ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

West Virginia Center on Budget and Policy: House Income Tax Plan Benefits Wealthy and Could Punch Large Holes in State Budget

March 2, 2020

Once the fund reaches “an amount equal to or exceeding 2.5 times the total net reduction in personal income tax revenue collections that would have been received in that fiscal year if the income tax rates for that fiscal year had been reduced by 0.25 percent” it triggers a reduction in the state’s personal income […]

Chicago Resilient Families Task Force: EITC Expansion and Modernization

February 28, 2020

Expanding and modernizing the Earned Income Tax Credit will put more money back in the pockets of the people who need it most. Recent polling suggests such policies would be popular, with 70% of respondents supporting a modernized EITC statewide and 80% supporting such an effort in Chicago. Read more

Lawmakers should keep in mind that transportation funding woes can be traced to the federal government’s extremely outdated gas tax rate, which has not been raised in more than 26 years—not even to keep up with inflation.

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.

Commonwealth Institute: State Funding Proposals Include Regressive Tax Increases – Many without Offsets

February 21, 2020

Although many significant state (Virginia) tax policy bills filed for this year did not move beyond the committee level, several proposals remain under consideration. A large transportation funding package (HB 1414 and SB 890) and several standalone regional transportation funding bills have advanced from their respective chambers in the Virginia General Assembly. In addition, proposed […]

Hawai’i Budget and Policy Center: Hawai’i’s Earned Income Tax Credit: Next Steps

February 20, 2020

In 2017, Hawaiʻi passed legislation to create a state EITC.11 The new law allowed qualified taxpayers to claim a state tax credit beginning in 2018. The state tax credit amounts to 20 percent of the federal EITC but, unlike its federal counterpart, Hawaiʻi’s tax credit is not refundable. That is, if the filer owes less […]

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

West Virginia Center on Budget & Policy: Senate Tax Plan a Bad Deal for West Virginia

February 19, 2020

Senate Republicans unveiled their latest proposal to eliminate the business personal property tax this week, passing the proposal out of the Senate Finance Committee. The plan, which builds upon an earlier proposal to eliminate the property tax on manufacturing equipment, machinery, and inventory, would blow a nearly $100 million hole in the state budget, introduce inconsistency in […]

States Can Lead on Making the EITC Benefit More Young and Older Workers

February 18, 2020 • By Aidan Davis

The federal Earned Income Tax Credit (or EITC) lifts millions out of poverty each year, but it is not created equal for everyone. Childless workers under 25 and over 64 receive no benefit from the existing federal credit. In the absence of immediate federal action, states have led–and continue to lead–the way.

Expanding State EITCs: Age Enhancements and a Credit Increase for Workers without Children in the Home

February 18, 2020 • By Aidan Davis

For 45 years, the federal Earned Income Tax Credit (EITC) has benefited low- and moderate-income workers. Yet, throughout its history, the EITC has provided little or no benefit to workers without children in the home—a group that includes noncustodial parents whose children live the majority of the year with another parent.

Kentucky Center for Economic Policy: Tax Plan Would Fix Kentucky’s Budget Challenges by Addressing Upside Down Tax Code

February 13, 2020

Kentucky’s current tax system lets those with the greatest ability to pay taxes contribute the least as a share of their income. A study by the Institute on Taxation and Economic Policy shows that low- and middle-income people pay between 9.5% and 11.1% of their income in total state and local taxes, while the top 1% pay […]

GBPI: Georgia Leaders Face Choice Between Tax Cuts for High Income Earners and Funding Key State Priorities

February 12, 2020

Twelve days into the 2020 session of the Georgia General Assembly, legislators voted to take a week-long break from regular business to allow extra time for deliberations over Georgia’s fiscal priorities and annual appropriations bills. State leaders continue to express concerns over Gov. Kemp’s executive budget proposals, which include the first mandatory agency budget cuts […]

ITEP Testimony In Support of H.B. 222 Income Tax Rates – Capital Gains Income & H.B. 256 Maryland Estate Tax – Unified Credit

February 12, 2020 • By Kamolika Das

Read as PDF Testimony of Kamolika Das, State Policy Analyst, Institute on Taxation and Economic Policy Submitted to: Ways and Means Committee, Maryland General Assembly Thank you for this opportunity to submit testimony. My name is Kamolika Das, and I represent the Institute on Taxation and Economic Policy (ITEP), a non-profit, non-partisan research organization that […]

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

Kamolika Das

February 10, 2020 • By ITEP Staff

Kamolika monitors trends in state tax policy and supports state researchers and advocates. She primarily focuses on the South and mid-Atlantic regions. Before joining the team in 2020, Kamolika promoted progressive affordable housing and workforce development policies at the local level in the District of Columbia.

Marco Guzman

February 10, 2020 • By ITEP Staff

Marco provides research and analysis to help support state policymakers across the country, including in many of the Great Plains states and Southwest. Prior to joining ITEP in 2020, Marco spent more than four years providing commentary and tracking state tax news as an associate editor with Tax Notes.

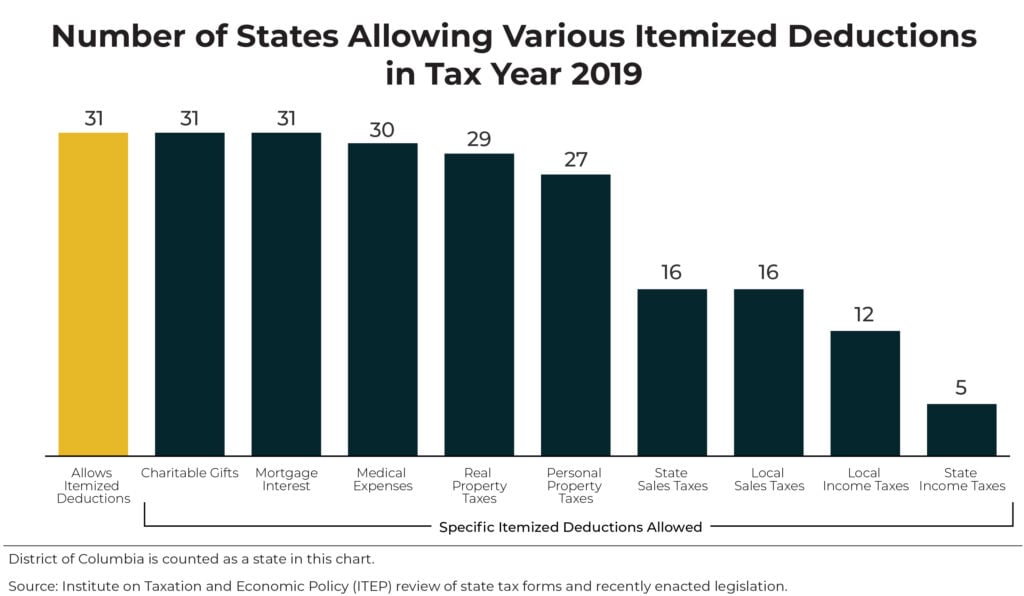

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

If President Trump puts forth another tax proposal this year, as he is hinting, it will be his third. The second round, already costing the U.S. Treasury billions, was implemented largely out of the public’s view.

Washington Is Finally Having the Right Conversation about Taxes

February 4, 2020 • By Amy Hanauer

Presidential candidates and some elected officials are finally talking about bold tax policy ideas that would increase taxes and raise revenue. This is a dramatic shift from when a radical, right-wing narrative dominated the public debate. Republicans redefined “fiscal responsibility” as fewer taxes and less government, peddled supply-side economic theories, and denied the clear evidence that tax cuts were adding to our nation’s deficits.

From 0% to 1.2%: Amazon Lauds Its Minuscule Effective Federal Income Tax Rate

January 31, 2020 • By Matthew Gardner

If we focus on the taxes the company paid in 2019, we see an effective federal income tax rate of just 1.2 percent. And since the company enjoyed federal income tax rebates in 2017 and 2018, this means that over the last three years Amazon has paid zero on $29 billion of U.S. pretax income.

Massachusetts Budget and Policy Center: The Gas Tax: What it is and Who Pays

January 31, 2020

Data from the Institute on Taxation and Economic Policy (ITEP) detail how the current system of state and local taxes in Massachusetts is regressive, largely because the state uses a flat income tax rate and relies heavily on sales taxes. The chart above shows how an increase in the gas tax would make Massachusetts taxes […]

Florida Policy Institute: Earned Income Tax Credit Crucial for Working Families

January 31, 2020

State EITCs are better targeted to people with low income than blanket tax exemptions, so they help to reduce the disproportionate impact of sales and excise taxes. According to new data from the Institute on Taxation and Economic Policy, a state EITC at 30 percent of the federal credit would reduce the share of income […]

Alabama Arise: End Alabama’s state grocery tax and protect school funding

January 30, 2020

How to untax groceries without costing education a dime It’s crucial to replace the grocery tax revenue without hurting the people who would benefit most from the tax’s elimination. Fortunately, Alabama has a way to untax groceries while protecting both struggling families and education funding. That solution would be to end an unusual tax loophole […]

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.