ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

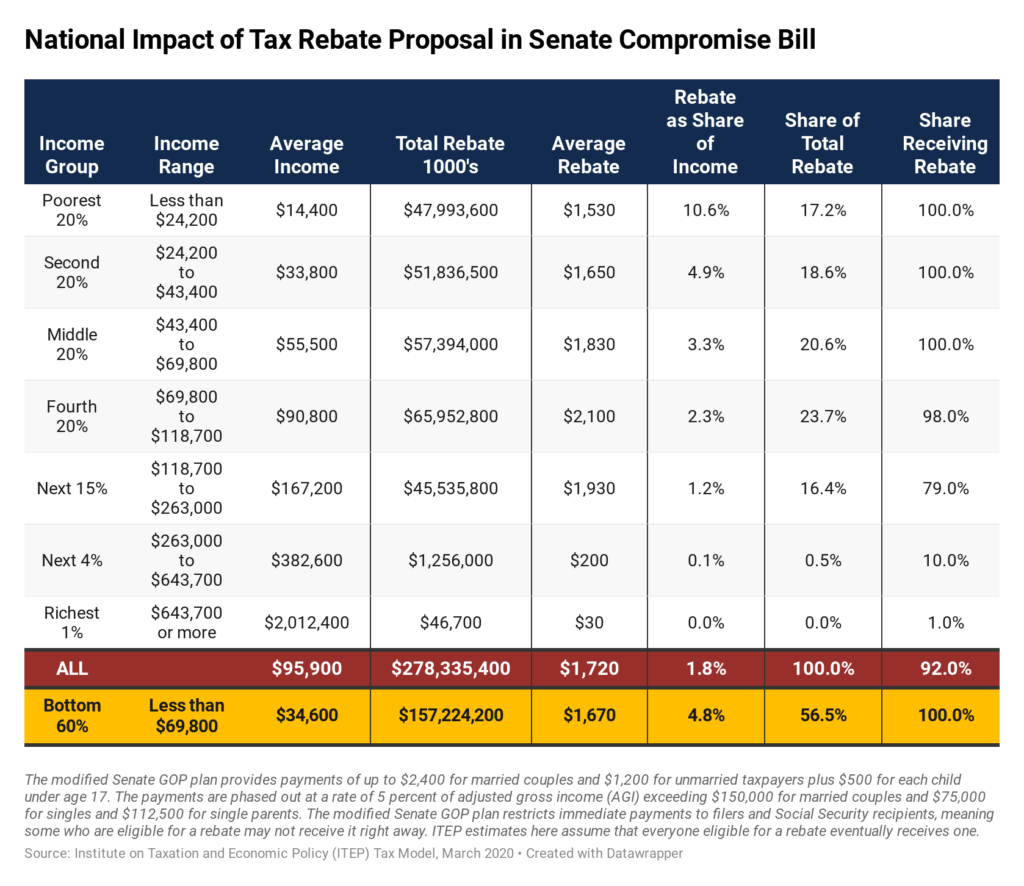

Data available for download Congress passed and the president signed a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. Though the bill improves on flaws in […]

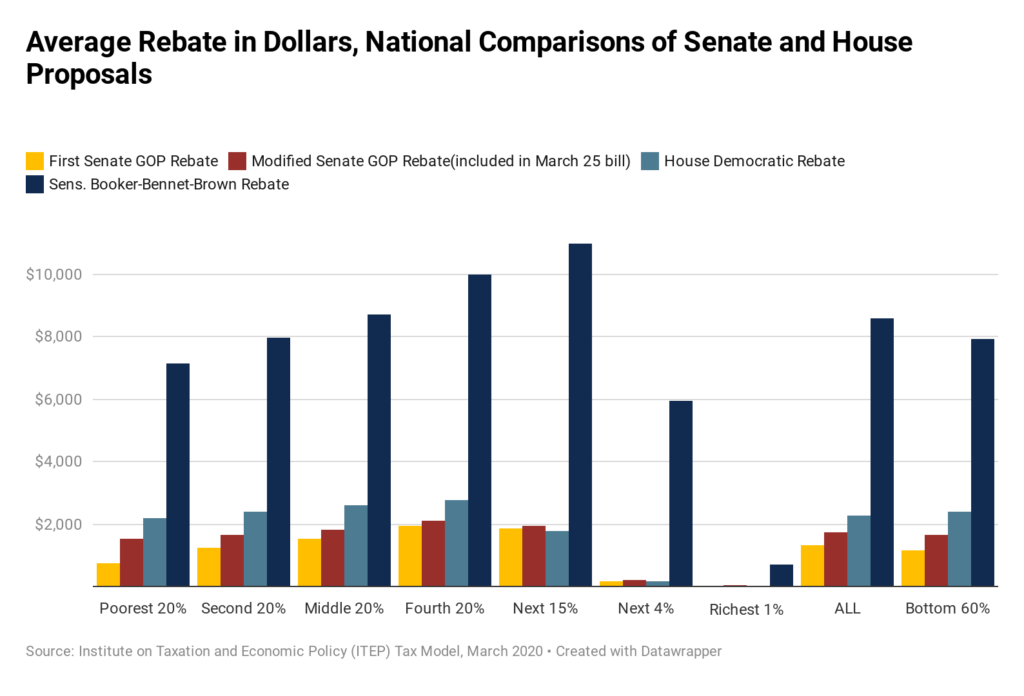

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…

New Analysis Shows Average Rebate for Families in the Stimulus Bill

March 25, 2020 • By ITEP Staff

The Senate agreed to a compromise stimulus bill last night that improves on flaws in its initial bill but still fails to go as far as other proposals and leaves out immigrants who file taxes via Individual Taxpayer Identification Numbers (ITIN), the Institute on Taxation and Economic Policy said today.

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

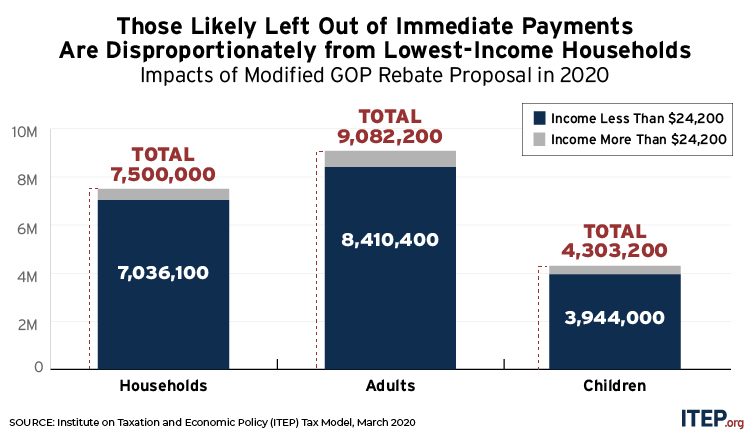

New Analysis: Revised GOP Stimulus Proposals Still Fails to Meet Critical Needs

March 23, 2020 • By ITEP Staff

Media Contact The revised GOP stimulus proposal still fails to do enough for struggling families while providing a no-strings-attached bailout to corporations, the Institute on Taxation and Economic Policy said today. ITEP today released an analysis of the revised plan. Among its key findings: The revised proposal could leave 7.5 million households without access to […]

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

New Analysis Compares Republican- and Democratic-Sponsored Proposals to Help Families and Individuals

March 20, 2020 • By ITEP Staff

Media Contact The economic stimulus bill released by Senate Majority Leader Mitch McConnell Thursday night would leave behind millions of adults and children and do little to help struggling families weather this current public health and economic crisis, the Institute on Taxation and Economic Policy (ITEP) said today. ITEP has released a new analysis that […]

It’s Time for Some State Fiscal Policy Triage

March 18, 2020 • By Carl Davis, Dylan Grundman O'Neill, ITEP Staff

The COVID-19 novel coronavirus’s effects on public health and economies at all scales are creating a daunting situation for state budgets as well. Lawmakers can choose and prioritize their responses through a straightforward approach similar to that taken by health professionals: marshal and reinforce available resources, triage response options to prioritize the most vital services and most vulnerable people, and enact or strengthen the policies that will help address longer-term issues as well as immediate emergencies.

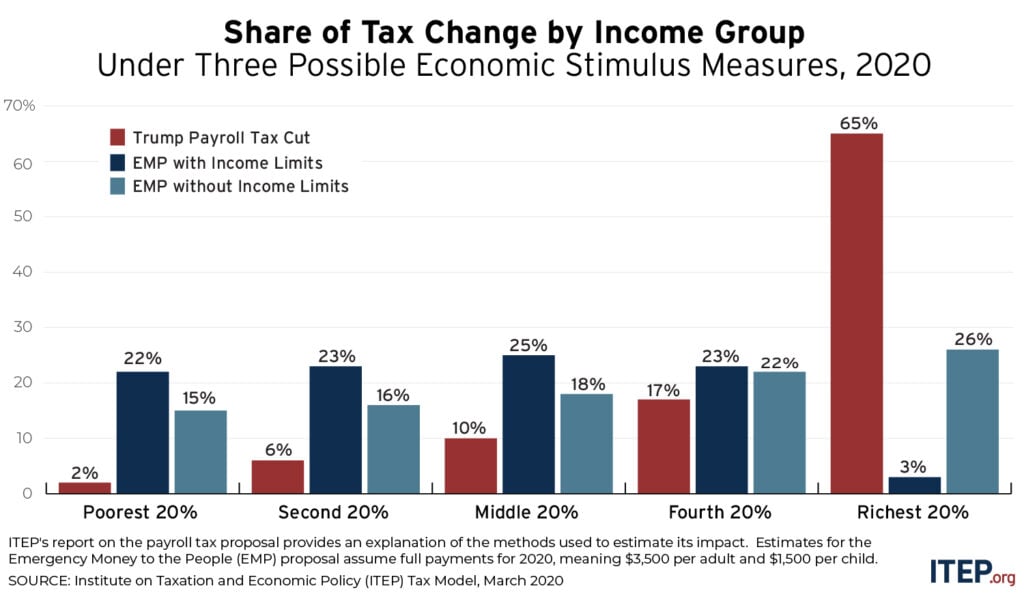

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

New ITEP Report on President’s Misguided Payroll Tax Proposal

March 13, 2020 • By Steve Wamhoff

Earlier this week, ITEP analyzed what would happen if Congress and the President repeated the 2 percentage-point cut in the Social Security payroll tax that was enacted for two years during the last recession. Little did we know that President Trump was about to propose something far more radical: eliminating all Social Security and Medicare […]

President Trump has proposed to eliminate payroll taxes that fund Social Security and Medicare through the end of the year. ITEP estimates that this would cost $843 billion and 65 percent of the benefits would go to the richest 20 percent of taxpayers, as illustrated in the table below.

An Overload of Pie Graphs and Metaphors for Pi Day

March 13, 2020 • By ITEP Staff, Jenice Robinson, Stephanie Clegg

For Pi Day, we’re doubling down on the pie metaphor to reiterate the compelling case for progressive tax policies to ensure more of us have an opportunity to share a slice of this nation’s economic pie.

ITEP Testimony on the Illinois Earned Income Credit

March 11, 2020 • By Lisa Christensen Gee

Read as PDF Testimony of Lisa Christensen Gee, Director of Special Initiatives, Institute on Taxation and Economic Policy Submitted to: Illinois House Revenue Committee Chairman Zalewski, committee members—thank you for holding this subject matter hearing this morning on the Earned Income Credit (EIC) and its importance for hard working Illinoisans and their families. My name […]

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.

Illinois ITIN Impact

March 10, 2020 • By ITEP Staff

Impact of Including Illinois ITIN Filers in State & Federal EITCs Based on IRS 2015 ITIN Filer Counts and Current EITC Policy Notes: ITIN filer counts represent estimate of EITC eligible ITIN filers in tax year 2015. All $s expressed in 2020. STATE EITC 2015 Assuming Full Participation EITC eligible ITIN Filers: 156,330 State EITC […]

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.

Some problems can only be solved when public officials have the resources to act. Today’s public health crisis is that kind of problem. Unfortunately, the Trump administration’s deep tax cuts leave our health infrastructure knee-capped, just when we need it most.

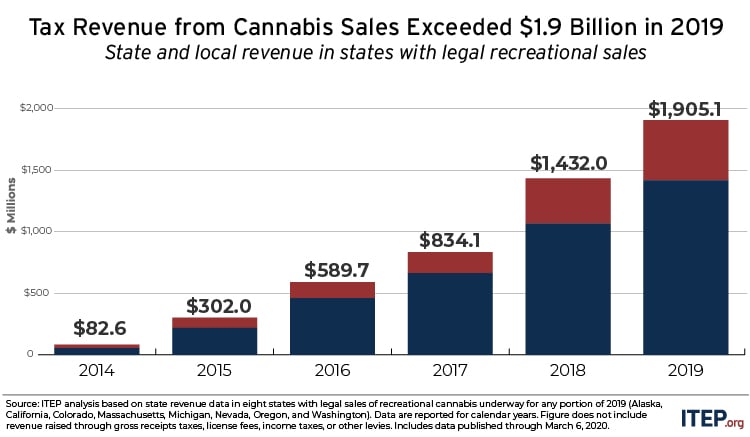

State and Local Cannabis Tax Revenue Jumps 33%, Surpassing $1.9 Billion in 2019

March 10, 2020 • By Carl Davis

Excise and sales taxes on cannabis raised more than $1.9 billion in 2019. This represents a jump of nearly half a billion dollars, or 33 percent, compared to a year earlier. These are the findings of an ITEP analysis of newly released tax revenue data from the eight states where legal sales of adult-use cannabis took place last year.

Alaska’s tax system underwent major changes in the 1970s when oil was found at Prudhoe Bay. Lawmakers repealed the state’s personal income tax (making Alaska the only state ever to do so) and began balancing the state’s budget primarily with oil tax and royalty revenue instead. But as oil prices and production levels have declined, a yawning gap has opened between state revenues and the cost of providing vital public services.

ITEP Testimony Regarding Connecticut Senate Bill 16, An Act Concerning the Adult Use of Cannabis

March 4, 2020 • By Carl Davis

This testimony explains the advantages of the cannabis tax structure proposed in Connecticut’s Senate Bill 16 and offers additional background information as well as ideas for potential changes to the bill.

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.