ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

State Income Tax Reform Can Bring Us Closer to Racial Equity

October 4, 2021 • By Carl Davis, ITEP Staff, Marco Guzman

To pave the way for a more racially equitable future, states must move away from poorly designed, regressive policies that solidify the vast inequalities that exist today.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

The Billionaires’ Income Tax Is the Latest Proposal to Reform How We Tax Capital Gains

September 28, 2021 • By Steve Wamhoff

When people first hear about proposals to tax unrealized capital gains, they often ask, “Is this income, and if so, should we tax it?” The answers to those questions are “yes” and “yes, when we are talking about the very rich.”

Reforming Federal Capital Gains Taxes Would Benefit States, Too

September 28, 2021 • By Carl Davis

Congress’s action or inaction on federal tax changes under consideration in the Build Back Better plan could have important implications for states on many fronts. One critical area of note is at the foundation of income tax law: setting the definition of income that most states will use in administering their own income taxes.

Florida Policy Institute: A Working Floridians Tax Rebate for a Stronger and More Equitable Florida

September 24, 2021

Floridians who are paid lower wages spend significantly more of their income on state and local taxes than those with high income. This is because the state lacks a personal income tax and relies mostly on the sales tax to raise revenue. The state’s upside-down tax code also exacerbates racial inequity because Floridians with low […]

The Commonwealth Institute: Tax Policy in Virginia

September 24, 2021

Black and Latinx people face tremendous barriers in areas like employment, education, and housing. These barriers include explicitly racist policies like school segregation as well as policies that appear “race-neutral” yet reinforce or exacerbate racially inequitable outcomes. Virginia’s upside-down tax code is no different. A more progressive and racially equitable tax code — one that […]

Repealing the SALT Cap Would Wipe Out Revenue Raised by the House Ways and Means Bill’s Income Tax Provisions

September 23, 2021 • By Steve Wamhoff

There are several ways that the House leadership could avoid this problem. One approach is for lawmakers to replace the SALT cap with a different kind of limit on tax breaks for the rich that actually raises revenue and avoids disfavoring some states compared to others as the SALT cap does. ITEP has suggested a way to do this.

New ITEP Report Examines the Tax Changes in the House Ways and Means Build Back Better Bill

September 21, 2021 • By Steve Wamhoff

The vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Tax Changes in the House Ways and Means Committee Build Back Better Bill

September 21, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

This report finds that the vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Why Congress Should Reform the Federal Corporate Income Tax

September 17, 2021 • By Joe Hughes, Steve Wamhoff

It is reasonable for corporations (and, indirectly, their shareholders) to pay taxes to support the government investments that make their profits possible, such as the highways that facilitate the movement of goods and people, the education and health care systems that provide a productive workforce, the legal system and the protection of property, all of which are vital to commerce. Corporate tax avoidance allows wealthy and powerful individuals to reap enormous benefits from these investments without contributing their fair share to support them.

House Ways and Means Provisions to Raise Revenue Would Significantly Improve Our Tax System But Fall Short of the President’s Plan

September 15, 2021 • By Steve Wamhoff

High-income people and corporations would pay more than they do today, which is a monumental change. But some wealthy billionaires like Jeff Bezos would continue to pay an effective rate of zero percent on most of their income, and American corporations would still have some incentives to shift profits offshore.

New Census Data Highlight Need for Permanent Child Tax Credit Expansion

September 14, 2021 • By Neva Butkus

The status quo was a choice, but the Census data released today shows that different policy choices can create drastically different outcomes for children and families. It is time for our state and federal legislators to put people first when it comes to recovery.

A Data-Driven Case for the CTC Expansion in the Ways & Means Committee’s Recent Proposal

September 13, 2021 • By Aidan Davis

The move toward permanent full refundability and inclusion of all immigrant children are crucial components of the future of the CTC. Together they will help ensure that the credit reaches the children most in need, making a vital dent in our nation’s unacceptably high rate of child poverty.

Extending Federal EITC Enhancements Would Bolster the Effects of State-Level Credits

September 13, 2021 • By Aidan Davis

The EITC expansion targets workers without children in the home. In 2022 it would provide a $12.4 billion boost, benefiting 19.5 million workers who on average would receive an income boost of $730 dollars.

Wisconsin Budget Project: Wisconsin’s Billion-Dollar Tax Cut Leaves out a Huge Chunk of Households

September 9, 2021

Shutting low-income families out of the tax cut will further skew Wisconsin’s tax system, which already requires people with low incomes to pay a higher share of their incomes in state and local taxes than people with much higher earnings. The lowest 20% of Wisconsin households by income, in which households earn less than $22,000 […]

Frequently Asked Questions about Proposals to Repeal the Cap on Federal Tax Deductions for State and Local Taxes (SALT)

September 3, 2021 • By Carl Davis, ITEP Staff, Steve Wamhoff

Even though Democrats in Congress uniformly opposed the TCJA because its benefits went predominately to the rich, many Democratic lawmakers now want to give a tax cut to the rich by repealing the cap on SALT deductions.

We asked New York state resident Morris Pearl, former Blackrock executive and current chair of the Patriotic Millionaires, a few questions to hear straight from the mouth of a millionaire how the SALT cap and its proposed repeal would affect his life.

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

The One Thing Missing From the Qualified Business Income Deduction Conversation: Racial Equity

August 25, 2021 • By Marco Guzman

When crafting tax policy, lawmakers and bill authors often work backward, using a patchwork of changes to help achieve their stated goal. One important consideration that is routinely left out is what impact the change will have on racial equity. Such is the case with the qualified business income deduction, which is helping to further enrich wealthy business owners, the overwhelming majority of whom are white. At present, white Americans own 88 percent of private business wealth despite making up only 60 percent of the population. Meanwhile, Black and Hispanic families confronting much higher barriers to entrepreneurship each own less…

Eliminating the State Income Tax Would Wreak Havoc on Mississippi

August 25, 2021 • By Kamolika Das

History has repeatedly shown that such policies harm state economies, dismantle basic public services, and exacerbate tax inequities.

One Voice: Who Pays, Mississippi? An Overview of State Tax Policy and Racial Equity Impacts

August 17, 2021

Historic and current injustices, both in public policy and in society more broadly, have resulted in vast disparities in income across race and ethnicity in Mississippi. State and local tax codes are not the sole contributors to, nor will they be the sole solution to, racial economic inequities. However, the state’s tax system is playing […]

North Carolina Policy Watch: NC House Tax Plan Isn’t Good for Our State (And These Graphs Explain Why This Is the Case)

August 10, 2021

The House tax plan would deliver the greatest share of the net tax cut to the richest North Carolinians. Fifty-six percent of the net tax cut would go to the richest 20 percent in North Carolina. During the House Finance debate, proponents of the tax plan suggested that North Carolinians with poverty-level incomes would see […]

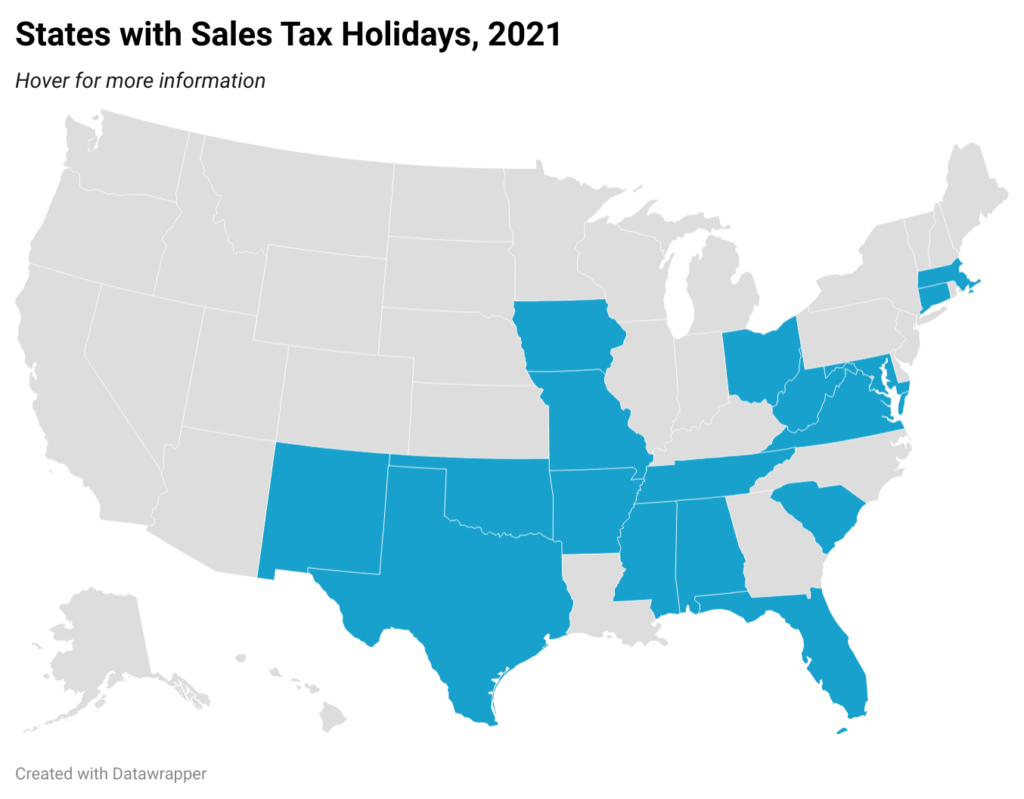

State Experimentation with Sales Tax Holidays Magnifies Their Flaws

August 6, 2021 • By Dylan Grundman O'Neill

It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

Congress is proving that there does not need to be a trade-off between good climate policy and good economic policy. Direct hires aside, an even bolder government-backed effort to secure the future of our planet could create as many as 25 million net new jobs at its peak, as well as 5 million permanent jobs, many of which deal directly with domestic infrastructure and cannot be outsourced. With the U.S. economy still down 5.7 million jobs from pre-pandemic levels, climate legislation can be a critical investment for jumpstarting our economic recovery.