ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Forbes: Biden Says He Supports $75,000-A-Year Threshold For Full $1,400 Stimulus Checks

February 9, 2021

An analysis from the left-leaning Institute on Taxation and Economic Policy found that proposals in the Democratic bill would boost income for the poorest Americans by around 33%. Read more

Washington Post: Here’s the New Democratic Plan for $1,400 Stimulus Payments

February 9, 2021

The best argument in favor of the checks is that they have kept many Americans out of poverty during the crisis. An analysis by the left-leaning Institute on Taxation and Economic Policy found that the bottom 20 percent of Americans — those earning less than $21,300 — would see their income rise nearly 30 percent, helping keep […]

Tampa Bay Times: Florida Should Close Tax Loopholes for Corporations | Column

February 9, 2021

Because of its lopsided reliance on sales tax — which forces poorer people to pay a larger share of their income in taxes than richer people — Florida has one of the most unequal tax structures in the country, according to the nonpartisan Institute on Taxation and Economic Policy. The poorest 20 percent of Florida […]

The Fiscal Times: Poorest Americans Would Get Major Income Boost From Covid Relief Bill: Report

February 9, 2021

Three provisions in the legislation released this week by the House Ways and Means Committee would provide a 33% income boost on average for the poorest 20% of Americans, according to an analysis by the left-leaning Institute on Taxation and Economic Policy. Read more

Does New York’s Cannabis Tax Idea Offer a Glimpse of the Future?

February 9, 2021 • By Carl Davis

Taxing cannabis won’t end New York’s budget difficulties, but a potency tax could bring New York a more sustainable stream of cannabis tax revenue than we see in most states. It could also have significant benefits for cannabis consumers.

Faulty Fact Check on Tax Breaks for the Rich and Corporations

February 5, 2021 • By Amy Hanauer

When it comes to tax policy, the details are complicated, but the story is often simple. For example, President Trump’s so-called Tax Cuts and Jobs Act (TCJA) disproportionately benefits the rich. This is not controversial. Yet some opinion makers with large megaphones get lost in the details and come to conclusions that only create more confusion.

States Are Finally Going Bold with Progressive Tax Efforts

February 4, 2021 • By Dylan Grundman O'Neill

Advocates, lawmakers, study commissions, and even governors in some states are proposing bold tax policy reforms that look beyond pandemic-induced budget shortfalls and the “K-shaped recovery” to address underlying inequities and underfunding that gave rise to them. These efforts include proposals to: end or reverse regressive tax policies like the preferential treatment of income derived from wealth over income earned through work; restore or strengthen estate and inheritance taxes to slow the concentration of wealth in ever-fewer hands; raise revenue and slow inequality with progressive income taxes; and many other ideas to right upside-down tax codes while raising the revenue…

The public and the Biden administration say corporations should contribute to the public infrastructure that lets them earn so much. We agree. It’s the least we can ask, in a pandemic and at all other times too.

Amazon Has Record-Breaking Profits in 2020, Avoids $2.3 Billion in Federal Income Taxes

February 3, 2021 • By Matthew Gardner

Amazon’s winning streak in its battle against the U.S. tax system remains intact. This week the retail giant announced record-breaking sales and income for 2020, and an effective federal income tax rate of just 9.4 percent, less than half the statutory corporate tax of 21 percent. If Amazon had paid 21 percent of its profits in federal income tax, that would have come to $4.1 billion. The company’s reported current tax of $1.8 billion was less than half that, meaning last year Amazon avoided $2.3 billion in taxes.

Montana Budget & Policy Center: What Proposed Tax Cuts Really Mean for Montanans

February 3, 2021

The 2021 Montana Legislature has the opportunity to address longstanding inequities in Montana’s tax code that have made life harder for many families. Previous legislatures have chosen to balance the budget by cutting needed services for our seniors, Montanans with disabilities, and those struggling with mental health instead of finding common-sense solutions to fairly increase […]

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

Immediate Action State Lawmakers Can Take to Support Families and Children

February 2, 2021 • By Aidan Davis

If Congress does act and enact President Biden’s CTC expansion, states could simply couple to that federal change. The changes, while temporary, could become the foundation of a permanent state-level credit over the long-term. But state lawmakers need not wait for legislative action in DC. They can take immediate steps to ensure that their state’s most vulnerable children are positioned to succeed.

Ever since it was enacted as part of the Trump-GOP tax law, some Democrats in Congress have been pushing to repeal the cap on federal tax deductions for state and local taxes (SALT). Recently several Democratic members have suggested that repeal of the cap should be part of COVID relief legislation. While the cap on SALT deductions is problematic, repealing it without making other reforms would result in larger tax breaks for the rich. Instead, lawmakers should consider ITEP’s proposal to replace the SALT cap with a broader limit on tax breaks for the rich that would accomplish Biden’s goal…

Pandemic Profits: Netflix Made Record Profits in 2020, Paid a Tax Rate of Less than 1 Percent

February 1, 2021 • By Matthew Gardner

Netflix’s “current” federal income tax for 2020 was $24 million, which equals just 0.9 percent of the company’s pretax income for the year. This is another way of saying Netflix paid an effective federal income tax rate of just 0.9 percent in 2020. If the company paid the statutory rate, its tax bill would be $572 million.

Law 360: La. Gov. Won’t Support Gas Tax Hike This Year Due To Virus

January 29, 2021

A January report from the American Petroleum Institute said Louisiana’s total per-gallon state taxes and fees of 20.01 cents on fuel rank below the national average of 36.83 cents for gasoline and 37.85 cents for diesel. Carl Davis, research director at the left-leaning Institute on Taxation and Economic Policy, told Law360 in November that Louisiana’s […]

Bloomberg: The 2017 Tax Law Report Card: Grading the Big Promises (Podcast)

January 29, 2021

On the latest episode of our weekly podcast, Talking Tax, Bloomberg Tax reporter Lydia O’Neal spoke with Tax Foundation economist Erica York and Institute on Taxation and Economic Policy senior fellow Matt Gardner about which of the law’s stated goals came to fruition. Listen here

Business Insider: Democrats Are Setting the Stage to Propose $300 Monthly Direct Payments for Families with Children under 17

January 27, 2021

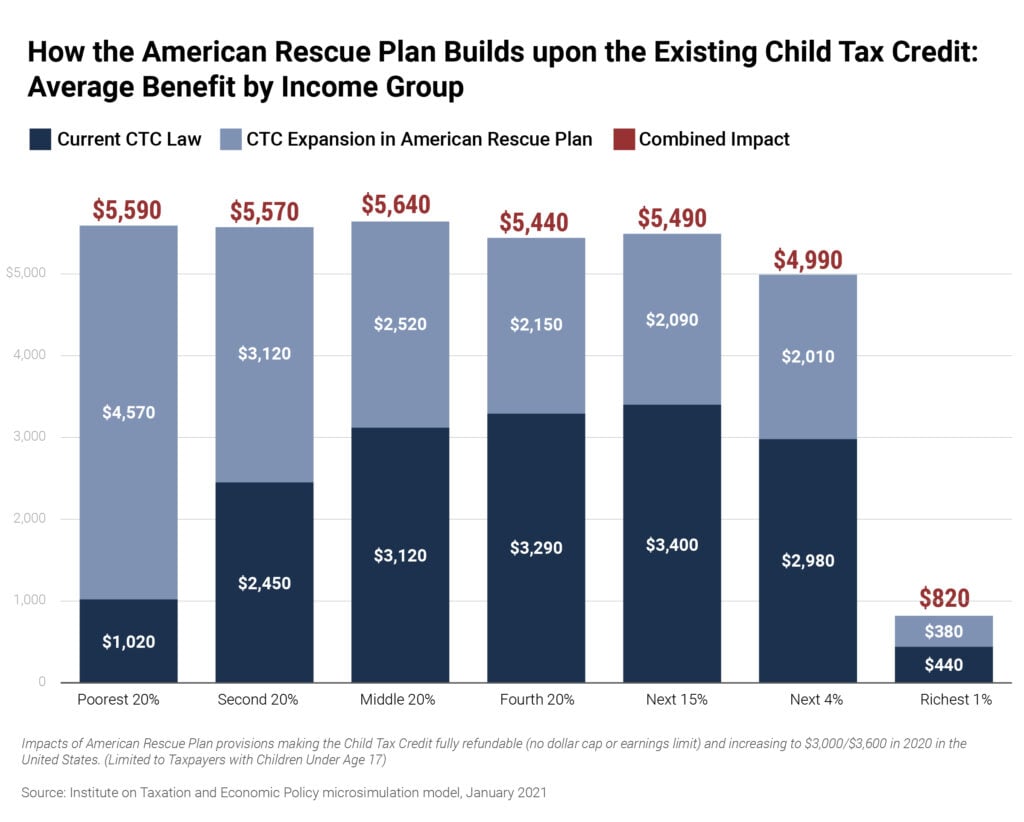

The Institute on Taxation and Economic Policy, a left-leaning think tank, released an analysis on Tuesday projecting that the poorest 20% of Americans — or those earning below $21,300 annually — would experience the largest benefit boost with an extra $4,570. The bottom 60% of Americans would receive $3,360 on average, the institute forecast. Read more

The 74: With DeVos Out, Movement for Private School Choice Shifts to State Legislatures

January 27, 2021

The scholarship policies rely on tax credits — from 50 up to 100 cents on the dollar, depending on the state — in return for contributions to assist with private school tuition. The high return rates are “incredibly unusual,” says Carl Davis, research director at the Institute on Taxation and Economic Policy. Most other credits, he […]

Maine Center for Economic Policy: Tax Policy Options: Maine Needs Progressive Revenue Solutions to Build a Stronger, Fairer Future

January 27, 2021

Generally, the sales tax is regressive. The poorest one-fifth of families pay a share of their income in Maine sales taxes that is nearly nine times larger than the top 1 percent. Poorer households pay larger shares of their income in sales taxes than wealthy households in part because wealthier households save a larger percent […]

Disaggregating Data Illuminates a Path to Equitable Policy

January 27, 2021 • By Jessica Schieder

The Biden administration’s move last week to establish an interagency working group to examine how well data is broken down, or disaggregated, within public sector data sources is welcome news. The executive order specifically names the limited availability of datasets disaggregated “by race, ethnicity, gender, disability, income, veteran status, [and] other key demographic variables.”

Raw Story: Expert Explains Why You Pay More than Corporations — and the People Who Own Them

January 26, 2021

The actual taxes paid in any given year may be less than zero as a company collects refunds on past taxes. Many big companies including Amazon have enjoyed a negative income tax in recent years. Matthew Gardner of the Institute on Taxation and Economic Policy explains more here. Read more

Bloomberg: The Trump Tax Cuts: Promises Made, Promises Kept?

January 26, 2021

In the waning days of the Trump administration, Bloomberg Tax examined the law’s stated goals and explored which of its seven major promises came to fruition. “The most prominent claims made were often the least serious claims,” said Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy. Read more

Child Tax Credit Enhancements Under the American Rescue Plan

January 26, 2021 • By Aidan Davis, Jessica Schieder

President Joe Biden’s coronavirus relief package, the American Rescue Plan, includes a significant expansion of the Child Tax Credit (CTC). The president’s proposal provides a $125 billion boost in funding for the program, which would essentially double the size of the existing federal credit for households with children. Combined with existing law, the CTC provisions in Biden's plan would provide a 37.4 percent income boost to the poorest 20 percent of families with children who make $21,300 or less a year.

The Nation: These Progressives Helped Keep Hope Alive in 2020—and Prepare Us for 2021

January 25, 2021

The Nation’s annual honor roll recognizes progressive activists and leaders who helped keep hope alive and set the groundwork for transformational change in 2021. Since taking over in 2019 as executive director of Citizens for Tax Justice and the Institute on Taxation and Economic Policy, Hanauer has been calling out the economic fallacies that pass […]

Newsweek: Third Stimulus Check of $1,400 Will Likely Be Passed by End of March, Analysts Say

January 25, 2021

A study released earlier in January by the Institute on Taxation and Economic Policy indicated that the bottom 60 percent of U.S. earners would see a “significant” impact to their finances with a $2,000 payment. Read more