ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Under Pressure, Trump Organization Abandons Risky Sales Tax Avoidance Strategy in New York. Will It Face Penalties for Taxes it Did Not Collect?

May 3, 2018 • By Carl Davis

While President Trump was busy publicly shaming Amazon for failing to collect some state and local sales taxes, his own business’s online store was not only failing to collect the same taxes, but was arguably more aggressive than Amazon in refusing to do so. As of last month, TrumpStore.com was not even collecting sales tax in New York State despite having a “flagship retail store” inside Trump Tower, in Manhattan. As ITEP pointed out at that time: “It seems likely that the presence of a New York location should be enough to put TrumpStore.com within reach of New York’s sales…

New UK Law May Shut Down the Biggest Tax Havens — Aside from the U.S.

May 2, 2018 • By Steve Wamhoff

The United Kingdom’s parliament has enacted a new law requiring its overseas territories — which include notorious tax havens like Bermuda, the Cayman Islands, and the British Virgin Islands — to start disclosing by 2020 the owners of corporations they register. This could shut down a huge amount of offshore tax evasion and other financial crimes because individuals from anywhere in the world, including the United States. have long been able to set up secret corporations in these tax havens to stash their money.

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

No Need for the MythBusters, the Millionaire Tax Flight Myth is Busted Again

May 1, 2018 • By Dacey Anechiarico

One of the most repeated myths in state tax policy is called “millionaire tax flight,” where millionaires are allegedly fleeing states with high income tax rates for states with lower rates. This myth has been used as an argument in state tax debates for years but Cristobal Young argues in his book, “The Myth of the Millionaire Tax Flight,” that both Democrats and Republicans are “searching for a crisis that does not really exist,” and that there is no evidence to support this myth.

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

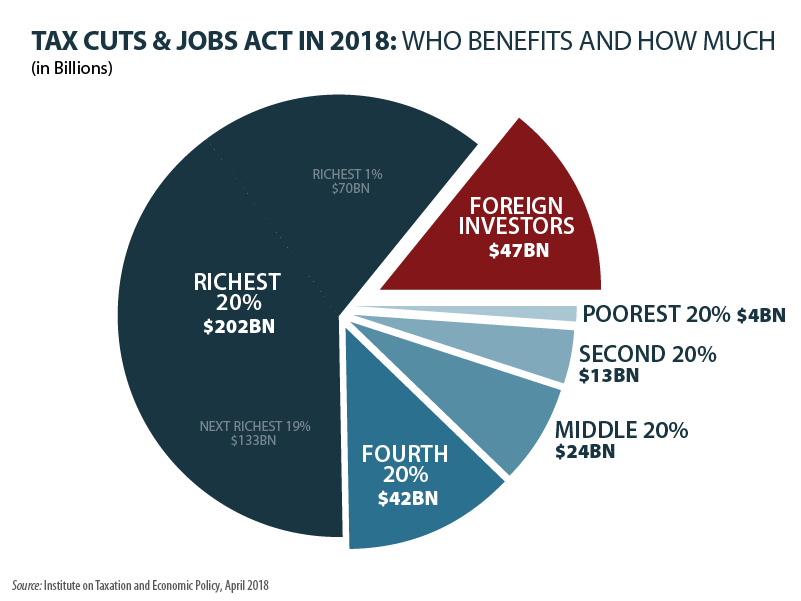

Congressional Budget Office: New Tax Law Helps Foreign Investors Even More than You Thought

April 19, 2018 • By Steve Wamhoff

President Trump and his allies in Congress have made many wild claims about economic growth that would result from the Tax Cuts and Jobs Act. And the Congressional Budget Office just released a report revealing the TCJA will, in fact, create economic growth — for foreign investors.

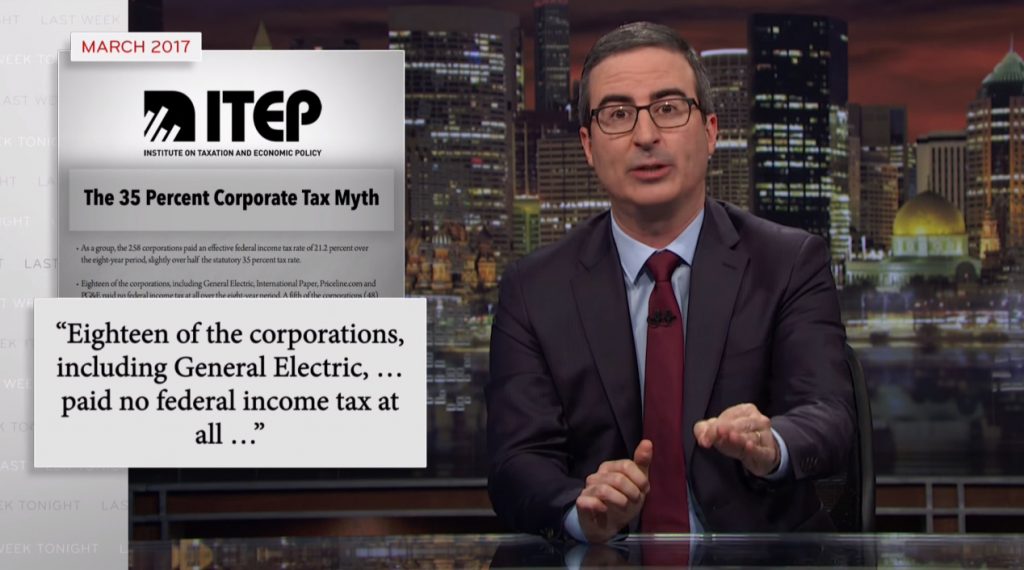

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

Many Large Corporations Reporting Tax Cut-Inspired Employee Bonuses Were Paying Low Tax Rates to Begin With

April 12, 2018 • By Matthew Gardner

Since the corporate tax cut took effect at the beginning of 2018, a number of large corporations have announced plans to give bonuses or pay raises to some of their employees. Some of these companies have explicitly said that the new tax law, which sharply reduced the federal corporate income tax rate from 35 to 21 percent, made these moves possible. But an examination of the tax-paying habits of these corporations found that many of them used various tax breaks and accounting maneuvers to reduce their tax rates to below 21 percent year after year before the new tax law…

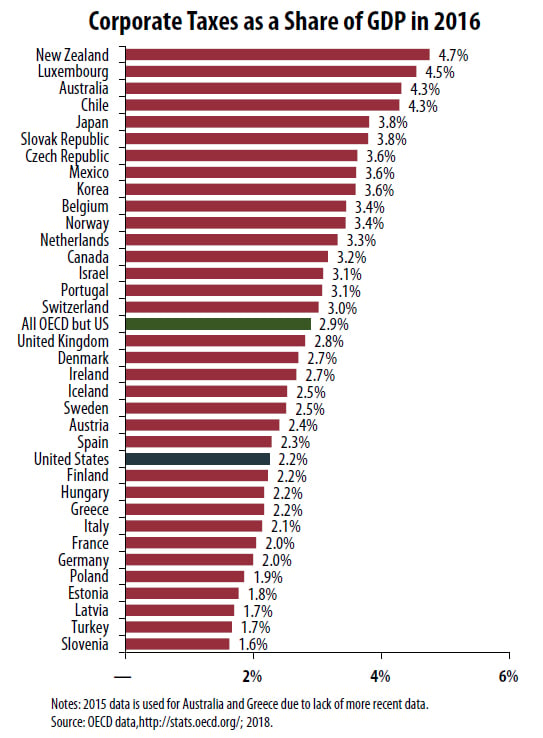

Trump Tax Cuts Likely Make U.S. Corporate Tax Level Lowest Among Developed Countries

April 11, 2018 • By Richard Phillips

U.S. corporate tax collection was equal to 2.2 percent of the nation’s gross domestic product (GDP) in 2016, significantly less than the average 2.9 percent collected by the other 34 other OECD countries for which data were available.

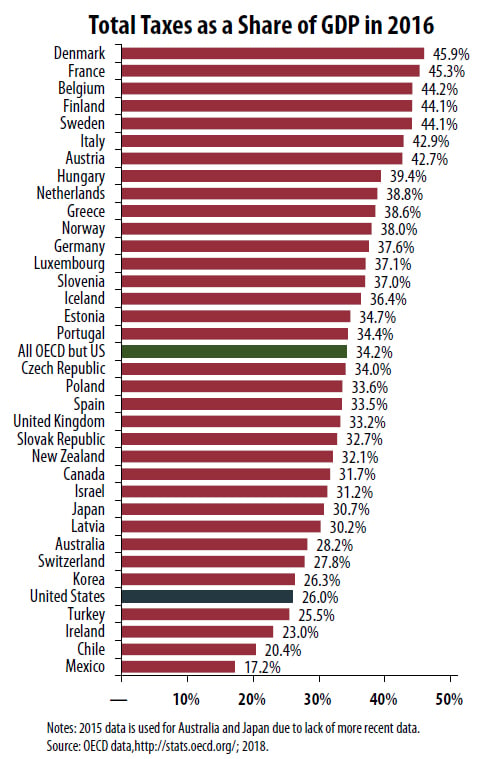

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed of the developed nations.

A Paul Ryan Retrospective: A Decade of Regressive Budget and Tax Plans

April 11, 2018 • By ITEP Staff

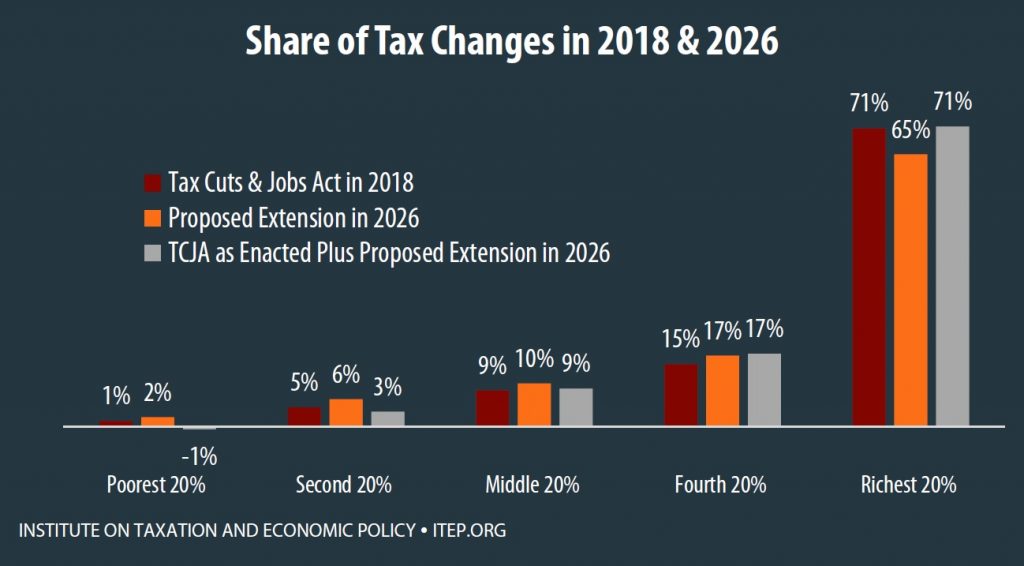

As Speaker of the House, Rep. Paul Ryan pushed through the Tax Cuts and Jobs Act that will cost at least $1.5 trillion and provide around half of its benefits to the richest five percent of households. He then announced that Congress needs to cut entitlements to get the budget deficit under control. Before becoming Speaker, Ryan spent several years running the Budget Committee and the Ways and Means Committee, where he issued budget and tax plans each year to carry out his goals (lower taxes for the rich and cuts in entitlement spending), which are described in the reports…

Fifteen (of Many) Reasons We Need Real Corporate Tax Reform

April 11, 2018 • By Matthew Gardner

This ITEP report examines a diverse group of 15 corporations’ federal income tax disclosures for tax year 2017, the last year before the recently enacted tax law took effect, to shed light on the widespread nature of corporate tax avoidance. As a group, these companies paid no federal income tax on $24 billion in profits in 2017, and they paid almost no federal income tax on $120 billion in profits over the past five years. All but one received federal tax rebates in 2017, and almost all paid exceedingly low rates over five years.

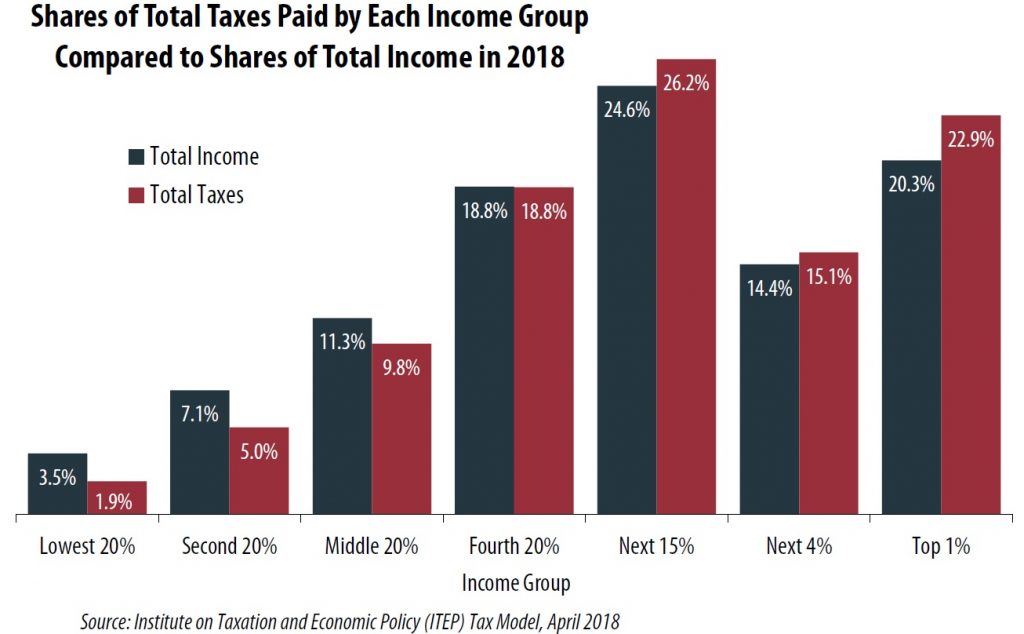

America’s tax system overall is marginally progressive. The share of all taxes paid by the richest Americans slightly exceeds their share of the nation’s income. Conversely, the share of all taxes paid by the poorest Americans is slightly smaller than the share of the nation’s income going to that group.

New ITEP Report: Extension of the Temporary TCJA Provisions Would Be Just as Regressive as TCJA Itself

April 10, 2018 • By Steve Wamhoff

A new ITEP report estimates the impacts in every state of the much-discussed idea of extending the temporary provisions in the Tax Cuts and Jobs Act, which will expire after 2025 without further action from Congress. The report concludes that extending or making permanent these provisions would be just as skewed to the wealthy as the original law.

Extensions of the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By Matthew Gardner, Steve Wamhoff

This analysis finds that extending the temporary tax provisions in 2026 would not be aimed at helping the middle-class any more than TCJA as enacted helps the middle-class in 2018.

Passing the Buck: Forcing Spending Cuts through a Balanced Budget Amendment

April 5, 2018 • By Ronald Mak

House leaders are preparing a vote on a balanced budget amendment next week that could force massive spending cuts and restrict the ability of lawmakers to raise revenue. Although a balanced budget amendment will likely be pitched as a way to address our nation’s long-term fiscal challenges, such proposals are economically harmful, ineffective, and one-sided.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

Unintended Consequences of the New Tax Bill Keep Cropping Up

March 23, 2018 • By Dacey Anechiarico

Due to its rushed passage in a matter of weeks, without public hearings or enough time even for basic proofreading, the Tax Cuts and Jobs Act (TCJA) contains numerous unintended consequences that Congress is now scrambling to fix. The authors of the new law have openly admitted that the law includes major mistakes. One of the most prominent drafting errors is what is now known as the “grain glitch,” which temporarily created a huge incentive for farmers to sell their products to cooperatives over businesses taking other forms.

The Heritage Foundation, the Institute on Taxation and Economic Policy (ITEP), and the Committee for a Responsible Federal Budget (CRFB) routinely disagree on a wide range of policy issues, but a recent Ways and Means Tax Policy Subcommittee hearing revealed they all agree that the continual and unpaid-for extension of temporary tax breaks needs to end.

ITEP Testimony on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

March 14, 2018 • By Richard Phillips

Statement of Richard Phillips, Senior Policy Analyst Institute on Taxation and Economic Policy Before the Committee on Ways and Means Subcommittee on Tax Policy Hearing on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut

March 14, 2018 • By Matthew Gardner

For the second time in seven months, President Trump will visit a Boeing factory to hype corporate tax cuts. He’s chosen the wrong poster child. If there was something preventing the aerospace giant from expanding its business before the Trump-GOP tax law, it certainly wasn’t taxes. Boeing made headlines in 2016 only because after years of paying zero in federal taxes, it finally paid something. Over 10 years (2008 to 2017), the company paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits.

The tobacco company Reynolds American announced this week that its full-time employees will receive a one-time bonus of $1,000 in the wake of a sharp reduction in its British parent company’s tax bill.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

Mnuchin’s Not So Grand Stand on the Carried Interest Loophole Explained

February 15, 2018 • By Matthew Gardner

When President Trump released the initial outline of his tax reform plan in April, carried interest repeal was nowhere to be found. And when Congress hammered out a tax plan in late December, lawmakers agreed to reduce the cost of the carried interest tax provision by about 5 percent. (Full repeal would have raised $20 billion over a decade; the enacted provision raises about $1 billion.)

A Gas Tax Hike Is the Obvious Answer to Infrastructure Funding

February 14, 2018 • By Steve Wamhoff

As part of his budget plan released Monday, President Trump offered an infrastructure proposal that he describes as a $1.5 trillion 10-year surge in infrastructure investments. The details of the proposal explain that the federal government would put up only $200 billion of this total, which the administration claims will be offset with cuts in other spending. Even this relatively meager funding amount is illusory because it would clearly be financed by cutting other federal spending — including infrastructure investments.