ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

The federal minimum wage is almost comically low. At $7.25 an hour, it is 29 percent below its inflation-adjusted peak in the 1960s. Raising the minimum wage to $15 an hour would lift 900,000 Americans out of poverty. A solid 61 percent of voters support the idea. A majority of lawmakers in both the House and Senate support at least some version of a minimum wage hike. The popular $1.9 trillion American Rescue Plan includes a measure that would raise the minimum wage over the next few years to $15. So, what is the problem? And why are lawmakers now…

Kansas Action for Children: Working Kansas Families Bear Brunt of Skewed Policies

February 26, 2021

In the midst of a global pandemic and recession, the Kansas Legislature shockingly continues to consider bills that will further lower the already low tax responsibilities of corporations and high-income Kansans. Lawmakers should reject legislation like Senate Bill 22 and instead work to enhance economic and racial equity through Kansas’s tax code. Our state’s leaders […]

Georgia Budget & Policy Institute: Georgia Tax Breaks Don’t Deliver

February 26, 2021

In addition to eroding the corporate income tax base and harming the state budget, in many cases, the state’s tax credit programs represent the transfer of Georgia taxpayer dollars to large out-of-state corporations and top income earners. Granting funds to corporations in this manner leaves less funding for schools, job training and health care programs […]

An Unequal Recession Will Breed Unequal Recovery Without Bold Investments

February 26, 2021 • By Stephanie Clegg

Without bold investments now, experts predict a longer, more unequal recovery. President Biden's American Rescue Plan, the framework for legislation expected to pass this week in the House, would boost economic well-being for those whose livelihoods were most affected by the pandemic-induced economic crisis.

Alaska is notoriously reliant on tax and royalty revenue from oil to fund vital public services and institutions, but declining oil prices and production levels have rendered those revenues inadequate to meet the state’s needs. ITEP analysis of potential state income tax options in Alaska shows the potential to raise between $526 million and $696 million per year yet are quite modest compared to personal income tax structures in other states. When measured relative to state residents’ incomes, any of these options would rank among the bottom five lowest state income taxes in the nation.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

Kentucky Center for Economic Policy: 10 Ways the Kentucky General Assembly Can Advance Race Equity and Shared Prosperity

February 15, 2021

HB 356, sponsored by Rep. Lisa Willner, would go a significant way toward cleaning up Kentucky’s tax code of the many tax breaks that benefit wealthy, predominately white Kentuckians — and would raise over $1 billion in needed revenue annually to invest in equitable and prosperous Kentucky communities. Currently, the state’s tax system plays an […]

Washington State Budget & Policy Center: Washington State’s Upside-down Tax Code is Even More Racist than You Think

February 12, 2021

Lawmakers in Olympia are finally listening to communities and rightly focusing on addressing racial disparities that have permeated our state economy and institutions for far too long. They must act immediately to reform many areas of public policy – from policing to housing, health care to employment – that serve to oppress Black, Indigenous, and […]

Washington Post: Drug Companies Seek Billion-dollar Tax Deductions from Opioid Settlement

February 12, 2021

“A settlement has not been reached, and, therefore, we applied significant judgment in estimating the ultimate amount of the opioid litigation settlement that would be deductible,” the company said. Matthew Gardner, a senior fellow at the nonprofit Institute on Taxation and Economic Policy, said these disclaimers suggest the companies are making conservative estimates. “That’s one […]

CARES Act Helps Create $4.6 Billion Tax Cut for Health Care Companies Paying Opioid Settlements

February 12, 2021 • By Matthew Gardner

Talk about a one-two punch. A new report from the Washington Post reveals that the U.S. public is set to pay for the opioid crisis again. Already, communities across the country have paid a heavy price via the devastating public health toll. Now, it appears taxpayers will be on the hook for billions in corporate tax breaks as four pharmaceutical companies exploit a loophole in the Trump-GOP tax law and a CARES Act tax provision meant for companies facing pandemic-related profit losses.

It’s Been 10,000 Days Since the Federal Government Raised the Gas Tax

February 12, 2021 • By Carl Davis

10,000 days. More than 27 years. By next Tuesday that’s how long it will have been since the federal government last raised the gas tax. Over that time, vehicle fuel efficiency has improved by 25 percent and construction costs have grown 185 percent. And yet the federal gas tax has remained frozen at 18.3 cents per gallon, with its purchasing power shrinking by the day. The federal government has never gone this long without updating the nation’s gas tax rate.

Testimony to Washington State Legislature House Finance Committee on HB 1496

February 11, 2021 • By Dylan Grundman O'Neill

Read as PDF Following is testimony of ITEP Senior State Tax Policy Analyst Dylan Grundman O’Neill submitted to Washington State Legislature House Finance Committee in support of HB 1496. “Hello and thank you for this opportunity to testify. My name is Dylan Grundman O’Neill, and I’m a Senior State Tax Policy Analyst with the Institute […]

Policy Matters Ohio: Ohio’s Tax Structure and Racial Disparities

February 11, 2021

Our success as a state and a nation depends on whether all people, regardless of race, have the opportunity to thrive. From the beginning, American policies and practices oppressed, exploited and excluded Black, brown and Indigenous people, who still face obstacles to good jobs, housing, educational opportunities and health care. As a result, wealth held […]

CNET: New Child Tax Credit Could Give Your Family A Bonus Check Every Month For A Year. What To Know

February 10, 2021

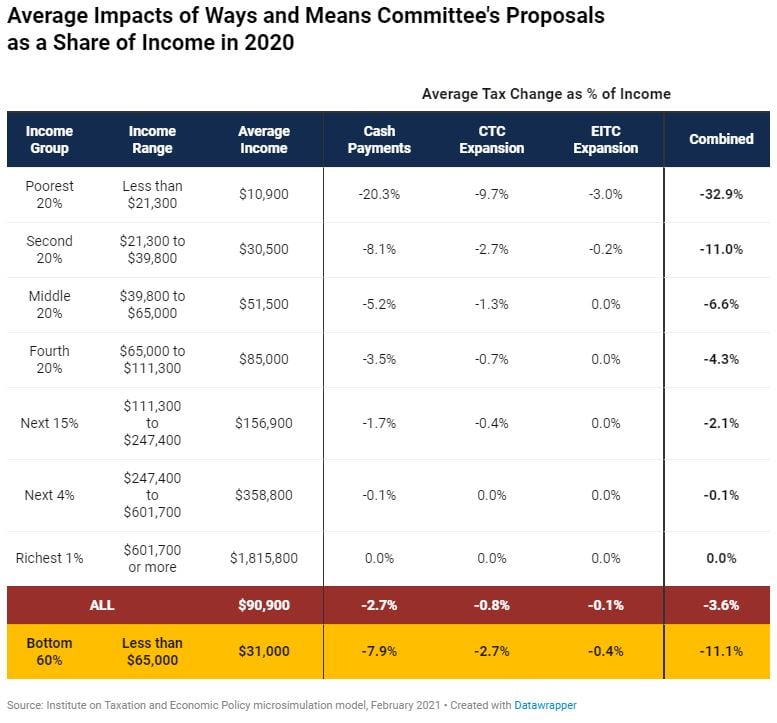

For the bottom 20% of families in terms of income, the proposed expansion of the CTC would increase income by an average of 9.7% — even higher if you only consider tax filers with children, according to the Institute on Taxation and Economic Policy. The proposal would also lift 4.1 million children above the poverty line, […]

Fatherly: This Chart Reveals How Much Money Families Will Get From Stimulus Package

February 10, 2021

It’s a genuine anomaly in American welfare policy, and a true sign that American politics is changing. But exactly how much money folks at different income levels can expect to receive is a complicated question, and it’s one that has been answered. Luckily, the Institute on Taxation and Economic Policy has a staff of people […]

Washington Post: The Pandemic Hit Undocumented Restaurant Workers Hard. These Bartenders Swooped in to Feed Them.

February 10, 2021

Of the 11 million undocumented immigrants in the country, many are cumulatively paying billions of dollars each year to state and local taxes, according to the nonpartisan Institute on Taxation and Economic Policy. Some file taxes under an individual taxpayer identification number in hopes that one day it will help their case in gaining legal status. […]

Forbes: Democrats’ Stimulus Priorities Would Boost Income By 33% For Poorest Americans

February 10, 2021

Amid fierce debate among liberal economists over the size of the next federal stimulus bill, a new analysis from the left-leaning Institute on Taxation and Economic Policy found that three of Democrats’ anti-poverty initiatives in the draft legislation—another round of direct payments and major expansions of the child tax credit and the earned income tax […]

AccountingToday: Immigration Reform Taxes Could Help States with Post-COVID Recovery

February 10, 2021

The Institute on Taxation and Economic Policy, a nonprofit, nonpartisan think tank, proposed that states and localities can significantly increase revenue collection by legalizing undocumented immigrants. According to an ITEP report, undocumented immigrants collectively pay an estimated $11.64 billion in taxes a year. The state of California, home to more than 3 million undocumented immigrants, collects […]

Business Insider: The Poorest Americans Can Expect to See a 33% Income Boost with Stimulus Checks and Tax Credit Expansions, New Report Finds

February 10, 2021

The poorest 20% of Americans can expect to see a nearly 33% boost to their incomes with key Democratic stimulus provisions of $1,400 stimulus checks, and the expansion of child tax credits and the Earned Income Tax Credit. In a report released on Tuesday by the Institute on Taxation and Economic Policy — a nonpartisan […]

Law360: NY Gov.’s Pot Tax Proposal Unique, Tax Group Says

February 9, 2021

A potency-based cannabis tax proposal by New York’s governor would bring in more sustainable revenue to the state if passed, Institute on Taxation and Economic Policy said on Tuesday. Read more

Details of House Democrats’ Cash Payments and Tax Credit Expansions

February 9, 2021 • By Steve Wamhoff

The House Ways and Means Committee published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

YahooFinance: Democrats Propose Leaving Out High Earners from Stimulus Checks and Trimming Jobless Benefits

February 9, 2021

Under Biden’s initial ‘American Rescue’ proposal, high-income households making $247,400 to $601,700 would get an average payment of $930 compared with a $280 payment for the same group under the House Democrats’ new plan, according to an analysis by the Institute on Taxation and Economic Policy. Read more