ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

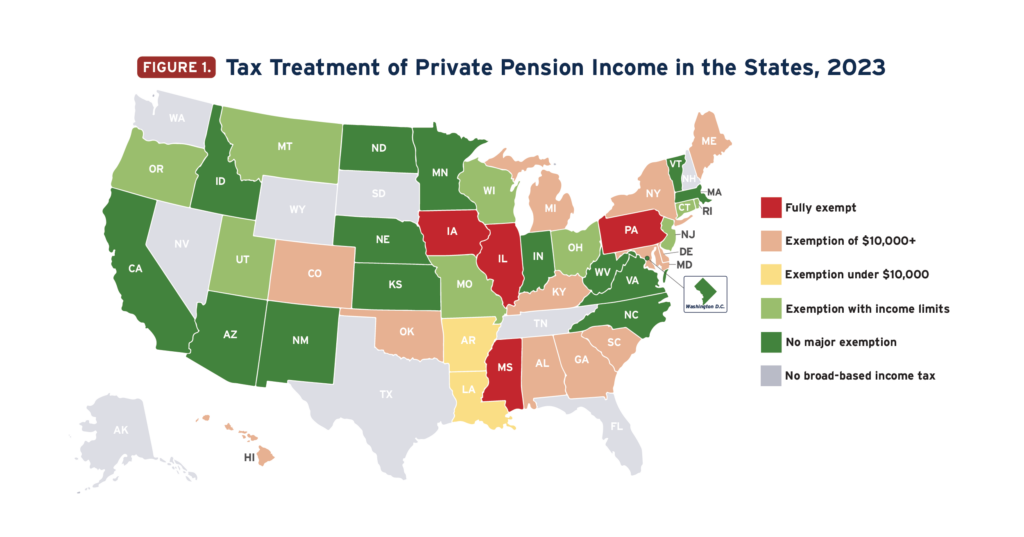

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2024 Budget Plan

March 10, 2023 • By Steve Wamhoff

President Biden’s latest budget proposal includes trillions of dollars of new revenue that would be paid by the richest Americans, both directly through increases in personal income, Medicare and estate taxes, and indirectly through increases in corporate income taxes.

President’s Budget Would Strengthen Medicare Taxes Paid by the Wealthy

March 8, 2023 • By Joe Hughes

As part of his new budget plan, President Biden is asking the richest Americans to pay a little bit more to strengthen Medicare. The proposal includes raising taxes related to Medicare very slightly for the highest earners and closing a loophole that some wealthy individuals use to avoid Medicare taxes altogether.

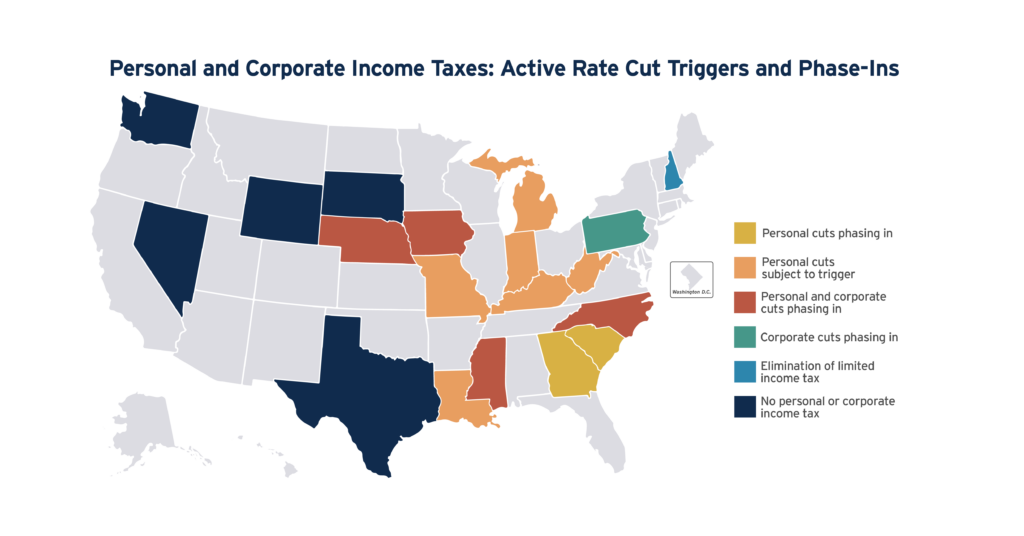

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

Policy Matters Ohio: Speaker’s #1 priority – Tax cut for the rich

February 23, 2023

One of Ohio House Speaker Jason Stephens’ top-priority bills, House Bill 1, is a massive giveaway to the rich, and the first of two such proposals by leading Republicans in Ohio’s House. According to a new analysis by Policy Matters Ohio, HB 1 slashes funding to children and all manner of local services, does nothing […]

Biden Says the Stock Buyback Tax Should Be Higher. Here are Three Reasons Why He’s Right.

February 13, 2023 • By Joe Hughes

A higher tax on stock buybacks would reduce the tax disparity between dividends and buybacks, raise more revenue for productive public investments, and recoup some of Trump's corporate tax cuts that went to wealthy shareholders.

Higher Stock Buyback Tax Would Raise Billions by Tightening Loophole for the Wealthy

February 13, 2023 • By Joe Hughes

A higher excise tax rate on buybacks is completely reasonable. Quadrupling the rate, as the President proposes, would raise more revenue and cut into the tax advantage buybacks have over dividends. When a company uses their cash holdings to repurchase their own stock, it is an admission that they have few productive investment opportunities. The public does have productive uses for the tax revenue like infrastructure and schools that create value for the entire economy.

By Fighting Audit Bias, Funding for Tax Enforcement Can Advance Racial Equity

February 1, 2023 • By Jon Whiten

Black households are between 2.9 and 4.7 times more likely to be audited by the Internal Revenue Service than non-Black households. This disparity is driven in part but not wholly by a lack of resources at the IRS, which itself is driven by years of budget cuts the agency has faced.

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

National Taxpayer Advocate: Infusion of New IRS Funding a ‘Gamechanger’ for Taxpayers

January 17, 2023 • By Jon Whiten

A new report from the National Taxpayer Advocate – part of an independent oversight arm inside the IRS – found that the agency struggled in 2022 with timely processing of tax returns and refunds, responding to taxpayer correspondence quickly, and answering phone calls. It expects these issues to improve in 2023, thanks in part to the influx of $80 billion in new funding from last year’s Inflation Reduction Act, which the Advocate’s office calls a “gamechanger” for Americans.

GAO Report Confirms: Trump Tax Law Cut Corporate Taxes to Rock Bottom

January 13, 2023 • By Steve Wamhoff

A new report from the Government Accountability Office finds the average effective federal income tax rate paid by large, profitable corporations fell to 9 percent in the first year the Trump tax law was in effect, and the share of such companies paying nothing at all rose to 34 percent that year.

“Fair Tax” Plan Would Abolish the IRS and Shift Federal Taxes from the Wealthy to the Rest of Us

January 11, 2023 • By Steve Wamhoff

The "Fair Tax" bill would impose a 30 percent federal sales tax on everything we buy – groceries, cars, homes, health care - and lead to a giant tax shift from the well-off to everyone else.

Congress should unite around a basic principle that Republican, Democratic, and independent voters support: the wealthiest, whether they are presidents, CEOs, or just rich heirs, should pay their fair share. Using Trump's tax maneuvering as a guidebook could make the tax code much fairer for all of us.

The European Union Moves Forward on Global Minimum Tax. Time for the U.S. to Follow.

December 21, 2022 • By Joe Hughes

The European Union has reached unanimous agreement to implement a global minimum tax beginning in 2024. With the EU and UK fully on board, it's time for Congress to follow suit and implement the plan negotiated by the Biden administration. Doing so would improve the corporate tax system here and around the world while making the United States economy stronger and more competitive.

Covering federal, state, and corporate tax work, here are our top 5 charts of 2022. It’s worth noting that the biggest tax news of 2022 – the adoption of a federal 15 percent corporate minimum tax in the Inflation Reduction Act – should make some of these charts look much better after the new law is implemented.

Any tax legislation enacted before this Congress ends should prioritize policies that have a proven track record of helping workers and children rather than policies that cut taxes for corporations or for individuals who are already well-off. It's not clear right now whether lawmakers will do that - or whether they will enact any tax legislation at all before the year ends, but here we take a look at the key tax issues that lawmakers are discussing.

Lawmakers Seek to Extend Tax Break for “Research” that Corporations Use to Develop Frozen Foods, New Beer Flavors, Casino Games and Tax Avoidance

December 8, 2022 • By Steve Wamhoff

If Congress creates a tax break to encourage businesses to conduct research that benefits society, should Netflix be eligible for it? There is no shame in binge-watching Stranger Things or Bridgerton or The Crown, but how many of us really think Netflix deserves a tax break for whatever “research” the company did to provide this […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Twenty-Three Corporations Saved $50 Billion So Far Under Trump Tax Law’s “Bonus Depreciation” that Many Lawmakers Want to Extend

November 10, 2022 • By Matthew Gardner, Steve Wamhoff

Nearly two dozen of America’s largest corporations together received roughly $50 billion in tax breaks from 2018 through 2021 under a Trump tax law provision that many lawmakers now want to extend. Corporate lobbyists are even asking Congress to extend this “accelerated depreciation” tax break as part of a possible year-end tax bill.

Key Republicans Say Negligible Decline in Economic Growth Outweighs Enormous Drop in Child Poverty

November 3, 2022 • By Joe Hughes

The expanded Child Tax Credit reduced child poverty dramatically and immediately. There is no debate or murkiness on this. Some lawmakers have decided that cutting child poverty in half is not worth the cost if it means an ambiguous and negligible decline in GDP growth. This view is not just cruel, it is bad economics.