ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Below is a list of tax expenditure reports published in the states.

Five Things to Know on the One-Year Anniversary of the Tax Cuts and Jobs Act

December 17, 2018 • By Richard Phillips

While it has only been a year since passage of the Tax Cuts and Jobs Act (TCJA), it’s clear the law largely is both a debacle and a boondoggle. Below are the five takeaways about the legacy and continuing effect of the TCJA. 1. The Tax Cuts and Jobs Act will substantially increase income, wealth, and racial inequality. 2. The Tax Cuts and Jobs Act will continue to substantially increase the deficit. 3. The Tax Cuts and Jobs Act is not significantly boosting growth or jobs. 4. The Tax Cuts and Jobs Act continues to be very unpopular. 5. Despite…

End-of-Year Tax Measure Would Give Deficit-Financed Tax Cuts to Wealthy Families and Corporations

December 12, 2018 • By ITEP Staff

Outgoing Ways and Means Chairman Rep. Kevin Brady (R-TX) today introduced legislation that includes $80 billion in tax cuts that are unpaid for and largely benefit the wealthy. The bill would, among its numerous provisions, expand retirement and education savings programs that offer very little value to low-income families, delay the Health Insurance Tax for an additional two years, and delay the Medical Device Tax for an additional five years.

Joint Letter: End the Tax Extenders Once And For All

December 7, 2018 • By ITEP Staff

A joint letter to Congressional leadership and the heads of the taxwriting committees making the case that it is time to end the practice of enacting tax policy one year at a time.

New Legislation Aims to Change Tax Law Provisions That Incentivize Outsourcing

November 29, 2018 • By Richard Phillips

Sen. Amy Klobuchar (D-MN) and several Senate co-sponsors this week introduced the Removing Incentives for Outsourcing Act, which curbs harmful new incentives created by the Tax Cuts and Jobs Act (TCJA) that encourage companies like GM to move their profits and operations offshore.

The Post-Midterms Tax Policy Outlook: Small Ball and Real Tax Reform Debate

November 8, 2018 • By Richard Phillips

With most of the results of the 2018 midterm elections in, the broad landscape for federal tax policy over the next couple years is coming into view. Democratic control of the House and Republican control of the Senate means a significant tax overhaul is unlikely, but minor tax changes may happen. And the run-up to the 2020 presidential election will force more robust debate over the impact of the Tax Cuts and Jobs Act (TCJA) and what aspects of the legislation should be repealed, reformed, or built upon.

New Report Finds Tax Transparency Is Not Just Ethical: It Has a Real Fiscal Impact

November 5, 2018 • By Monica Miller

A new report by Hubertus Wolff and Michael Overesch finds that public country-by-country reporting (CBCR) can have a significant fiscal impact. In fact, the report shows that new CBCR rules applied to European banks appear to have substantially increased the tax rates paid by banks that engage in tax-haven activities. This means that CBCR may not just improve the integrity of the tax system and provide critical information so investors can gauge investment risks, but may also have a much more immediate impact on curbing tax avoidance.

Post-TCJA, International Corporate Tax System Still Leaking Hundreds of Billions in Profits

November 5, 2018 • By Richard Phillips

A recently released working paper from Kimberley Clausing of Reed College finds that U.S. corporations will avoid taxes on nearly $300 billion in offshore profits every year for the foreseeable future. The paper provides an informative new look into the level of offshore tax avoidance before and after the Tax Cuts and Jobs Act (TCJA). While advocates of the TCJA claimed the tax law would end tax haven abuse through lowering the statutory rate and other measures, Clausing’s analysis shows that the TCJA will still allow the vast majority of offshore tax avoidance to remain intact.

New Study Confirms Offshore Earnings are Flowing into Stock Buybacks, Not Jobs and Investments

September 7, 2018 • By Richard Phillips

A new study by the Federal Reserve found that the evidence so far suggests that the new repatriation tax break has resulted in a surge in stock buybacks and little discernable impact in investment by its biggest beneficiaries, just as critics predicted.

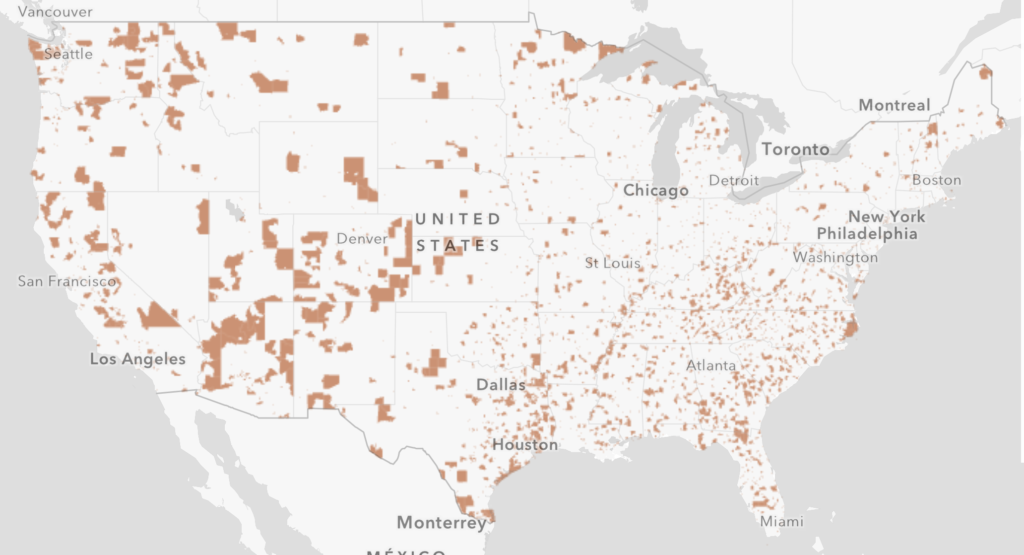

How Opportunity Zones Benefit Investors and Promote Displacement

August 10, 2018 • By ITEP Staff

The idea behind the new tax break is to provide an incentive for wealthy individuals to invest in the economies of struggling communities. Despite alleged intentions, it appears opportunity zones are turning into yet another windfall for wealthy investors and may encourage displacement of people in low-income areas, working against the provision’s intended goal.

The Preferential Tax Treatment of Capital Gains Income Should Be Curbed, Not Substantially Expanded

August 1, 2018 • By Richard Phillips

For true believers in supply-side economics, however, one major flaw of the TCJA is that it did not further cut taxes for the wealthy by reducing capital gains tax rates. But now the Trump Administration is considering using executive action to remedy this by indexing capital gains to inflation for tax purposes.

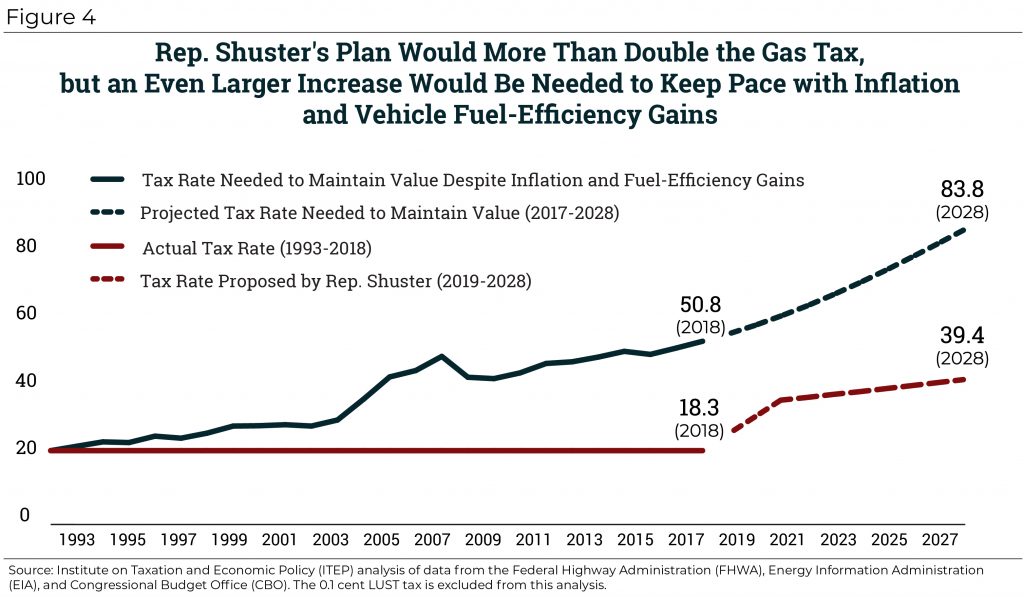

Rep. Shuster’s Mixed Bag: Doubling the Gas Tax before Repealing It Entirely

July 24, 2018 • By Carl Davis

This article examines the good aspects of Rep. Shuster’s infrastructure funding plan (a higher gas tax that is indexed to inflation), the bad (a flawed indexing formula and eventual gas tax repeal), and the downright ugly (tying the hands of a funding commission before their work even begins and refusing to ask more of high-income households).

How should lawmakers fix the system? A new ITEP report breaks down how the international corporate tax code under the TCJA works, and how lawmakers can fix it. The report lays out three key principles for reform: equalize the rates, eliminate inversions, and create transparency.

Understanding and Fixing the New International Corporate Tax System

July 17, 2018 • By Richard Phillips

The Tax Cuts and Jobs Act (TCJA) radically changed the international tax system. It slashed taxes on corporate income, both domestic and foreign. It encouraged U.S. multinational corporations to shift jobs, profits, and tangible property abroad, and keep intangibles home. This report describes the new international tax system—and its many gaps—and also provides a road map for how to fix these gaps and surveys recent legislative approaches.

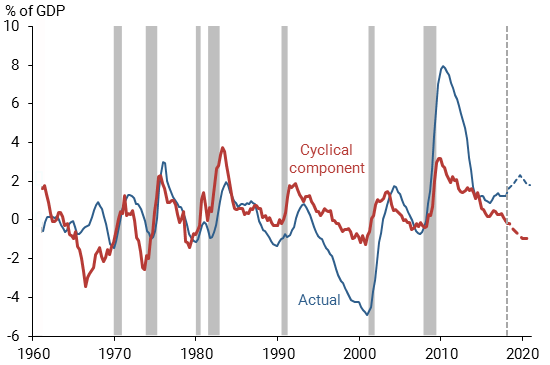

The Immediate Economic Impact of the Tax Cuts and Jobs Act Could be Even Less Than Expected

July 11, 2018 • By Richard Phillips

Now, new research from the Federal Reserve Bank of San Francisco finds that the Tax Cuts and Jobs Act may not be so much of a stimulus after all. In other words, lawmakers have left themselves with few options should the country face an economic recession, and the country may not receive a substantive economic benefit in the short term.

New Legislation Would Close Significant Offshore Loopholes in the Tax Cuts and Jobs Act

June 6, 2018 • By Richard Phillips

One simple rule should drive the nation’s international tax policies: tax the offshore profits of American companies the same way their domestic profits are taxed. The latest legislation to approach that ideal is the Per-Country Minimum Act (H.R. 6015), from Rep. Peter DeFazio (D-OR). The DeFazio bill closes the loophole that allows corporations to use foreign tax credits to shelter profits in tax havens from U.S. taxes. No other bill addresses this.

The New International Corporate Tax Rules: Problems and Solutions

June 6, 2018 • By Steve Wamhoff

The nation’s corporate tax system has been dysfunctional for decades. Unfortunately, the recently enacted Tax Cuts and Jobs Act (TCJA) fails to solve fundamental problems facing the corporate tax and, in some ways, makes these problems even worse.

ITEP’s Senior Policy Analyst Richard Phillips Remarks at Facebook Shareholders Meeting in Favor of Tax Principles Resolution

May 31, 2018 • By Richard Phillips

Read the Remarks in PDF Listen to Webcast of Shareholders Meeting (Richard’s remarks begin at 21:20) My name is Richard Phillips and I am here to present Item 8 on behalf of the AFL-CIO Office of Investments. This proposal requests that the board articulate a set of responsible global tax principles that ensure the company […]

Facebook Facing Shareholder Scrutiny for Its Offshore Tax Avoidance

May 30, 2018 • By Richard Phillips

In advance of its annual shareholders meeting on May 31, Facebook was confronted with a shareholder resolution asking it to endorse a set of principles to guide its tax policy and to ensure that such principles consider the impact of its tax strategies on local economies and public services. The resolution is a signal from a group of concerned shareholders that Facebook’s tax avoidance hurts its reputation, the communities in which it operates, and creates financial risks to the company’s shareholders.

New Legislation Would End Tax Incentives to Move Jobs and Profits Offshore

May 24, 2018 • By Richard Phillips

New legislation introduced today, the No Tax Breaks for Outsourcing Act, by Rep. Lloyd Doggett (D-TX) and Sen. Sheldon Whitehouse (D-RI) would help repair the damage to the international tax code wrought by the new Trump-GOP tax law and move toward a system where U.S. corporations can’t reap tax benefits from shifting jobs and profits offshore.

New Jersey’s new governor, Phil Murphy campaigned on a promise to raise state income taxes on millionaires, a proposal that is supported by 70 percent of the state and was, until recently, backed by New Jersey’s Senate President, Steve Sweeney. In recent months, Sweeney changed his position on the proposed millionaires tax and called for an increase in New Jersey’s corporate tax instead. The idea of hiking taxes on corporations is not a bad one, particularly since corporations received a windfall from the Tax Cuts and Jobs Act. But Sweeney’s new opposition to an income tax hike for the state’s…

Why Proponents of the Trump-GOP Tax Law Can’t Get their Story Straight

May 16, 2018 • By Steve Wamhoff

If you listened closely to today’s House Ways and Means Committee hearing on the Tax Cuts and Jobs Act (TCJA), you could sense that the witnesses speaking in favor of the new tax law were not 100 percent on the same page. This has been apparent ever since the law was enacted at the end of last year. The economists who speak in favor of the law (including Douglas Holtz-Eakin at today’s hearing) tend to focus on other indicators of its success. They know that the talk of bonuses and raises is nothing more than a desperate corporate PR campaign…

There Is No Evidence That the New Tax Law Is Growing Our Economy or Creating Jobs

May 15, 2018 • By Steve Wamhoff

The House Ways and Means Committee will hold a hearing on the Tax Cuts and Jobs Act (TCJA) Wednesday. Proponents of the law likely will use the occasion to tout its alleged economic benefits and argue that its temporary provisions should be made permanent. The title of the hearing is “Growing Our Economy and Creating Jobs,” but there is little evidence that the law does either of these things.

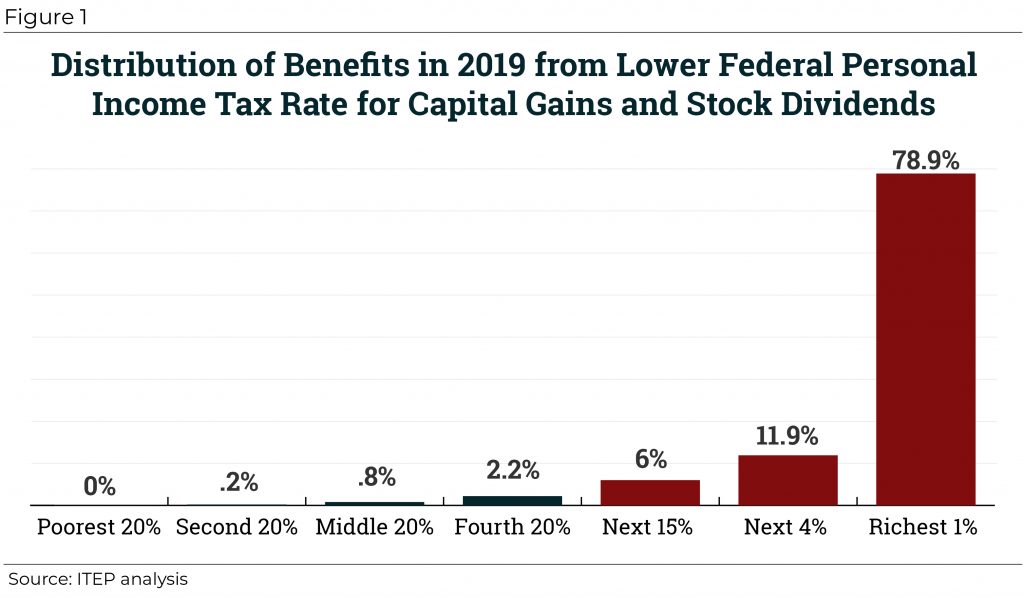

No Work Requirements for the Richest 1 Percent — Most of Their Tax Cuts Are for Unearned Income

May 10, 2018 • By Steve Wamhoff

The Trump Administration is pushing to add or strengthen work requirements for programs that benefit low- and middle-income people but holds a different view when it comes to the wealthy. Most tax cuts enjoyed by the richest 1 percent of households under the recently enacted Tax Cuts and Job Act (TCJA) are tax cuts for unearned income.

Tax Wars: 3 Lessons about Tax Policy from the Star Wars Universe

May 4, 2018 • By Richard Phillips

Even in the universe of Jedi, Death Stars and Ewoks, tax policy plays a surprisingly important role in driving the events of the day. In celebration of Star Wars Day, we just wanted to share some of the little-known tax policy lessons from the Star Wars universe.