ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Opponents of Inflation Reduction Act Call for Continued Tax Avoidance by Large Manufacturers

August 2, 2022 • By Steve Wamhoff

The biggest revenue-raising provision in the Inflation Reduction Act, the 15 percent minimum tax for corporations that have more than a billion dollars in profits, is under attack from members of Congress who argue that manufacturing companies should not be required to pay any minimum amount of tax. Sen. Mike Crapo, the top Republican on […]

Top Republican Tax-Writer Falsely Claims that Minimum Tax for Huge Corporations Is a Tax Hike on Middle-Class

August 2, 2022 • By Steve Wamhoff

Opponents of requiring corporations to pay even a minimum amount of taxes hold an unpopular position. But Sen. Mike Crapo, the top Republican on the Senate Finance Committee and a leader of that opposition, is using a one-sided and incomplete analysis to claim that the corporate minimum tax would raise taxes on low- and middle-income people.

The Washington Post: How the Schumer-Manchin Climate Bill Might Impact You and Change the U.S.

July 28, 2022

“This would certainly be the biggest corporate tax increase in decades,” said Steve Wamhoff, a tax expert at Institute on Taxation and Economic Policy. “We’ve had decades of tax policy benefiting the rich, but this is really the first attempt to raise revenue in a progressive way that would begin to combat wealth and income […]

Reuters: Biden Pledge to Tax Wealthy, Companies Revived with Manchin-Led Bill

July 28, 2022

Biden said during a speech on Thursday that the deal would “for the first time in a long time begin to restore fairness to the tax code – begin to restore fairness by making the largest corporations in America pay their fair share without any new taxes on people making under $400,000 a year.” The […]

ITEP: Reconciliation Deal Represents “Transformational Change” for U.S. Tax Policy

July 28, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act of 2022,” the reconciliation bill announced yesterday by Senate Democrats. “This is a transformational change for U.S. tax and energy policy. The bill restores sorely needed and long-overdue accountability to our tax code. By […]

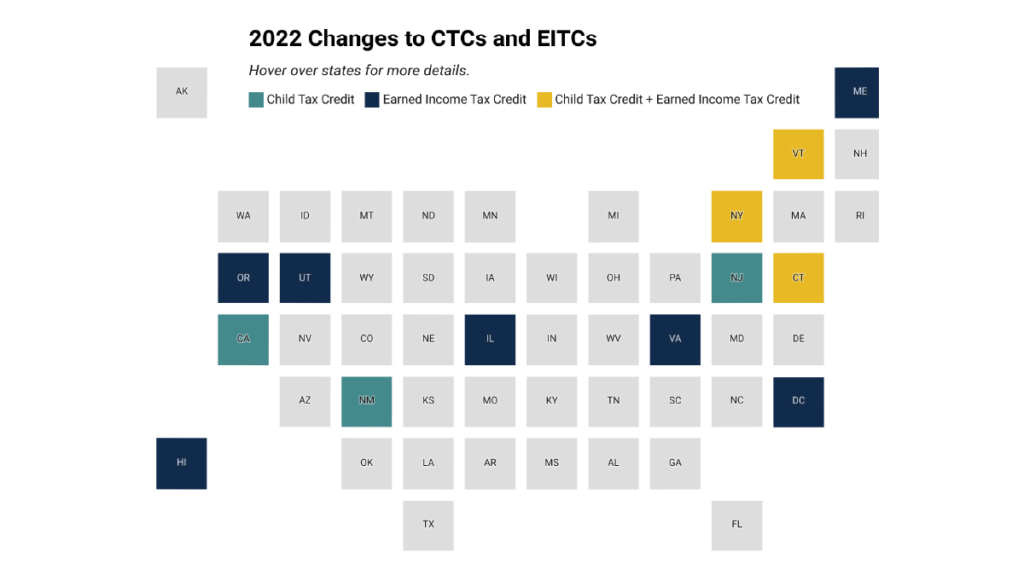

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Most States Used Surpluses to Reduce Taxes But Not in Sustainable or Progressive Ways

July 22, 2022 • By Kamolika Das

The average person on the street would have no idea that many states experienced unprecedented budget surpluses this year. Iowa, for instance, has the most structurally deficient bridges of any state with nearly 1 in 5 falling apart. The Iowa Board of Regents proposed a 4.25 percent tuition increase for all three state universities and […]

The Tax Legislation Debated in Congress Would Reduce Inflation and Help Americans Deal with Rising Costs

July 19, 2022 • By Steve Wamhoff

Opposing a fully paid-for spending bill because of inflation concerns does not make any sense. Opposing a deficit-reducing bill because of inflation is absurd.

ITEP: Tax and Climate Provisions Are What Americans Want and Need

July 15, 2022 • By Amy Hanauer

In response to conflicting reports on negotiations with Sen. Joe Manchin of West Virginia on tax increases and climate provisions, Amy Hanauer, ITEP Executive Director, released the following statement: Sen. Joe Manchin may be uncertain about higher taxes on the rich and corporations, but the American people are not. Large majorities of Americans support the tax […]

CNBC: Millions of Calif. families to get ‘inflation relief’ stimulus checks of up to $1,050

July 5, 2022

Democratic California Gov. Gavin Newsom and Democratic legislative leaders agreed on a $17 billion relief package that includes $9.5 billion in inflation relief funds. Those estimated 23 million California taxpayers will receive between $200 and $1,050 by early next year. California has more flexibility to send these kinds of payments because its budget is one of the […]

No Reason to Water Down the Tax Reforms in the Build Back Better Act

June 30, 2022 • By Steve Wamhoff

There is no justification for recently reported efforts to scale back the tax reforms in the Build Back Better Act, a bill passed by the House of Representatives in November that would raise significant revenue and make our tax code more progressive by enacting widely popular proposals. (See ITEP’s report on the BBBA.) Of course, […]

State Policy Associate or Policy Analyst (Research Team)

June 23, 2022 • By ITEP Staff

Read as PDF The Institute on Taxation and Economic Policy (ITEP) is a non-profit research organization that analyzes tax laws and tax proposals at the federal, state and local levels. ITEP’s work demonstrates the need to raise more revenue from corporations and the wealthy. Our small, influential staff works with policymakers and front-line partners to research, support, and develop tax policies that address […]

New ITEP Report Examines the Path to Equitable Tax Policy in the South

June 22, 2022 • By Kamolika Das

“From the inception of the emerging American nation, the South is a central battleground in the struggles for freedom, justice, and equality. It is the location of the most intense repression, exploitation, and reaction directed toward Africans Americans, as well as Native Americans and working people generally. At the same time the South is the […]

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

Bloomberg Tax: Flat Income Tax Revival Draws Sharply Mixed Reviews (Podcast)

June 14, 2022

With cash cushions plump with federal pandemic relief dollars and a surge in tax revenues, state legislatures across the country have cut taxes aggressively this year. But several states went further, converting their tiered income tax structures to flat-rate systems. Arizona, Georgia, Iowa, and Mississippi have committed to the flat tax in recent weeks, and […]

Rising Prices: Another Reason to Be Wary of Tax Cutting Right Now

June 10, 2022 • By Carl Davis

Many state lawmakers see any economic challenge as an excuse to cut taxes and in 2022, some are citing inflation as a reason to do so. All eyes today are on the inflation rate facing consumers which, spurred on in part by rising corporate profits, is now running at its fastest pace in decades. But […]

State Policy Associate or Policy Analyst (Policy Team)

June 9, 2022 • By ITEP Staff

Read as PDF The Institute on Taxation and Economic Policy (ITEP) is a non-profit research organization that analyzes tax laws and tax proposals at the federal, state and local levels. ITEP’s work demonstrates the need to raise more revenue from corporations and wealthy individuals. Our small, influential staff works with policymakers and front-line partners to research, support, and develop tax policies that address […]

Georgia Budget and Policy Institute: New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income and Racial Inequities

May 27, 2022

House Bill 1437, signed into law by Gov. Kemp after a final version emerged during the last hours of Sine Die 2022, sets Georgia on course to make fundamental changes to its income tax that primarily benefit the state’s highest earners at an annual cost greater than $2 billion when fully implemented. Beyond adding to […]

Arizona Center for Economic Progress: $2 Billion Tax Cuts for the Rich are Irresponsible

May 13, 2022

Last year, the legislature passed huge tax cuts whose benefits will only be seen by the richest Arizonans. Once these new tax cuts go into effect, they will reduce state revenues by an estimated $2 billion a year. The state approved a flat tax that will not result in a meaningful tax cut for most […]

Communications Director

April 25, 2022 • By ITEP Staff

Read as PDF The Institute on Taxation and Economic Policy seeks an experienced communications director to build the visibility and influence of our tax policy research. This senior position reports to ITEP’s executive director. ITEP, a non-profit, non-partisan research organization, conducts rigorous analyses of tax and economic proposals and provides recommendations to shape tax policy. […]

Spandan Marasini

April 25, 2022 • By ITEP Staff

Spandan is an Associate Data Analyst in ITEP’s Data and Model Team. He utilizes the organization’s microsimulation tax model to understand wealth concentration within the United States and prepares outputs for reports, campaigns, and advocacy on the impact of tax policy on everyday people.

Biden’s Proposals Would Fix a Tax Code that Coddles Billionaires

April 21, 2022 • By Steve Wamhoff

Billionaires can afford to pay a larger share of their income in taxes than teachers, nurses and firefighters. But our tax code often allows them to pay less, as demonstrated by the latest expose from reporters at ProPublica using IRS data. According to their calculations, Betsy DeVos, the Education Secretary under former President Donald Trump, […]

Model Development Intern Summer 2022

April 21, 2022 • By ITEP Staff

The Institute on Taxation and Economic Policy, the country’s premier progressive tax policy research organization, seeks a model development intern for 28 hours a week for 10 weeks between June and August 2022, with flexibility on precise dates. Preference given to those available for on-site work in Northeast Ohio but remote applicants may apply.

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

Cannabis Taxes Outraised Alcohol by 20 Percent in States with Legal Sales Last Year

April 19, 2022 • By Carl Davis

In 2021, the 11 states that allowed legal sales within their borders raised nearly $3 billion in cannabis excise tax revenue, an increase of 33 percent compared to a year earlier. While the tax remains a small part of state budgets, it’s beginning to eclipse other “sin taxes” that states have long had on the books.