ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

On COVID-19 and Economic Recovery “There will be calls for austerity from politicians who were happy to incur debt to pay for tax cuts but now want to deny necessary aid. Fortunately, both economic experience and public opinion support paying to help with job loss, housing, and economic aid. The risk right now is not spending […]

MarketWatch: Here’s the Maximum Amount Biden’s Stimulus Checks and Tax Credits Would Deliver to America’s Poorest Families

January 20, 2021

For the bottom 60% of incomes, the new round of direct payments, plus the two expanded tax credits would average $3,520, equaling around 11% of annual income, the Institute on Taxation and Economic Policy researchers said. “We are not out of the COVID-19 situation yet and this is what we need,” according to Steve Wamhoff, […]

The Daily Northwestern: Advocates Against Income Inequality Reassess After the Fair Tax Act’s Failure

January 20, 2021

The Fair Tax Amendment would have introduced a progressive income tax to Illinois. The state currently mandates a flat income tax of 4.95 percent. Illinois ranks eighth in the country for tax inequality, according to the Institute on Taxation and Economic Policy. Throughout the state, the lowest-income 20 percent contribute over 14.4 percent of total […]

ITEP Statement on President Biden’s Inauguration: Ready for Change

January 20, 2021 • By Amy Hanauer

Media contact Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding President Biden’s inauguration. “Today, we pause to recognize President Joe Biden and Vice President Kamala Harris’s historic victory. Tomorrow, we get to work. “President Biden has consistently vowed to lead by putting the needs of […]

Yahoo!Money: Here’s Who Gets a Payment under Biden’s $1,400 Stimulus Check Proposal

January 16, 2021

The $2,000 stimulus checks would also mean a big increase in income for America’s poorest families. The 20% of households with the lowest incomes would see their annual income increase by 29% if Congress passed the Democrats’ $2,000 stimulus check proposal, the Institute on Taxation and Economic Policy (ITEP) found. The effect of Biden’s plan […]

ANALYSIS: Cash and Tax Provisions in Biden’s Economic Recovery Plan

January 15, 2021 • By Steve Wamhoff

The $1.9 trillion economic recovery plan, known as the American Rescue Plan, announced by President-elect Biden contains, among other provisions, expanded cash payments and changes to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

Happy Double Take: A President Who Takes Economic Challenges Seriously

January 15, 2021 • By Amy Hanauer

After a solid year of federal policy doing too little to combat staggering job loss, spiking poverty, a raging pandemic and nearly 400,000 COVID deaths, we are ready for a leader who wants to hunker down and get to work on behalf of the people. So we did a happy double take when President-elect Joe Biden outlined his economic plan last night.

WWD: Execs Flag ‘Concerns’ Over Corporate Taxes Amid Rising Inequality

January 14, 2021

“The lack of accessible child care, climate change, inequality…all these things are pretty basic existential threats for American workers, families and America as a nation,” said Gardner. “And the only way they can be meaningfully solved is through government spending and intervention, and an effective government requires an effective tax system.” Corporate income tax revenues […]

Policy Matters Ohio: Ohio Needs a Corporate Profits Tax

January 12, 2021

Moreover, the 2017 federal tax law has put more money in the pockets of many Ohio business owners. The Tax Cuts and Jobs Act, slashed corporate taxes and provided a big new tax break for owners of partnerships, S Corporations and other businesses known as “passthrough entities” because their profits are taxed under the individual […]

New Jersey lawmakers passed an innovative tax design that other states debating cannabis legalization should look to for inspiration. The state officially legalized cannabis in November when voters overwhelmingly approved a constitutional amendment by a margin of 67 to 33 percent. The amendment applied the state’s general sales tax to cannabis and allowed local governments to create their own taxes on the industry. The legislature added the most notable part of the tax structure last month with a Social Equity Excise Fee.

New Leadership Should Seize Tax Justice Mandate; Cash Payments Offer On-ramp

January 8, 2021 • By Amy Hanauer

With the victory of Senators-elect Raphael Warnock and Jon Ossoff in Georgia, Democrats now control all three branches of government. New leaders should seize this moment to create a tax code that does much more to reduce inequality and to resource long-overdue investments in climate, health, education and other essentials. Most immediately, the historic election shifts power, making it easier to deliver on the promise to increase the recently enacted $600 cash payments to $2,000 per person.

Dems Promised $2,000 Payments. Here’s What that Would Mean for Taxpayers Across the Income Spectrum.

January 7, 2021 • By ITEP Staff

New estimates from ITEP show how taxpayers across the income spectrum would fare should Democrats enact the $2,000 payments they promised would happen if they gained control of the Senate.

How the Proposed $2,000 Cash Payments Compare to the $600 Already Provided by Congress

January 6, 2021 • By Steve Wamhoff

On Dec. 28, the House of Representatives passed the Caring for Americans with Supplemental Help (CASH) Act of 2020, which would increase the cash payment recently provided by Congress from $600 per person to $2,000 per person, among other changes. New estimates from ITEP compare the impacts of $2,000 payments to $600 payments.

Feet to the Fire: Taxes in the Time of COVID

December 28, 2020

ITEP Executive Director Amy Hanauer joined Jim Lardner’s Feet to the Fire podcast to speak about how we can seize this moment to promote higher taxes on corporations and the wealthiest to pay for the America we need. Feet to the Fire is a podcast dedicated to helping the Biden Administration and the Democratic Party […]

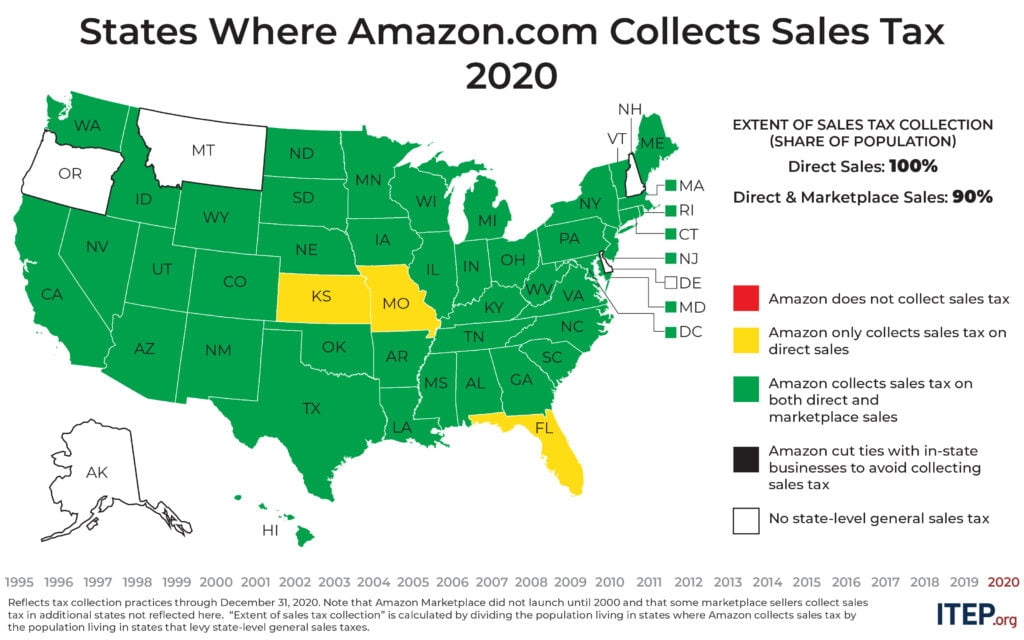

Today, Amazon is collecting state-level sales taxes on all its direct sales but it still usually fails to collect sales tax on the large volume of sales it makes through the Amazon Marketplace. This points to a broader problem in state tax enforcement that lawmakers in many states are moving quickly to address with laws and administrative action requiring tax collection by Amazon and other large online marketplaces such as Etsy and eBay.

Delaware Business Times: Congress Approves $900 Billion Stimulus

December 22, 2020

The stimulus, approved as part of a large end-of-year catchall package including traditional spending measures, also allocates $82 billion in support to school systems and higher education institutions, $10 billion for childcare assistance, $13 billion to assist people facing hunger, and $13 billion to support farmers who have suffered losses during the pandemic. According to […]

Newsweek: Millions of Americans Who Missed Out on Stimulus Checks Will Qualify Under New Deal

December 21, 2020

Democrats, along with immigration groups, would have preferred to also include millions of ITIN immigrant taxpayers, who makeup a large portion of essential workers. The left-leaning Institute On Taxation and Economic Policy estimates that 4.3 million adults and 3.5 million children—7.8 million people—were excluded from the direct payments in the CARES Act because ITIN filers were ineligible. Read more

COVID Relief Bill Will Help Families Now; Bigger, Bolder Package Needed in 2021

December 21, 2020 • By Amy Hanauer

Following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the COVID-19 relief deal reached Sunday night.

National and State-by-State Estimates of New $600 Cash Payments

December 21, 2020 • By Steve Wamhoff

The House and Senate are about to pass the first COVID-19 relief legislation since the CARES Act was enacted in March. The new relief package includes, among other provisions, cash payments of $600 per person, which is half as large as the payments provided under the CARES Act, but also extends payments to spouses and children of certain undocumented immigrants who were left out of the previous payments.

The American Prospect: Can Corporate Tax Incentives Revive a Pandemic Economy? New Jersey Thinks They Can.

December 18, 2020

“New Jersey has really been an exemplar this year in positive progressive tax policies, with their millionaire’s tax and extension of the Earned Income Tax Credit—which are really the best ways of raising money from the people who are making money right now and delivering aid to the people who need aid right now,” said […]

The American Prospect: The Day One Agenda for Corporate Taxes

December 16, 2020

Even without Congress, President-elect Biden’s regulatory agencies can fix a lot of problems with the corporate tax code. BY STEVE WAMHOFF, MATTHEW GARDNER The public has long told pollsters that corporate taxes should be increased, not decreased. President-elect Biden won his election after campaigning on a promise to raise taxes on wealthy individuals and corporations. […]

Center on Budget and Policy Priorities: Improved State Taxes on Wealth, High Incomes Can Help Fuel an Equitable Recovery

December 10, 2020

Families’ access to wealth has played a large role in determining how the pandemic has affected them. The worst of the economic and health effects have largely bypassed wealthier, higher-paid families — which are disproportionately white — but have been far more prevalent among lower-income families and those of color. Amid sizeable state budget shortfalls […]

Bloomberg: Musk Flees California. He Now Faces a Battle to Escape Its Taxes

December 10, 2020

Fear of rich people moving for tax reasons is overblown, says Carl Davis, research director at the left-leaning Institute on Taxation and Economic Policy, or ITEP. Studies show the wealthy actually move less often than other Americans. “A billionaire can obviously afford to live wherever they want,” Davis said. “There’s no reason on Earth that […]

A Second Round of Direct Cash Payments Could Provide an Average $1,550 to the Poorest Families

December 8, 2020 • By Jenice Robinson

It will not magically become easier for families to put food on the table or make their next rent payment. Policymakers must act. People are struggling because they are either out of work, involuntarily working part-time, trying to financially catch up after being out of work for a spell, or squeaking by because we live in a wealthy democracy that fails to guarantee basics such as access to affordable housing, health care, food, and jobs that pay living wages.

Connecticut Voices for Children: Advancing Economic Justice Through Tax Reform

December 8, 2020

Connecticut Voices for Children released a new report, “Advancing Economic Justice Through Tax Reform,” which proposes a tax restructure so that the system is fair for all residents. The report provides an overview of economic injustice in Connecticut, Connecticut’s regressive tax system and shows that it is a key contributor to the economic injustice in the state, […]