ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Tax Justice and Racial Justice: Transformative Change Is Overdue

June 16, 2020 • By Amy Hanauer, ITEP Staff

Progressive tax policy can spur deep investments in communities, help families afford childcare and college, provide healthcare for everyone, re-imagine energy consumption to stop heating the planet, expand parks and bike lanes and public transit. Economic justice can give workers a greater voice than corporations in our democracy. People are protesting because the moment for transformative change in policing and our economy is long overdue.

Crain’s New York Business: Legalizing Marijuana Can’t Cure Inequality, But It Will Ease Budget Crisis

June 14, 2020

My methodology is informed by the work of Carl Davis, research director at the Institute on Taxation and Economic Policy, who recently published a thoughtful blog post on per-capita cannabis excise tax collections. Davis found that last year more than $1.9 billion of tax revenue was collected across seven adult-use states (Alaska, California, Colorado, Massachusetts, Nevada, Oregon, […]

Most people assume that the federal government is the main—if not only—agent for ensuring economic stability and recovery in response to COVID. Yet, the fight for tax fairness at the state level will have a dramatic impact on economic recovery.

New Jersey Policy Perspective: Road to Recovery: Reforming New Jersey’s Income Tax Code

June 9, 2020

A sensible way to address revenue shortfalls and an unfair tax code is to raise income taxes on the state’s wealthiest households. By reforming New Jersey’s income tax, our recovery can be strengthened by reducing the tax burden that low-paid and middle class families pay, while generating more revenue for public programs and services that […]

POLITICO: States Move Cautiously in Contending With Huge Budget Gaps

June 5, 2020

“This crisis is still in its very early stages,” said Carl Davis of the Institute on Taxation and Economic Policy. Davis noted that the last recession began in December 2007, about nine months before the global financial system really imploded. And yet, many state tax increases didn’t happen until 2009 or even later as they […]

White House Incredibly Still Believes Tax Cuts Are the Answer to America’s Problems

June 2, 2020 • By Steve Wamhoff

White House officials continue to discuss tax cuts in response to the COVID-19 pandemic. Steve Wamhoff provides a roundup of these terrible ideas that would do little to boost investment or reach those who need it most.

Depreciation Breaks Have Saved 20 Major Corporations $26.5 Billion Over Past Two Years

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

The Trump administration and its congressional allies have proposed making permanent the expensing provision in the Trump-GOP tax law. Expensing is the most extreme form of accelerated depreciation, which allows businesses to deduct the cost of purchasing equipment more quickly than it wears out. But expensing and other types of accelerated depreciation already account for a very large share of corporate tax breaks and allows many companies to pay nothing at all.

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

Minneapolis Star Tribune: Minnesota Companies Cashing in on CARES Act Business Tax Breaks

June 2, 2020

Other taxation watchdogs call it a windfall, and one that disproportionately benefits large companies with volatile earnings, not the neighborhood auto shop or hair salon whose business vanished in the wake of COVID-19. Plus, unlike the Paycheck Protection Program, which has limits on how the loans can be used in order for the loan to […]

Salon.com: About 75% of Trump’s Proposed Coronavirus Capital Gains Tax Cut Would Go to the Top 1% of Earners

May 30, 2020

Steve Wamhoff, the director of federal tax policy at the liberal-leaning Institute on Taxation and Economic Policy (ITEP), argued that “proponents of capital gains tax breaks have always offered a weak argument that they encourage investment” but Trump’s proposal is more dubious given that it is only a temporary cut. A temporary cut “is supported […]

Trump Administration Stops Pretending to Care About the Economy with Its Capital Gains Tax Proposal

May 28, 2020 • By Steve Wamhoff

Proponents of capital gains tax breaks have always offered a weak argument that they encourage investment and thereby grow the economy. But the Trump administration is now floating a temporary capital gains tax break, which is supported by no argument at all. It would only reward investments made in the past while doing nothing to encourage new investment.

Yahoo Finance: Biden Hits Amazon on Taxes, Which May Benefit From the Coronavirus Outbreak

May 22, 2020

While the numbers prove its savviness for capitalizing on advantages under the U.S. Tax Code, newly available deductions under the CARES Act make tax savings even more accessible. And with the windfalls, tax experts believe Amazon appears positioned to reduce its federal tax liability to at or near zero, again, in 2020. “I’d say their […]

Washington State Budget and Policy Center: It’s time to include undocumented immigrants in state response to COVID-19

May 21, 2020

In addition to state and local taxes, new estimates show that the labor of undocumented workers in Washington state has resulted in nearly $400 million of contributions to the state and federal unemployment trust fund over the past ten years. Yet these workers are systematically denied protection when they become unemployed. Read more

The Health Economic Recovery and Omnibus Emergency Solutions (HEROES) Act includes important changes to business tax provisions in the CARES Act, the most recent COVID-19 legislation enacted by Congress and the president. The House-passed plan would undo CARES Act changes that make it easy for businesses to claim losses to reduce or avoid all taxes. […]

JPMorgan Chase CEO Jamie Dimon, in a May 19 memo to employees, outlines steps the company is taking to help its customers, small businesses and communities stay afloat. The part of the public relations memo that has received the most attention, however, is Dimon’s call for “rebuilding a more inclusive economy.” “It is my fervent […]

Major Cash Payment and Tax Provisions in the HEROES Act

May 15, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

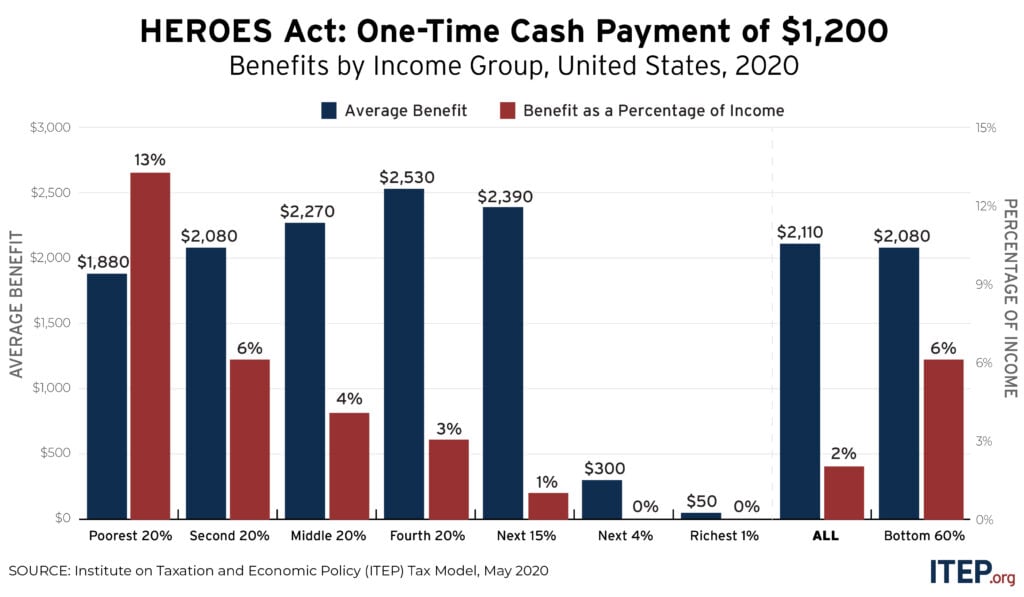

The major provisions for cash payments and tax changes in the House Democrats’ Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act would provide nearly $600 billion to individuals and households and average benefits of more than $3,000 to families in all but the highest income levels.

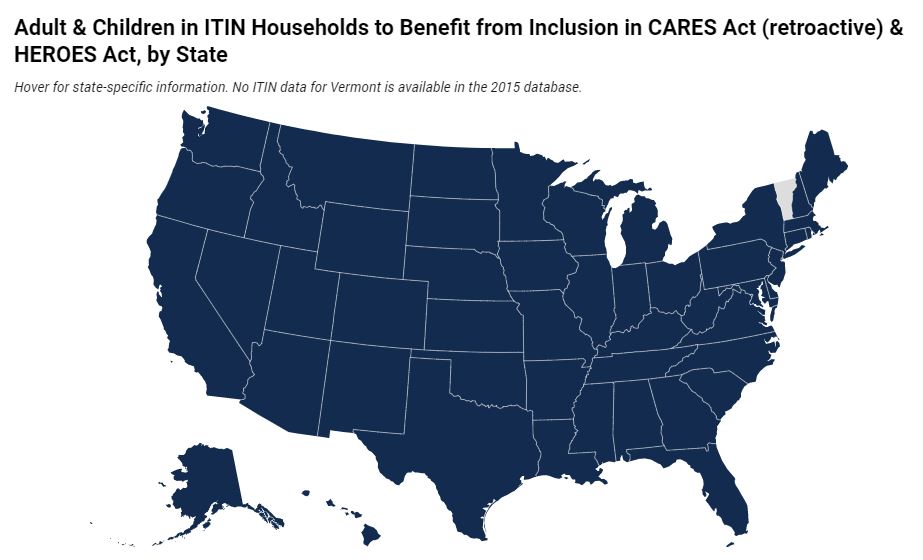

The HEROES Act, filed by the House Democrats this week, includes a new one-time payment of $1,200 per adult and child and extends the payment to ITIN filers and their families. The bill also includes a retroactive change to the CARES Act ensuring ITIN filers will also receive the initial payment under the CARES Act. ITEP estimates more than 4.3 million adults and 3.5 million children would benefit from this change.

Fiscal Policy Institute: Unemployment Insurance Taxes Paid for Undocumented Workers in NYS

May 14, 2020

In the midst of a pandemic, there has been a growing call for undocumented immigrants, who make up five percent of the New York State labor force, to be covered by some form of unemployment insurance. What is often overlooked in discussions of unemployment insurance is the extent to which undocumented immigrants are already part […]

House Democrats today introduced a proposal that responds to our staggering economic crisis with the right policies at the necessary scale. It’s a refreshing change from some of the misdirected ideas that have passed or been floated in these alarming economic times.

Which Workers Wouldn’t Be Helped by a Payroll Tax Cut?

May 8, 2020 • By Jessica Schieder, Lorena Roque

New data released today estimates 20.5 million jobs were lost in the month of April alone. Workers not currently receiving paychecks would be left out of any benefits provided by a payroll tax cut.

Harris-Sanders-Markey Cash Payment Proposal Would Dwarf Checks Sent Under the CARES Act

May 8, 2020 • By Steve Wamhoff

Sens. Kamala Harris, Bernie Sanders and Edward Markey released a proposal to provide a monthly payment of $2,000 for each member of a household (including up to three dependents), with benefits phased out at income levels starting at $200,000 for married couples. The proposal is partly a response to concerns that one-time cash payments under the CARES Act, which amount to $1,200 ($2,400 for married couples) and $500 for each child under age 17, are not sufficient to help families make ends meet or boost the economy.

ITEP: White House Seeks to Exploit COVID-19 Crisis to Enact Unpopular Tax Cuts

May 6, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the Trump administration’s musings to respond to the COVID-19 health and economic crisis with tax cuts.

Trump’s Latest Tax Break Proposals Include Everything—Except Helping Regular People

May 6, 2020 • By Steve Wamhoff

None of the tax proposals considered by the administration would provide help to those who need it or do much, if anything, to boost investment.

Trump’s Payroll Tax Cut Makes Even Less Sense as Job Losses Mount

May 5, 2020 • By Steve Wamhoff

Last August, long before COVID-19 ravaged the U.S. economy, the Trump Administration began touting a payroll tax cut as a stimulus. Now, with more than 30 million official unemployment claims and projections that the jobless rate could grow to Depression-era levels, the White House is claiming that a payroll tax cut is the best way […]

There is every reason to believe that Amazon will continue its tax-avoidance ways in 2020. The entirely-legal tax avoidance tools the company used to zero out its federal income tax bills over the last three years remain entirely legal today. From accelerated depreciation to the research and development tax credit to the deduction for executive stock options, Amazon’s tax avoidance tools have been blessed by lawmakers, and presidents, of all stripes.