ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Donald Trump and Taxes: Fast and Loose with Loopholes or Fraud?

September 30, 2020 • By Matthew Gardner

The president’s apparent abuse of everything from hair-care deductions to consulting fees for family members raises questions about whether Trump was fast and loose with tax loopholes or whether the IRS simply wasn’t enforcing the law. Either way, Trump successfully flouting or pushing the limits of the law shouldn’t come as a surprise: Congress has cut IRS funding, in real terms in each of the last 10 years.

A 2017 Tax Provision Could Have Restrained Trump’s Tax Dodging, But Congress Just Weakened It

September 29, 2020 • By Steve Wamhoff

President Trump and Republicans in Congress passed up almost every opportunity to shut down special tax breaks and loopholes for real estate investors when they enacted their 2017 tax law. They did, however, include some welcome provisions to limit how business owners use losses to avoid taxes, and these provisions could potentially limit the sort of tax dodging perfected by Trump. Unfortunately, Congress temporarily reversed these limits with some provisions tucked into the CARES Act that was enacted in March, and this may help Trump and others like him to continue avoiding taxes.

Congress is certainly to blame both for providing a ridiculously lenient tax code for the super-wealthy and for preventing the IRS from enforcing even the existing weak limits in the law on tax avoidance. But make no mistake, one person is primarily responsible for the farce that is Donald Trump’s tax dodging, and that is Donald Trump. For years, he has actively and loudly supported special tax breaks and tax shelters, making him anything but a passive bystander to their creation.

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.

ITEP: New York Times’ Trump Tax Revelation Confirms What We Already Know

September 27, 2020 • By Steve Wamhoff

"The New York Times revelation of Trump’s years of dodging taxes confirms something we already know. There are two tax systems: one that most of us follow, and another far more generous one for the very rich."

It’s No Secret—To Save State Budgets End Preferential Treatment of Capital Gains

September 25, 2020 • By Marco Guzman

In an updated policy brief, ITEP explores the flaws in state capital gains tax breaks and highlights how ending special tax breaks provides one of the simplest ways to raise additional revenue and increase equity in the tax system.

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms

September 25, 2020 • By Marco Guzman

The federal tax system and every state treat income from capital gains more favorably than income from work. Preferential capital gains tax treatment includes exclusions and seldom-discussed provisions like deferral and stepped-up basis, as well as more direct tax subsidies for profits realized from local investments and, in some instances, from investments around the world. This policy brief explains state capital gains taxation, examines the flaws in state capital gains tax breaks, and proposes reform options that will help make state tax systems more progressive and more equitable.

While the moneyed elite were dangling shiny objects, scapegoating Black and brown people, denigrating immigrants, and financing studies to convince us that poor people are the problem, they were concurrently securing policies that cut taxes primarily for the rich and profitable corporations, deregulated industry, weakened unions and attacked voting rights. This and more allowed the rich to amass even more wealth and power.

Another Reason to Tax the Rich? States with High Top Tax Rates Doing as Well, if Not Better, than States Without Income Taxes

September 23, 2020 • By Carl Davis

ITEP updated a 2017 study that examined the economic performance of the nine states with the highest top marginal tax rates compared to the nine states with no state income tax. Economies in states with the highest top marginal rates grew faster. States facing budget shortfalls should first look at raising taxes on those most able to pay (incomes at the top have grown during this economic crisis) before considering harmful budget cuts.

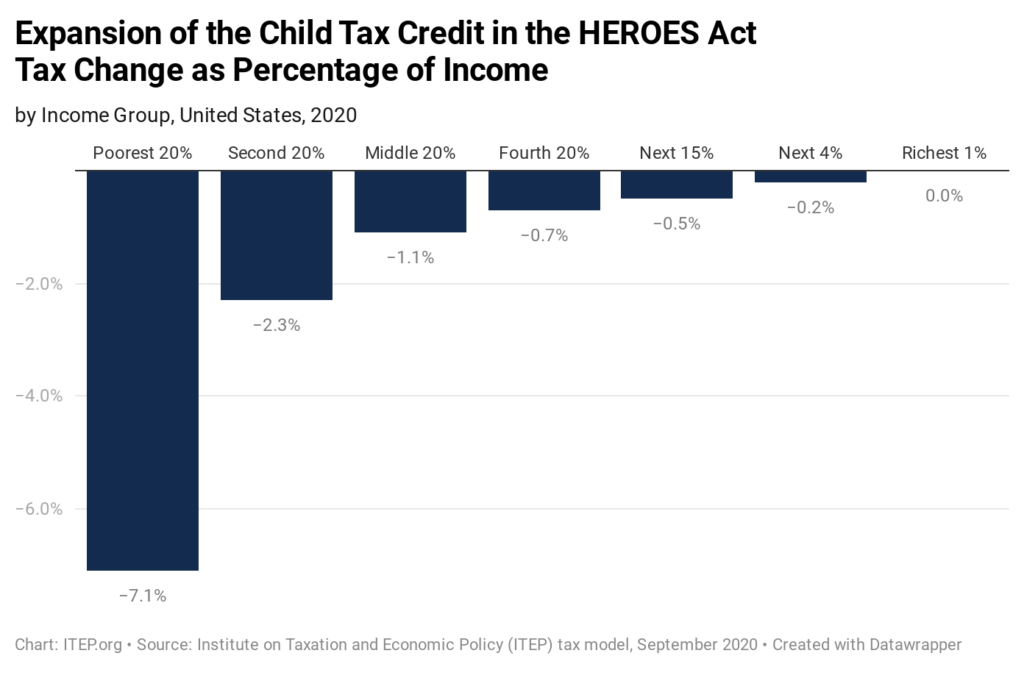

New ITEP Estimates on Biden’s Proposal to Expand the Child Tax Credit

September 18, 2020 • By Steve Wamhoff

On Thursday, former Vice President Joe Biden announced that his tax plan would include a provision passed by House Democrats to temporarily expand the Child Tax Credit (CTC), potentially lifting millions of children out of poverty. Estimates from ITEP show that this change would benefit most families with children—more than 83 million children live in households that would benefit if this was in effect in 2020—but the most dramatic boost would go to low-income families.

Webinar: What’s Tax Got to Do With It?

September 17, 2020 • By ITEP Staff

Tax justice is necessary to achieve racial, social and economic justice. We need race-forward tax policies that create opportunity for everyone, demand corporations and the wealthy pay their fair share and raise enough revenue to respond to compounding climate, health and economic crises. Tax justice is justice. Sen. Sherrod Brown, joined by Dorian Warren (Community […]

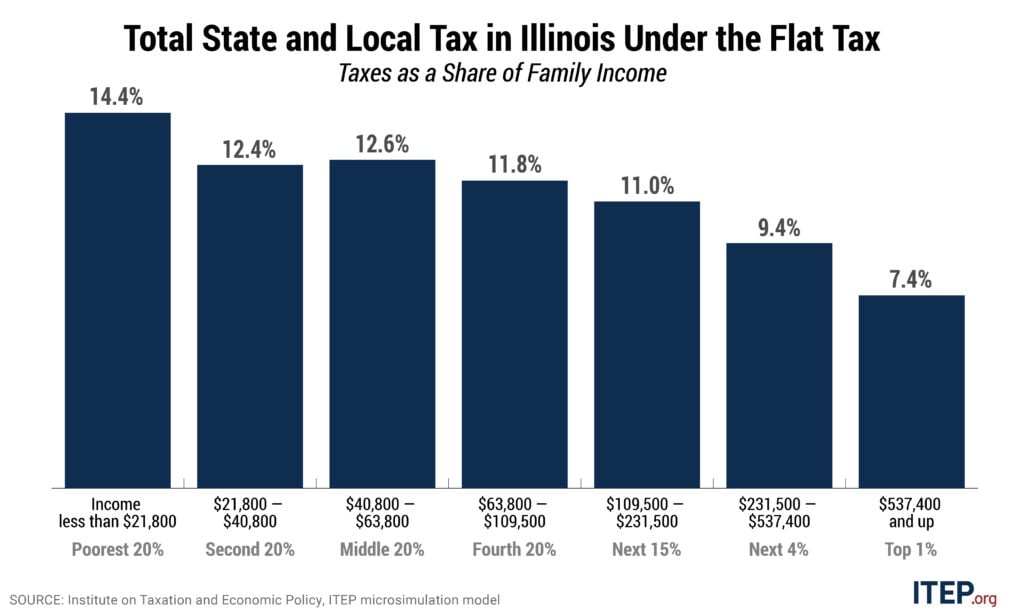

Illinois’s Flat Income Tax Amounts to a Tax Subsidy for the Wealthiest Illinoisans that Compounds Income and Wealth Inequalities

September 17, 2020 • By Lisa Christensen Gee

This November, Illinoisans will decide whether to amend the state constitution to allow a graduated income tax. A “yes” vote on the Illinois Fair Tax constitutional amendment will make effective legislation that will replace the current flat tax rate of 4.95 percent with graduated rates that cut taxes for those with taxable income less than $250,000 and institute higher marginal rates on taxable incomes greater than $250,000.

New 20-Year Study Provides Insight on How State Tax Systems Worsen Inequality and the Racial Wealth Gap

September 17, 2020 • By ITEP Staff, Lisa Christensen Gee

A new study finds that over the last 20 years, Illinois’s tax system has effectively sapped $4 billion more from Black and Hispanic communities than it would have under a graduated income tax while also allowing the state’s highest-income (mostly white) households to pay $27 billion less in taxes, the Institute on Taxation and Economic Policy (ITEP) said today.

Illinois’s Flat Tax Exacerbates Income Inequality and Racial Wealth Gaps

September 17, 2020 • By Lisa Christensen Gee

Flat or graduated personal income taxes have varying effects on the annual individual tax liabilities of taxpayers at different income levels. Less examined is how tax structures affect income inequality and racial wealth gaps. This brief illustrates how Illinois’s historic flat income tax structure compares to the proposed Fair Tax through a multi-year retrospective analysis. It shows that Illinois’s flat income tax in lieu of a graduated rate tax used by most states amounts to a tax subsidy for the wealthiest Illinoisans that compounds income inequality and racial wealth gaps.

The Vital Role of Public Programs in Moving People and Families Out of Poverty

September 15, 2020 • By Aidan Davis

More families across our nation are struggling to meet their most basic needs. High unemployment, the struggle to put enough food on the table, and an inability to make rent or mortgage payments are widespread. Absent federal intervention, outcomes would have been worse. Over the past few months, federal and state relief measures have mitigated hardship. By putting cash in the hands of those who need it most, lawmakers were able to stabilize some families’ budgets and prop up our fragile economy. With time we will surely glean many lessons from 2020. But the sheer power of targeted assistance is already apparent.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

Racial justice requires tax justice. Economic justice requires tax justice. Climate and health justice require, yes, tax justice.

GOP ‘Skinny Bill’ Rightly Fails, Too Skimpy for This Crisis

September 10, 2020 • By Amy Hanauer

"Nearly one in eight households don't have enough to eat. Millions are at risk of eviction. State and local governments are facing revenue shortfalls of well more than $500 billion, leading to inevitable layoffs and cuts to critical services. Knowing that, the Republican Senate put forth a so-called skinny COVID relief package that failed to address these concerns. Too skimpy for this crisis, the bill failed as it should have."

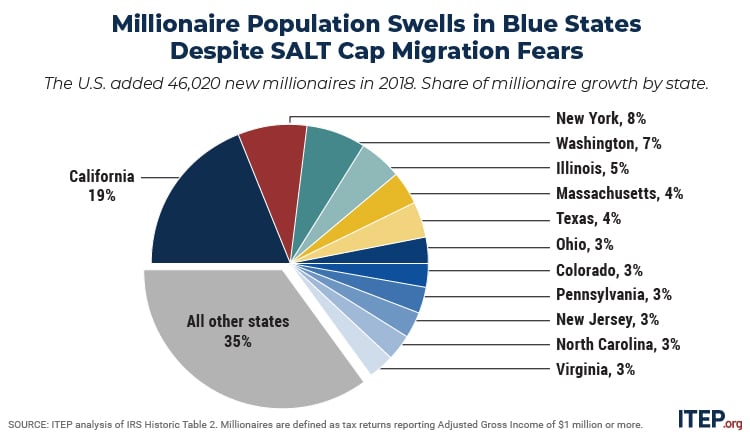

Millionaire Population Swells in Blue States Despite Migration Fearmongering

September 3, 2020 • By Carl Davis

Although the 2017 Tax Cuts and Jobs Act has created a slew of problems, it is now clear that a mass migration of top earners out of higher-tax blue states is not one of them.

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

South Strong: Racial Equity and Taxes in Southern States

August 26, 2020

Southern states have a particularly egregious record on tax equity, rooted partly in racism. Lawmakers baked some of the most egregious and anti-democratic tax policies into southern state constitutions, such as supermajority requirements to raise taxes in Florida, Mississippi and Louisiana, income tax rate caps in North Carolina and Georgia, and the recent elimination of […]

Missed Opportunity: Flimsy Paper Touts Flawed Program

August 25, 2020 • By Amy Hanauer, ITEP Staff, Lorena Roque

Republicans continue to tout Opportunity Zones as their main vehicle to assist poor people, most recently with a deeply flawed report from President Trump’s White House Council of Economic Advisors and a mention from Donald Trump Jr. in his opening night convention speech. The report purports to compare—as a way of cutting poverty—tax breaks for investors vs food, cash or health insurance coverage for struggling families.

Keystone Research Center: REPORT: Why Pennsylvania Needs a State Earned Income Tax Credit (EITC)

August 25, 2020

If one thing has become clear during the COVID-19 pandemic, it is that workers who do essential things like providing care for the sick, stocking shelves at grocery stores, and cleaning facilities to keep our buildings clean and safe are undervalued in our society. Despite their hard work, many Pennsylvanians earn such low wages that […]

Analysis: Trump’s Proposed Capital Gains Break Almost Exclusively Benefits Top 1 Percent

August 18, 2020 • By Steve Wamhoff

On Aug. 13, President Trump pledged to cut the top federal income tax for capital gains to 15 percent. The Institute on Taxation and Economic Policy estimates that 99 percent of the benefits would go to the richest 1 percent of taxpayers. This is unsurprising given that only those with taxable income of nearly half a million dollars are subject to a capital gains tax rate higher than 15 percent.

Revenue for Rhode Island: An Equitable Path Forward

August 18, 2020

We propose raising revenue for Rhode Island by adding one new tax bracket for the top 1% of earners – from 5.99% to 8.99% on adjusted gross income above $475,000. The average adjusted gross income for those impacted is $1 million dollars per year. This proposal will have no effect on Rhode Islanders outside of […]