ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

The Moneyist: ‘I’m Having a Hard Time Understanding How Earning Over $200K/year Is Too Much to Qualify for a Decent Stimulus Check’

July 14, 2020

According to the Institute on Taxation and Economic Policy, the majority of state tax systems are regressive. “Those in the highest-income quintile pay a smaller share of all state and local taxes than their share of all income while the bottom 80% pay more. In other words, not only do the rich, on average, pay […]

Who Pays Taxes in America in 2020?

July 14, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

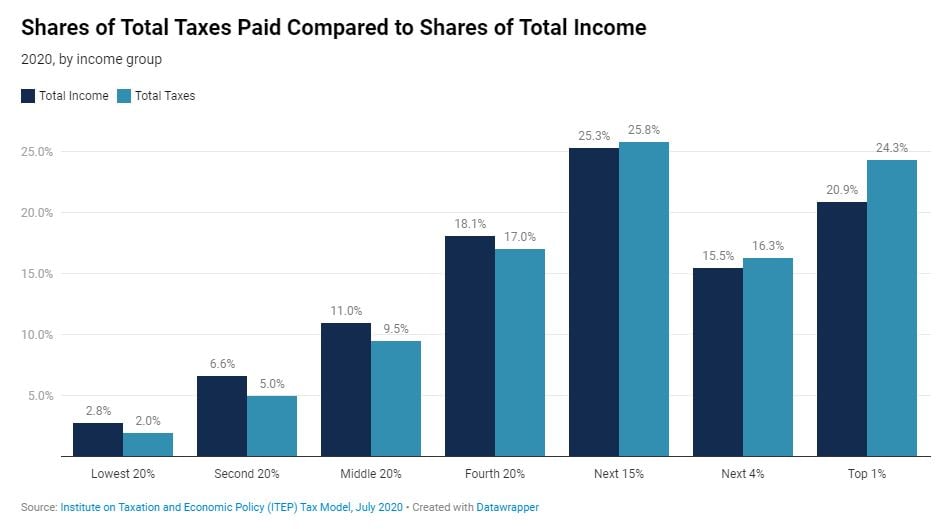

Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans (24.3 percent) will be just a bit higher than the share of all income going to this group (20.9 percent). The share of all taxes paid by the poorest fifth of Americans (2 percent) will be just…

ITEP: Tax Cuts for the Rich Will Exacerbate Inequality, Fail to Address Current Economic Crisis

July 13, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding White House Advisor Larry Kudlow’s statement on priorities for the next economic relief package.

Adequately Funding the IRS Would Be One Small Step Toward Racial Equity in the Tax Code

July 10, 2020 • By Jenice Robinson

IRS Commissioner Charles Rettig vowed to work with Congress to explore how the federal tax system contributes to the racial wealth gap. There are at least two ways this can happen: tax policies enacted by Congress and IRS enforcement of these policies.

Wall Street Journal Opinion: Payroll-Tax Cuts Mostly Go to the Well Off

July 9, 2020

Contrary to the authors’ claim, a payroll tax cut wouldn’t “disproportionately benefit” lower-income workers. According to the Institute on Taxation and Economic Policy, nearly half of the benefit from a payroll-tax cut would go to the richest 20% of taxpayers, and would be a boon to big corporations that are under no obligation to rehire […]

Jacobin: The 1 Percent Are Cheating Us Out of a Quarter-Trillion Dollars in Taxes Every Year

July 9, 2020

On the international front, Trump’s 2017 tax cut bill included several provisions that “encourage American-based corporations to shift profits offshore,” according to the Institute for Taxation and Economic Policy. The administration has also recently moved to roll back rules designed to crack down on so-called corporate inversions, whereby companies incorporate offshore in order to avoid […]

Yahoo Finance: This GOP Proposal May Slash Taxes for Big Tech: ITEP

July 9, 2020

Matthew Gardner, Senior Fellow at the Institute on Taxation and Economic Policy, joins Yahoo Finance’s Zack Guzman to discuss how a possible Republican tax credit proposal could provide new breaks to tax avoiders like Netflix and ITEP. Watch here (video)

MedPage Today: Tenet Gets Big Federal $$$ but Still Cuts Employees

July 9, 2020

Many companies, including Tenet, delayed paying their 2017 tax liabilities at the rate then (35%) to follow whatever the rate is when they decide to pay (21% for 2019), said Matthew Gardner, a senior fellow with the Institute on Taxation and Economic Policy. “That’s certainly an incentive created by the tax cut,” Gardner told MedPage […]

Gothamist: Undocumented Immigrants In Need Finally Get Promised Pandemic Cash Assistance

July 9, 2020

Most workers who lost their jobs during the COVID-19 pandemic started receiving unemployment and federal stimulus checks in March and April. But undocumented immigrants don’t qualify, even though the Institute on Taxation and Economic Policy found more than half pay taxes (including over $1 billion in New York alone). U.S. citizens married to undocumented immigrants […]

Congressional Budget Office Confirms That IRS Budget Cuts Lose Money and Benefit the Rich

July 9, 2020 • By Steve Wamhoff

Lawmakers often claim that they are “saving” taxpayers money by slashing federal spending, but the truth is that these cuts often are counterproductive and costly in the long-term. One type of budget-cutting has costs that are immediate and obvious—cuts to the IRS, the agency that collects the revenue that pays for federal spending. A new report from the Congressional Budget Office (CBO) confirms that lawmakers’ anti-government, IRS funding-cuts zeal has increased the deficit.

Business Insider: Trump Wants Tax Breaks to Encourage People to Watch Sports Games and Travel Around the US. Here’s Why That Could Backfire as the Pandemic Rages.

July 8, 2020

The McSally proposal also drew fire from economists who argued it would mainly benefit wealthier taxpayers and not be well targeted. “Low and most middle-income families will receive no or minimal benefit as you can’t claim the maximum credit until you’re pretty well off,” Matthew Gardner, a senior fellow at the left-leaning Institute on Taxation […]

Financial Times: ‘It’s a Matter of Fairness’: Squeezing More Tax From Multinationals

July 8, 2020

Since the late 1980s, there has been a complete change in mindset, one pioneered and taken to its extreme by General Electric, America’s biggest manufacturer by market capitalisation for most of the past 40 years. Under the late Jack Welch, who ran the company from 1981 to 2001, a tiny corporate tax team was transformed […]

New Fiscal Year Brings New Challenges and Opportunities in the States

July 1, 2020 • By Kamolika Das

July 1—the start of the new fiscal year in most states—typically marks a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions. 2020 is markedly different. Nationwide business closures and stay-at-home orders in response to COVID-19 have led to unprecedented spikes in unemployment, decreased demand for consumer spending, and increased demand for vital public services. As a result, states face incredibly uncertain financial futures with little clarity regarding how their tax collections will fare over the next year.

Nonprofit Quarterly: The $370 Billion Fiscal Cliff: Why State Budgets Need Our Attention

June 30, 2020

A 2018 study released by the nonprofit Institute on Taxation and Economic Policy finds that the poorest fifth spend on average 11.4 percent of their income on state and local taxes, compared to 7.4 percent for the top one percent. As Peter Sabonis wrote for NPQ this spring, particularly during times of crisis, we rely […]

Law 360: Biz Tax Credit Proposals Would Aid Wealthy, Report Says

June 30, 2020

Republican proposals to make business tax credits refundable to mitigate the economic downturn caused by the novel coronavirus pandemic would provide unnecessary tax breaks to high-income people, the Institute on Taxation and Economic Policy said in a report. Read more

POLITICO Morning Tax: Welcome, commissioner

June 30, 2020

FOOT OFF THE ACCELERATOR, PLEASE: The Institute on Taxation and Economic Policy’s Matthew Gardner and Steve Wamhoff maintain in a new paper that the proposals to allow companies to cash out on their tax credits won’t just help businesses in desperate need of cash. Instead, they argue that companies like Amazon and Netflix, which are already […]

Republican Tax Credit Proposal Would Provide New Breaks to Tax Avoiders Like Amazon and Netflix

June 30, 2020 • By Matthew Gardner, Steve Wamhoff

While lawmakers of both parties and policy experts discuss various ways to respond to the continuing COVID-19 crisis and resulting economic downturn, Republicans in Congress are offering a new solution. Their idea, which is still being discussed, is to waive existing limits on business tax credits. This could benefit corporations that are profitable but that nonetheless pay no taxes or very little in taxes because of the many tax breaks and legal loopholes they already enjoy.

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

McSally “Travel Tax Credit” Is an Invitation for Tax Avoidance

June 23, 2020 • By Matthew Gardner

Earlier this week, U.S. Sen. Martha McSally (R-AZ) introduced the “American TRIP Act,” a bill ostensibly designed to encourage Americans to boost the economy by traveling within the United States. The bill is certainly a trip in the colloquial sense of the word.

The Fiscal Times: A ‘Wacky’ Tax Credit Idea: $4,000 for Vacation

June 23, 2020

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, says that the loose requirements in the bill mean “that any car owner with an ounce of creativity should be able to gin up an excuse for taking a tax credit for every tank of gas they’ve purchased in 2020.” That, says […]

The Institute on Taxation and Economic Policy stands with activists who are guiding the movement to transform America, dismantle systemic racism in policing, and envision a better justice system. Committed protestors in big cities, small towns, and suburban enclaves have spurred a sea change in public opinion and policy possibility on policing and incarceration. Their work and activism builds on years of action by Black Lives Matter and other leaders.

The Dallas Morning News: DACA Texans Are Essential to our COVID-19 Response and Economic Future

June 22, 2020

In total, Texas is home to more than 107,000 DACA recipients, according to U.S. Citizenship and Immigration Services. Those DACA recipients pay $244.5 million annually in state and local taxes, the Institute on Taxation and Economic Policy estimates. Read more

Sentinel & Enterprise: It’s Been a Year Without Equal

June 21, 2020

Instead, the last real action on the fiscal 2021 budget came in January when Baker rolled out a $44.6 billion spending plan that would have its underlying assumptions wiped away before lawmakers could try their hands at producing a budget of their own. The Institute on Taxation and Economic Policy this week said that “despite […]

CNN: This Is Who’s Affected by the Supreme Court Decision on DACA

June 18, 2020

According to a 2018 report from the Institute on Taxation and Economic Policy, the young undocumented immigrants who are enrolled in DACA and those who would be eligible for the program if it were still accepting new applicants contribute about $1.7 billion in state and local taxes annually. That figure includes personal income, property, and […]

New Jersey Policy Perspective: Unemployment Insurance Taxes Paid by Undocumented Workers Top $1 Billion

June 17, 2020

Over the past ten years, unemployment insurance taxes paid based on undocumented immigrants’ work in New Jersey added more than $1.36 billion to state and federal unemployment insurance trust funds, according to a recent analysis conducted by the Institute on Taxation and Economic Policy and the Fiscal Policy Institute. In addition to contributions to unemployment […]