who benefits from the 2017 Trump-GOP tax law, most recently claiming most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” But the numbers prove […]

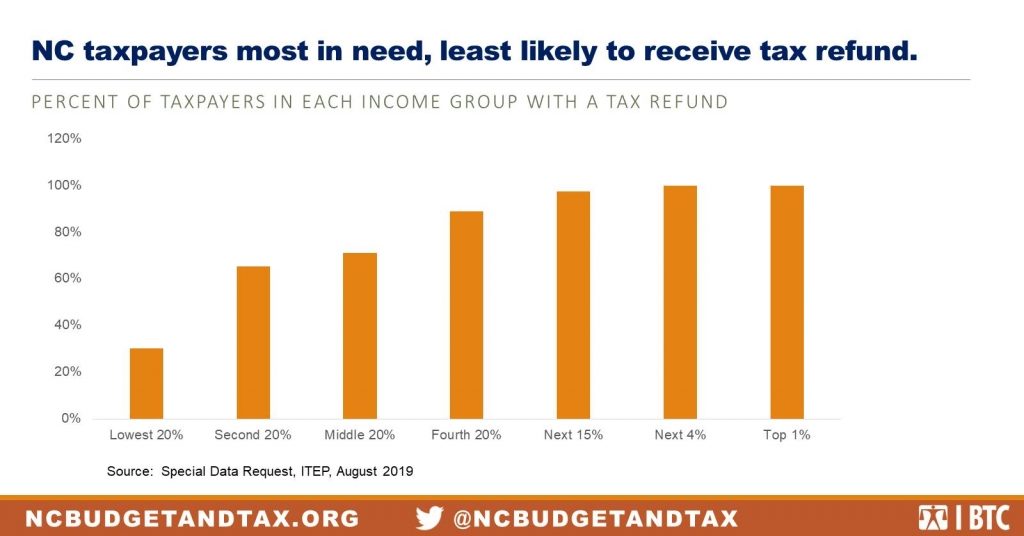

New Analysis: A Third of NC Taxpayers Won’t Benefit from Proposed Tax Refund Plan

August 29, 2019 • By Guest Blogger

North Carolina Senate and House leaders are moving forward with a flawed proposal to spend the majority of the state’s revenue over collections, more than $600 million, to issue tax refund checks of $125 per taxpayer ($250 for married couples).

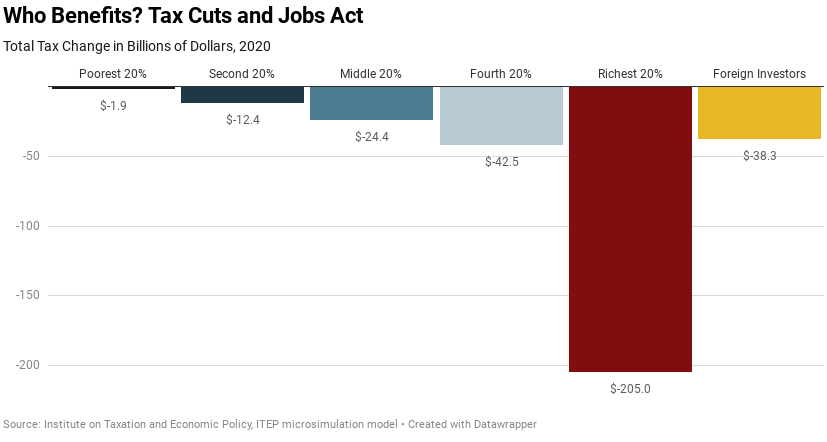

Updated Estimates from ITEP: Trump Tax Law Still Benefits the Rich No Matter How You Look at It

August 28, 2019 • By Steve Wamhoff

President Trump’s allies in Congress continue to defend their 2017 tax law in misleading ways. Just last week, Republicans on the House Ways and Means Committee stated that most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” ITEP’s most recent analysis estimates that in 2020 the richest 5 percent of taxpayers will receive $145 billion in tax cuts, or half the law's benefits to U.S. taxpayers.

The Tax Cuts and Jobs Act (TCJA), signed into law by President Trump at the end of 2017, includes provisions that dramatically cut taxes and provisions that offset a fraction of the revenue loss by eliminating or limiting certain tax breaks. This page includes estimates of TCJA’s impacts in 2020.

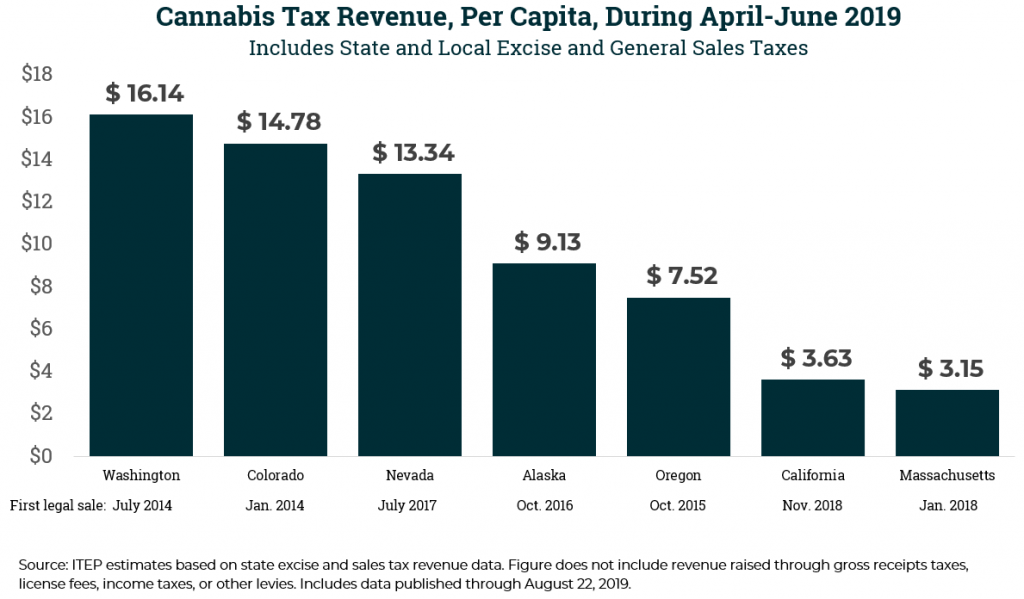

Why California’s Cannabis Market May Not Tell You Much about Legalization in Your State

August 22, 2019 • By Carl Davis

New tax data out of California, the world’s largest market for legal cannabis, tell a complicated story about the cannabis industry and its tax revenue potential. Legal cannabis markets take time to establish, and depending on local market conditions, the revenue states raise can vary significantly.

White House Considers Payroll Tax Cut that GOP Opposed During Obama Years

August 20, 2019 • By Steve Wamhoff

The Trump Administration is considering cutting the Social Security payroll tax to prevent an economic downturn, something that seemed more justified when enacted in the aftermath of the Great Recession—when congressional Republicans largely opposed it. Here are some things to remember about this tax.

Business Roundtable’s Newfound Devotion to Corporate Responsibility Doesn’t Include Paying Taxes

August 20, 2019 • By Matthew Gardner

If you squint really hard, the Business Roundtable’s newly declared fondness for “supporting the communities in which we work” could be read as an acknowledgment of the need for a tax system that can pay for needed services. But it’s not.

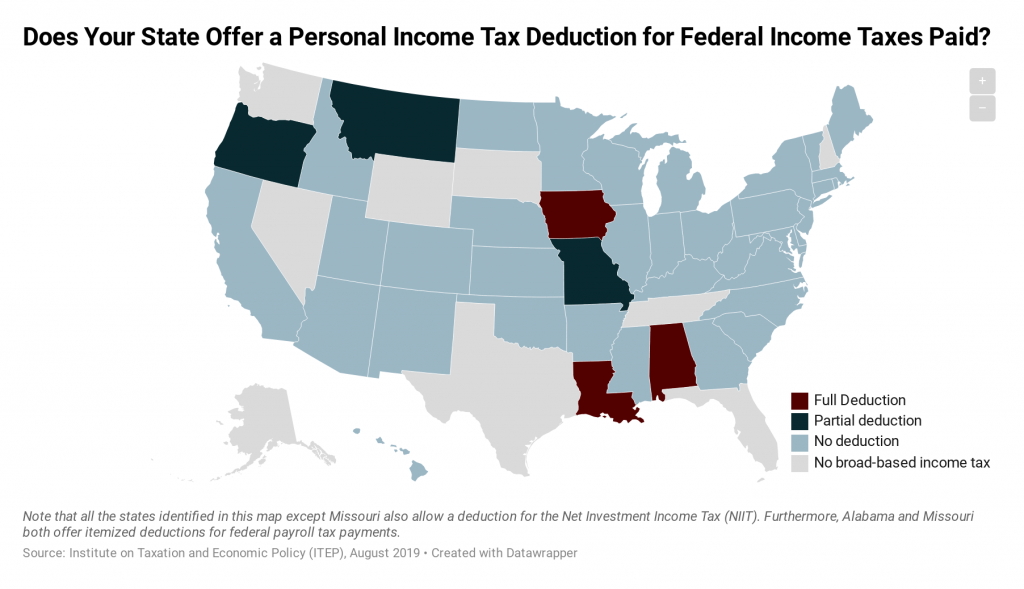

Six states allow an unusual income tax deduction for federal income taxes paid. These deductions are detrimental to state income tax systems on many fronts, as they offer large benefits to high-income earners and undercut the adequacy and stability of state income tax systems.

One Tax System for Most Americans, and a Second System for the Wealthiest

August 16, 2019 • By Matthew Gardner

Last year, the Walton family's fortune grew by $100 million a day. This level of wealth is particularly obscene in the context of the Walmart Corporation’s dark store strategy. The company works nationwide to reduce its property tax assessments, which, when successful, deprives local communities of revenue necessary to fund education, libraries, parks, public health and other services.

IRS’s SALT Workaround Regulations Should be Strengthened, Not Rejected

August 13, 2019 • By Carl Davis

Lawmakers are seeking to achieve a backdoor repeal of the $10,000 cap on deductions for state and local taxes paid (SALT) by invalidating recent IRS regulations that cracked down on schemes that let taxpayers dodge the cap. If successful, their efforts would drain tens of billions of dollars from federal coffers each year, with the vast majority of the benefits going to the nation’s wealthiest families.

Georgia Budget & Policy Institute: The Tax Cuts and Jobs Act in Georgia: High Income Households Receive Greatest Benefits

August 12, 2019

This report offers the first comprehensive look at how the Tax Cuts and Jobs Act of 2017 (TCJA), in combination with Georgia’s enacted response, will impact the state budget and families at every level of income from 2020–2025. In partnership with Step Up Savannah and the Institute on Taxation and Economic Policy (ITEP), a case […]

Policy Matters Ohio: Ohio Tax Shift Away From the Wealthy: The Pattern Repeats

August 8, 2019

The main tax measures in Ohio’s new budget bills will bring tax increases on average for lower- and middle-income taxpayers, while those at the top of the income scale on average will see cuts. Overall, the bottom 95% of taxpayers with annual income below $208,000 a year will average increases, while those in the top […]

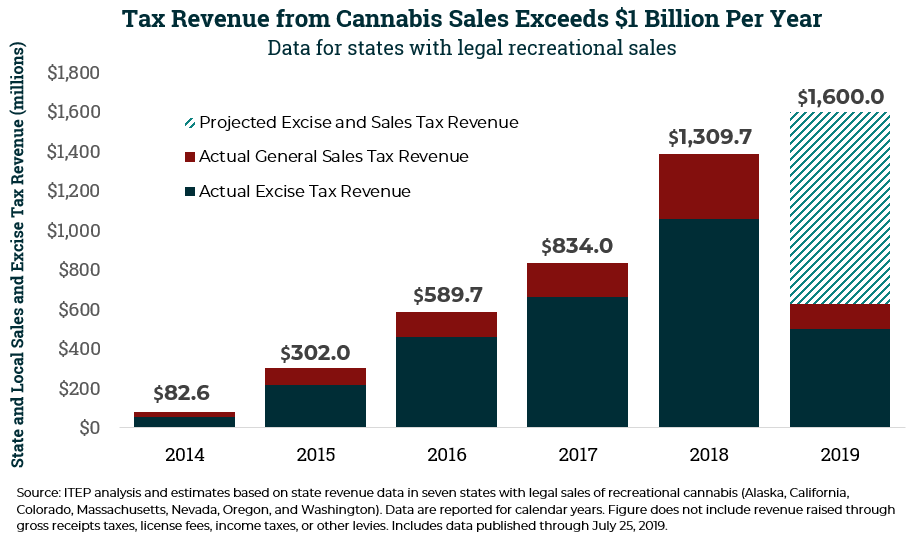

State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019

August 7, 2019 • By Carl Davis

Cannabis tax revenue is becoming more significant as legal sales grow. The tax is far from a budgetary panacea, but an ITEP analysis of revenue data reported by the seven states with legal cannabis sales underway suggests that excise and sales tax revenues from the sale of the drug could reach $1.6 billion this year.

Notes from Alan Essig, Executive Director of the Institute on Taxation and Economic Policy and Citizens for Tax Justice, and Joan Entmacher, Board Chair of the Institute on Taxation and Economic Policy, and Ed Jayne, Board Chair of Citizens for Tax Justice, announcing leadership transition.

In December 2017, federal lawmakers hastily enacted the Tax Cuts and Jobs Act. So rushed was its passage that provisions of the legislative text were scrawled in the margins. Scroll through this timeline for an in-depth look at the Tax Cuts and Jobs Act and the impact since its passage.