ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Parents of College Students: The Tax Plans’ Losers that No One Is Talking About

December 13, 2017 • By Steve Wamhoff

Parents of college students or kids in their last years of high school are more likely to face a tax hike than others under the tax legislation moving through Congress. Higher education has entered the tax debate because the House bill (but not the Senate bill) would repeal several provisions that make college and graduate education more accessible. But little thought has been given to how the tax bills would affect the parents of college students in more direct ways and make it difficult for them to finance college for their kids. If tax legislation were allowed a reasonable number…

Who Is “America First” Under the Tax Plan? The Rich First, Foreign Investors Second, Then the Rest of Us.

December 12, 2017 • By Steve Wamhoff

In his inaugural speech, President Trump told the world that Washington would be driven by a principle of “America First.” But the tax plans moving through Congress only put the richest Americans first. Everyone else comes after foreign investors.

Treasury’s 1-Page Memo Reasserts False Claims that Tax Cuts Largely Pay for Themselves — But Only When Accompanied by Spending Cuts

December 12, 2017 • By Steve Wamhoff

Treasury Secretary Steven Mnuchin claimed for weeks that his department would release a study showing that the $1.5 trillion tax cut moving through Congress would “pay for itself.” On Monday he released a one-page memo that asserts, without evidence, that economic growth resulting from President Trump’s policies would raise enough revenue to more than offset the costs of the tax cuts.

“Compromises” Under Discussion for the State and Local Tax Deduction Do Not Fix Flawed Tax Bills

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

Republicans in Congress are reported to be considering two versions of a change they claim would “improve” the current bills by making them more generous to residents of higher-taxed states. As illustrated by these estimates, the reality is that these proposals would make little difference on those states and taxpayers hit hardest.

Even with Potential SALT Compromises, Senate Bill Forces California and New York to Shoulder a Larger Share of Federal Taxes While Texas, Florida, and Other States Will Pay Less

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

The Senate tax bill, with or without either of the compromises that could be added to it, would shift personal income taxes away from Florida and Texas to states like California and New York, which are already paying a high share relative to their populations.

New ITEP Report Explains How Tax Reform Should Eliminate Breaks for Real Estate Investors Like Trump

December 1, 2017 • By Steve Wamhoff

A new report from ITEP provides more details on the many breaks and loopholes for wealthy real estate investors like Trump and what a true tax reform would do to close them.

How True Tax Reform Would Eliminate Breaks for Real Estate Investors Like Donald Trump

December 1, 2017 • By ITEP Staff

The federal tax code includes several loopholes and special breaks that advantage wealthy real estate investors like President Donald Trump. Under current law, real estate investors can claim losses much more quickly and easily than other taxpayers, but they also have several methods to delay or avoid reporting any profits to the IRS.

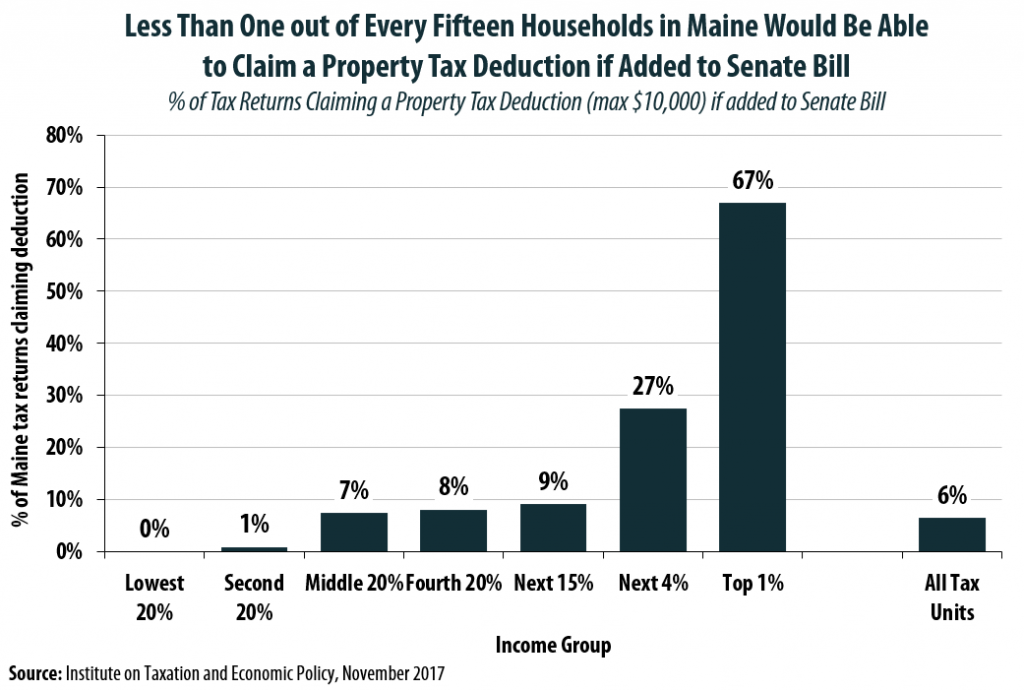

Senator Collins Pushes Hard for a Property Tax Deduction that Very Few of Her Constituents Will Be Able to Claim

December 1, 2017 • By Carl Davis

Adding a property tax deduction back into the Senate bill may sound like a compromise, but a new analysis performed using the ITEP Microsimulation Tax Model reveals that the amount of state and local taxes deducted by Maine residents would plummet by 90 percent under this change, from $2.58 billion to just $262 million in 2019. In short, this change is much more symbolic than substantive.

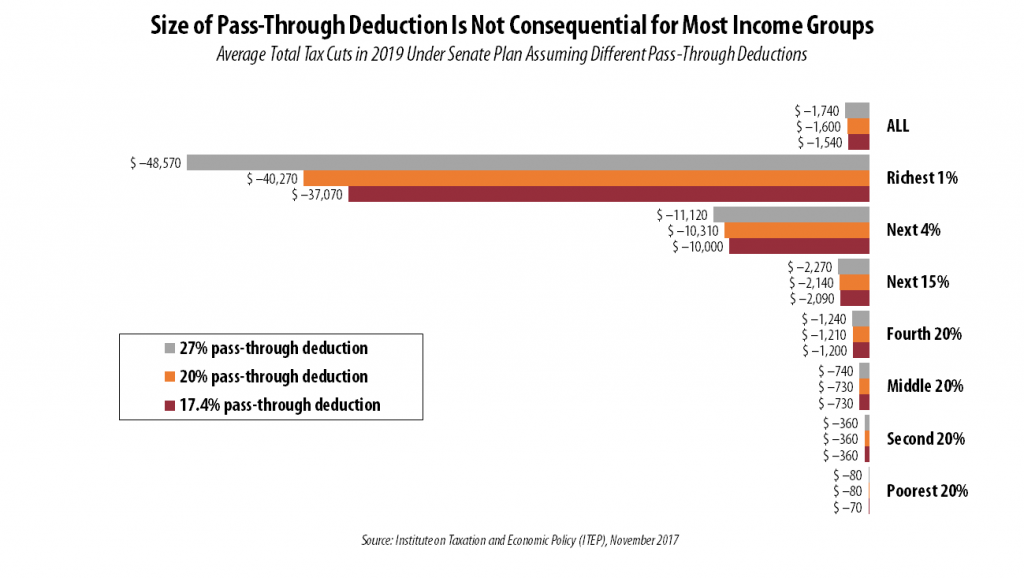

Republican Senators Debate Size of “Pass-Through” Break, But Proposed Compromises Will Make No Difference to Anyone Who Is Not Well-Off

November 30, 2017 • By Steve Wamhoff

Senators Ron Johnson of Wisconsin and Steve Daines of Montana want the tax bill on the Senate floor to be amended to offer a more generous tax break for “pass-through” businesses. We have estimated how all the provisions in the tax bill would impact each income group under three possible scenarios. The only thing different in each scenario is the size of the deduction for pass-through income: 17.4 percent (the deduction in the bill as this is written), 20 percent and 27 percent. We find that the size of the pass-through break makes no difference for anyone who is not…

Lawmakers Are Allowing Monied Interests to Trump the Voices of Their Constituents

November 30, 2017 • By Alan Essig

George Washington is said to have described the U.S. Senate as the body that cools the passions of an impulsive House of Representatives just as a saucer cools tea. But current Senate leaders appear to think of themselves as more of a Bunsen burner.

Chained CPI Would Raise Everyone’s Personal Income Taxes in the Future, Would Hurt the Poor Right Away

November 30, 2017 • By Steve Wamhoff

One of the findings is that every income group would face higher personal income taxes in years after 2025 (including 2027). Chained CPI would gradually push taxpayers into higher income tax brackets and make the standard deduction, the Earned Income Tax Credit, and several other breaks less generous over time. The switch to chained CPI would cause some low-income people to face a tax hike starting in 2019, the second year the plan would be in effect.

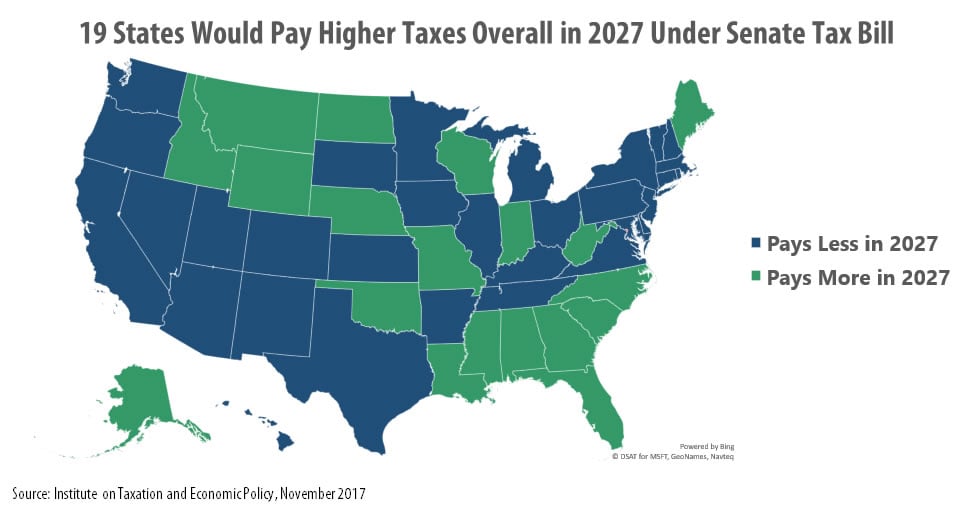

Mick Mulvaney and the 19 States Paying Higher Taxes Under the Senate Tax Bill

November 22, 2017 • By Steve Wamhoff

One of the more surprising findings of ITEP’s recent estimates on the Senate tax bill is that 19 states would pay more overall in federal taxes if the bill becomes law. This is not just an increase in the personal income taxes paid (which would happen in some states under the House bill). This is an increase in their net federal taxes overall, even including the assumed benefits of corporate tax cuts and estate tax cuts.

The Senate Tax Plan’s Big Giveaway to Multinational Corporations

November 21, 2017 • By Richard Phillips

Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Senate tax bill would forgive most of the taxes owed on these profits and open the floodgates to even more offshore profit-shifting in the future.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

Shopping for a Tax Haven: How Nike and Apple Accelerated Their Tax Avoidance Strategies, according to the Paradise Papers

November 14, 2017 • By Steve Diese

A year and a half after the release of the Panama Papers, a new set of data leaks, the Paradise Papersreleased by the International Consortium of Investigative Journalists (ICIJ) provides important new information on the tax dodging of wealthy individuals as well as multinational corporations.

How the Revised Senate Tax Bill Would Affect Wyoming Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Wyoming, 56 percent of the federal tax cuts would go to the richest 5 percent of residents, and 6 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Georgia Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Georgia, 60 percent of the federal tax cuts would go to the richest 5 percent of residents, and 19 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Wisconsin Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Wisconsin, 47 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect West Virginia Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In West Virginia, 34 percent of the federal tax cuts would go to the richest 5 percent of residents, and 6 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Washington Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Washington, 54 percent of the federal tax cuts would go to the richest 5 percent of residents, and 12 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Virginia Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Virginia, 59 percent of the federal tax cuts would go to the richest 5 percent of residents, and 19 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Vermont Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Vermont, 40 percent of the federal tax cuts would go to the richest 5 percent of residents, and 11 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Utah Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Utah, 58 percent of the federal tax cuts would go to the richest 5 percent of residents, and 18 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Texas Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Texas, 54 percent of the federal tax cuts would go to the richest 5 percent of residents, and 8 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Tennessee Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Tennessee, 46 percent of the federal tax cuts would go to the richest 5 percent of residents, and 8 percent of households would face a tax increase, once the bill is fully implemented.