Blog - Federal Policy

525 posts

Congressional Budget Office: New Tax Law Helps Foreign Investors Even More than You Thought

April 19, 2018 • By Steve Wamhoff

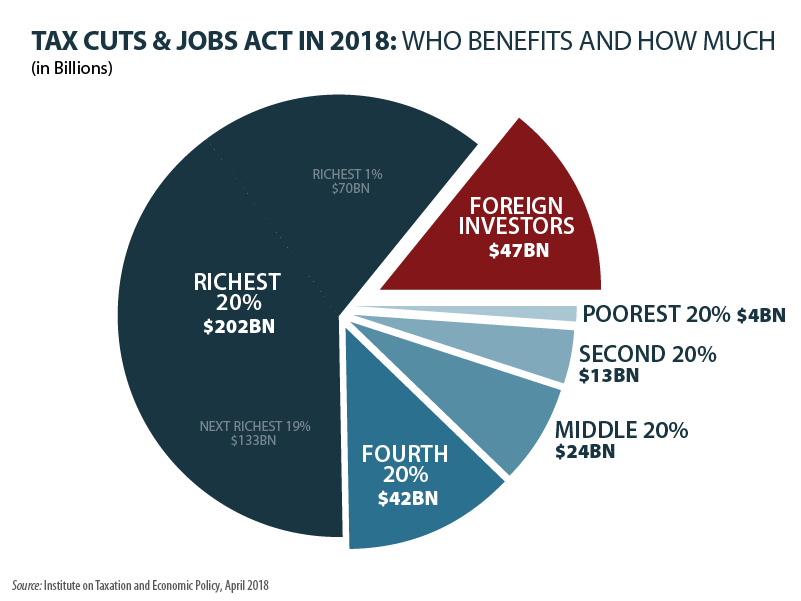

President Trump and his allies in Congress have made many wild claims about economic growth that would result from the Tax Cuts and Jobs Act. And the Congressional Budget Office just released a report revealing the TCJA will, in fact, create economic growth — for foreign investors.

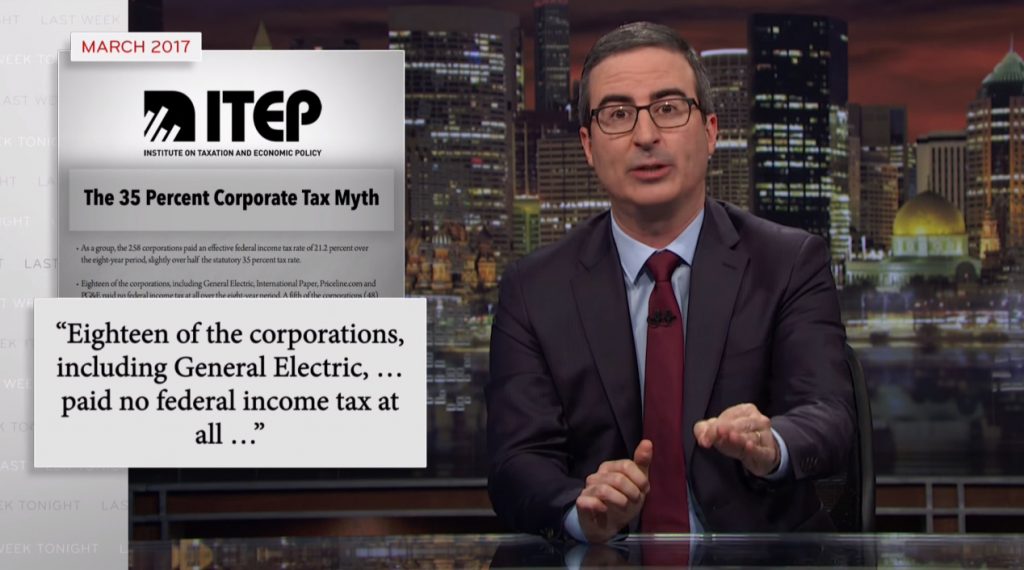

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

A Paul Ryan Retrospective: A Decade of Regressive Budget and Tax Plans

April 11, 2018 • By ITEP Staff

As Speaker of the House, Rep. Paul Ryan pushed through the Tax Cuts and Jobs Act that will cost at least $1.5 trillion and provide around half of its benefits to the richest five percent of households. He then announced that Congress needs to cut entitlements to get the budget deficit under control. Before becoming Speaker, Ryan spent several years running the Budget Committee and the Ways and Means Committee, where he issued budget and tax plans each year to carry out his goals (lower taxes for the rich and cuts in entitlement spending), which are described in the reports…

New ITEP Report: Extension of the Temporary TCJA Provisions Would Be Just as Regressive as TCJA Itself

April 10, 2018 • By Steve Wamhoff

A new ITEP report estimates the impacts in every state of the much-discussed idea of extending the temporary provisions in the Tax Cuts and Jobs Act, which will expire after 2025 without further action from Congress. The report concludes that extending or making permanent these provisions would be just as skewed to the wealthy as the original law.

Passing the Buck: Forcing Spending Cuts through a Balanced Budget Amendment

April 5, 2018 • By Ronald Mak

House leaders are preparing a vote on a balanced budget amendment next week that could force massive spending cuts and restrict the ability of lawmakers to raise revenue. Although a balanced budget amendment will likely be pitched as a way to address our nation’s long-term fiscal challenges, such proposals are economically harmful, ineffective, and one-sided.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

Unintended Consequences of the New Tax Bill Keep Cropping Up

March 23, 2018 • By Dacey Anechiarico

Due to its rushed passage in a matter of weeks, without public hearings or enough time even for basic proofreading, the Tax Cuts and Jobs Act (TCJA) contains numerous unintended consequences that Congress is now scrambling to fix. The authors of the new law have openly admitted that the law includes major mistakes. One of the most prominent drafting errors is what is now known as the “grain glitch,” which temporarily created a huge incentive for farmers to sell their products to cooperatives over businesses taking other forms.

The Heritage Foundation, the Institute on Taxation and Economic Policy (ITEP), and the Committee for a Responsible Federal Budget (CRFB) routinely disagree on a wide range of policy issues, but a recent Ways and Means Tax Policy Subcommittee hearing revealed they all agree that the continual and unpaid-for extension of temporary tax breaks needs to end.

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut

March 14, 2018 • By Matthew Gardner

For the second time in seven months, President Trump will visit a Boeing factory to hype corporate tax cuts. He’s chosen the wrong poster child. If there was something preventing the aerospace giant from expanding its business before the Trump-GOP tax law, it certainly wasn’t taxes. Boeing made headlines in 2016 only because after years of paying zero in federal taxes, it finally paid something. Over 10 years (2008 to 2017), the company paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits.

The tobacco company Reynolds American announced this week that its full-time employees will receive a one-time bonus of $1,000 in the wake of a sharp reduction in its British parent company’s tax bill.

Five Ways States Can Recoup Corporations’ Massive Federal Tax Giveaway

March 2, 2018 • By Aidan Davis

Corporate America is doing alright. Corporate profits soared last year, and 2018 has already brought a major windfall in the form of the Trump-GOP tax law, which dramatically cut the federal corporate tax rate from 35 percent to 21 percent and shifted to a territorial tax system, giving income earned offshore by U.S. companies a free pass by no longer making it subject to U.S. taxes.

Why the Minute Federal 529 Provision Has Huge Consequences for States

February 23, 2018 • By Ronald Mak

When Republican leaders rushed through an overhaul to the federal tax code over a seven-week legislative period, they failed to acknowledge that many provisions in their bill would have negative consequences for states. One such provision of the Tax Cuts and Jobs Act that undermines state laws is the expansion of federal tax breaks that now allows taxpayers to use 529 savings plans to pay for private K-12 education.

Two narratives that intentionally obscure who benefits from the tax law are emerging. One focuses on the personal income tax cuts that will result in an increase in net take-home pay for many employees once their employers adjust withholding. Anecdotes abound of working people getting a $100 or more increase, after taxes, per paycheck, but the reality is that most workers will receive a lot less than that. Meanwhile, the wealthiest 1 percent of households will receive an average annual tax break of $55,000, an amount that nearly eclipses the nation’s median household income.

Mnuchin’s Not So Grand Stand on the Carried Interest Loophole Explained

February 15, 2018 • By Matthew Gardner

When President Trump released the initial outline of his tax reform plan in April, carried interest repeal was nowhere to be found. And when Congress hammered out a tax plan in late December, lawmakers agreed to reduce the cost of the carried interest tax provision by about 5 percent. (Full repeal would have raised $20 billion over a decade; the enacted provision raises about $1 billion.)

A Gas Tax Hike Is the Obvious Answer to Infrastructure Funding

February 14, 2018 • By Steve Wamhoff

As part of his budget plan released Monday, President Trump offered an infrastructure proposal that he describes as a $1.5 trillion 10-year surge in infrastructure investments. The details of the proposal explain that the federal government would put up only $200 billion of this total, which the administration claims will be offset with cuts in other spending. Even this relatively meager funding amount is illusory because it would clearly be financed by cutting other federal spending — including infrastructure investments.

GOP Dilemma: Love the Tax Cut, Hate the Agency that Administers It

February 14, 2018 • By Matthew Gardner

The president’s budget proposal would cut the agency’s baseline funding from $12 billion to $11.1 billion this year. This is almost a quarter less, in inflation-adjusted terms, than the $14.4 billion the agency received in fiscal year 2010. Not surprisingly, the long, steady decline of IRS funding during this period has led to a reduction in staffing: the agency’s 2016 employee total of 77,000 was 17,000 lower than at the beginning of the decade.

Amazon Inc. Paid Zero in Federal Taxes in 2017, Gets $789 Million Windfall from New Tax Law

February 13, 2018 • By Matthew Gardner

The online retail giant has built its business model on tax avoidance, and its latest financial filing makes it clear that Amazon continues to be insulated from the nation’s tax system. In 2017, Amazon reported $5.6 billion of U.S. profits and didn’t pay a dime of federal income taxes on it. The company’s financial statement suggests that various tax credits and tax breaks for executive stock options are responsible for zeroing out the company’s tax this year.

The More Things Change: PG&E Records a Tenth Straight Year of No Federal Income Taxes

February 9, 2018 • By Matthew Gardner

In the runup to last fall’s tax debate, it was commonly observed that corporate tax reform is both easy and hard: the easy part is cutting the rate, and the hard part is paying for it by closing loopholes. The real test of Congress’ determination to achieve tax reform would be whether they would stand up to corporate lobbyists and shut down loopholes like accelerated depreciation that allow profitable companies to pay little or no income tax. As is now widely known, Congress was not especially determined: lawmakers aggressively cut the corporate rate from 35 to 21 percent, but then…

How the Latest Budget Deals Expose the Failure of “Tax Reform”

February 9, 2018 • By Richard Phillips

If there was one thing that tax reform legislation was supposed to accomplish, it was to put an end to the scandalous semiannual ritual of extending and expanding the list of the temporary provisions in the tax code, known as tax extenders. During the passage of the last tax extenders bill at the end of December 2015, lawmakers on both sides of the aisle agreed that it was critical to have a tax code that provides “permanency and certainty” and to move forward with comprehensive tax reform that would decide the fate of the extenders once and for all. Unfortunately,…

How Much Will Typical Middle-Class Workers Really See Their Paychecks Change?

February 3, 2018 • By Steve Wamhoff

The campaign by Republican leaders in Congress to promote their new tax law has two prongs. One is the claim that corporate income tax cuts are already trickling down to workers, which, as we have explained, is believed by basically no economists anywhere. The other prong of their campaign is to argue that the personal income tax cuts will provide a noticeable decline in withholding from paychecks that middle-class people will notice soon. At this point, it’s helpful to look at some actual data and see how small the boost in take-home pay will really be for most Americans.

Sometimes, ranking near No. 1 in the world is not a badge of pride. According to the Financial Secrecy Index released by the Tax Justice Network (TJN), the United States is the second largest contributor to financial secrecy in the world, placing it in the company of infamous tax havens such as Switzerland (ranked No. 1) and the Cayman Islands (ranked No. 3). Financial secrecy is enabling people to hide income from the authorities to evade taxes or financial regulation, launder profits from crime, finance terrorism, or otherwise break the law.

How Exxon’s Empty $50 Billion Promise Made Its Way into Trump’s SOTU

January 31, 2018 • By Matthew Gardner

Never one to let the truth get in the way of a good story, House Speaker Paul Ryan immediately published a press release with the headline, “ExxonMobil to Invest an Additional $50 Billion in the U.S. Due to Tax Reform.” The statement was completely faithful to ExxonMobil’s statement, except for the words “additional” and “due to tax reform.” Not to be outdone, President Trump implied during his State of the Union address that the company was investing $50 billion in response to the new tax law. But a closer examination of ExxonMobil’s recent history of domestic spending finds that the…

Fact-Checking Trump’s State of the Union Address on Tax Issues

January 31, 2018 • By Steve Wamhoff

Here are some claims the President made during his State of the Union address, along with the facts.

Moody’s and Conservative Economists Agree: The Trump Corporate Tax Cut Is Not Helping Workers

January 26, 2018 • By Steve Wamhoff

Moody’s does not believe that corporate tax cuts are trickling down to working people as bonuses and pay raises. The real problem with the corporate PR campaign is that even those economists who supported Trump’s corporate tax cut and claimed it would help workers do not believe that it works this way.