ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Reuters: Analysis: Despite Republican Opposition, Red States Fare Well in Biden’s COVID-19 Bill

March 10, 2021

The Biden bill also expands tax breaks for children and low-income workers to encompass poor households that did not qualify before. Experts say the expanded child tax credit alone could cut child poverty nearly in half. “That’s a big deal,” said Steve Wamhoff of the left-leaning Institute on Taxation and Economic Policy, which analyzed the […]

Washington Post: Yes, the Covid Rescue Bill Is a ‘Liberal Wish List.’ What’s Wrong With That? (Opinion)

March 10, 2021

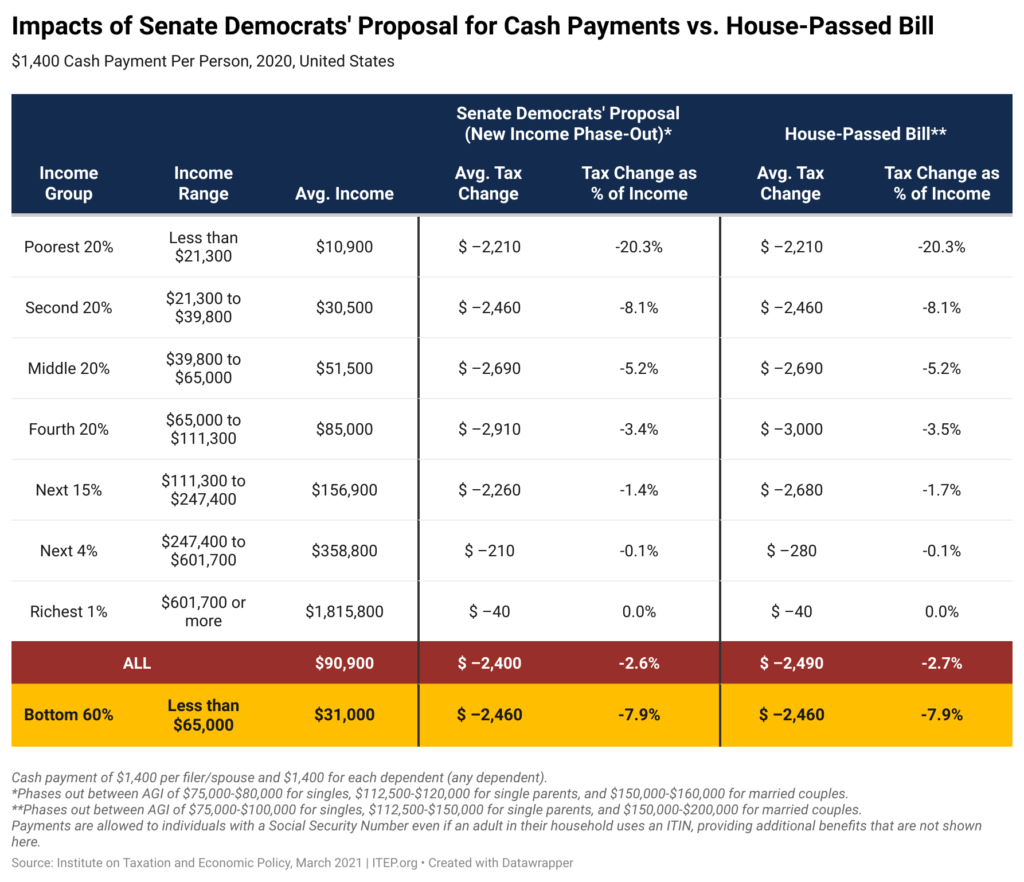

Indeed, the design of the bill is such that the benefits are spread among poor and middle-class people, while giving little or nothing directly to the wealthy (though the rich will certainly benefit from a quicker recovery). As an analysis from the Institute on Taxation and Economic Policy demonstrates, the direct benefits “are spread evenly […]

Kiplinger: Congress Passes Bill with More “Targeted” Stimulus Payments

March 10, 2021

However, the stimulus check plan in the original version of the bill is different than what’s found in the final bill. While in the Senate, a more aggressive stimulus check “phase-out” (i.e., reduction) rate was added. The new rate made the stimulus check provisions more “targeted” to people who need assistance the most. As a […]

Los Angeles Times: House Sends $1.9-trillion COVID-19 Economic Relief Bill to Biden’s Desk

March 10, 2021

The checks are phased out quickly compared to the previous checks Congress approved last year. Individuals with annual incomes of $80,000 or more, joint filers with annual incomes of $160,000 or more and heads of households earning $120,000 or more would not receive anything. The Institute on Taxation and Economic Policy, a progressive research group, estimates […]

American Rescue Plan Uses Government Muscle to Tackle Big Economic Problems

March 10, 2021 • By Amy Hanauer

Media contact Following is a statement by Amy Hanauer, executive director of The Institute on Taxation and Economic Policy, regarding the American Rescue Plan, which has cleared both houses of Congress and President Biden is expected to sign. “The American Rescue Plan is a monumental first step toward President Joe Biden’s pledge to build back […]

BuzzFeed: Congress Just Passed Another Round Of COVID Checks And Unemployment Aid

March 10, 2021

The Institute on Taxation and Economic Policy found that 83 million children live in households that will benefit [from the Child Tax Credit expansion]. Currently, the families with the lowest incomes are excluded from receiving this support due to a lack of taxable income. The COVID bill rewrites that language so that families with the […]

Philadelphia Inquirer: The New Coronavirus Relief Bill Promises Big Financial Help for Parents in the Philly Region

March 10, 2021

Combining the relief checks and tax credits, people in the bottom 60% of earners, those making less than $65,000, would see an 11% jump in income, according to the liberal Institute on Taxation and Economic Policy. Those with families would see the largest benefits. Read more

Forbes: Here’s Everything You Need To Know About The New Expanded Child Tax Credit

March 10, 2021

83 million. That’s how many children live in households that will benefit from the expanded credit, according to the Institute on Taxation and Economic Policy. The expansion would send about $116 billion to families with children in 2021, the ITEP estimates. Read more

CNBC: Stimulus Checks and Expanded Tax Credits

March 10, 2021

Between stimulus checks and expanded tax credits in the latest Covid-relief package, most U.S. households are poised to get some extra cash. The amount? An average of $3,450 for the bottom 60% of earners ($65,000 or less), according to research from the Institute on Taxation and Economic Policy. The number reflects direct stimulus payments and […]

San Francisco Chronicle: California Schools, Governments and Residents to Get Billions in COVID Stimulus

March 9, 2021

The bill includes another round of direct stimulus payments to Americans. The nonpartisan Institute on Taxation and Economic Policy estimates that 22 million adults and 9 million children in California will benefit from the $1,400 checks. The bill also expands the child tax credit from $2,000 per year to $3,000 for children over the age […]

Mississippi Today: Study: House Tax Proposal Increases Burden on Poor Mississippians

March 9, 2021

The bottom 60% of Mississippi’s income earners would be paying more taxes under legislation that has passed the House while the top 40% would be paying less, according to an analysis conducted by a Washington, D.C.-based policy think tank. A person in the top 1% with average income of $924,000 would pay $28,610 less in […]

CNET: Child Tax Credit 2021 Approval Could Bring More Money Than Stimulus Checks. What to Know

March 9, 2021

For the bottom 20% of families in terms of income, the proposed expansion of the CTC would increase income by an average of 9.7% — even higher if you consider only tax filers with children, according to the Institute on Taxation and Economic Policy. The proposal would also lift 4.1 million children above the poverty line, […]

Washington State Budget & Policy Center: Why Now Is the Time to Pass a Tax on Extraordinary Profits

March 8, 2021

Members of the Washington State Senate have an historic opportunity to create a more just state tax code while bolstering and sustaining our state’s fiscal and economic recovery long after federal recovery funds fade away. Senate Bill 5096 would create a new 7% excise tax on extraordinary profits from the sale of financial assets (capital […]

Fiscal Times: Biden’s Stimulus: What You Need to Know Now

March 8, 2021

What you need to know about the $1,400 “stimulus checks”: Individuals earning less than $75,000 and couple making less than $150,000 are eligible for the full $1,400 relief payments, plus an additional $1,400 per dependent. The payments phase out completely for individuals who earn more than $80,000 a year and married couples earning more than […]

Estimates of Cash Payment and Tax Credit Provisions in American Rescue Plan

March 7, 2021 • By Steve Wamhoff

Update: On March 10, the House passed the Senate version of the COVID relief bill, called the American Rescue Plan Act, and sent it to President Biden for his signature. This means that the Senate version of the bill described herein is the final legislation enacted into law.

West Virginia Center on Budget & Policy: Governor Justice’s Tax Plan Favors the Wealthy, While Creating Large Holes in the Budget

March 5, 2021

Governor Justice has finally unveiled his proposal to make sweeping changes to the state’s tax system, including a substantial cut to the state’s personal income tax, while raising a variety of sales and other taxes. The changes would be a dramatic shift in who pays state taxes in West Virginia, shifting the responsibility onto working […]

DC Fiscal Policy Institute: Tax Injustice: DC’s Richest Residents Pay Lower Taxes than Everyone Else

March 5, 2021

A tax system that adequately advances racial and economic justice must be progressive, requiring the richest people to pay a much higher share of their income in taxes than lower-income families who have little or no wiggle room in their family budget. Yet new findings from the Institute on Taxation and Economic Policy (ITEP), a […]

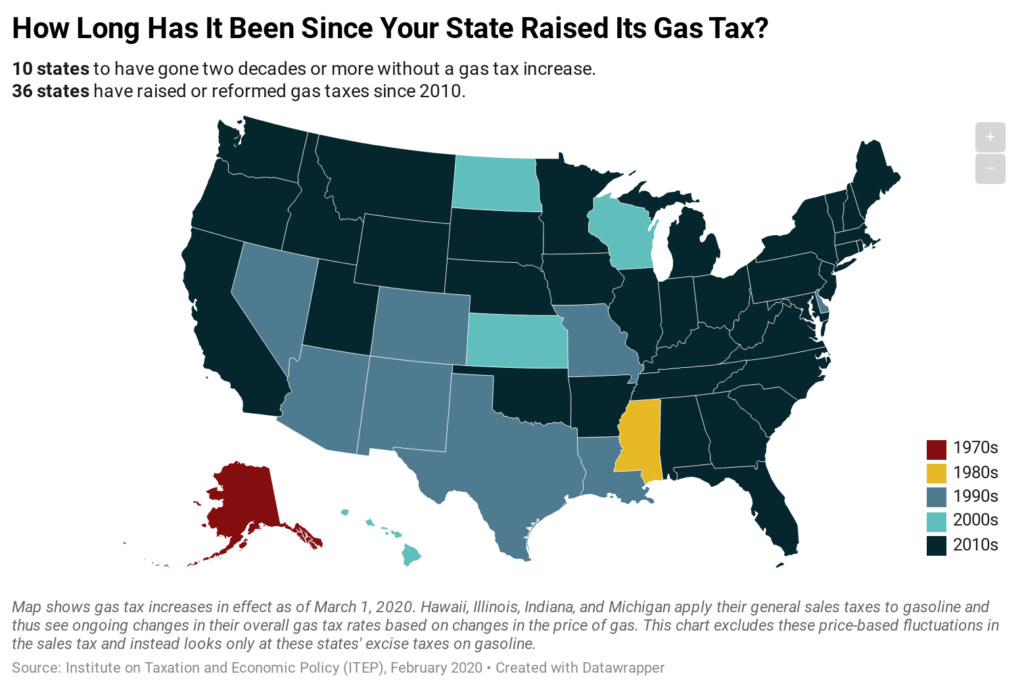

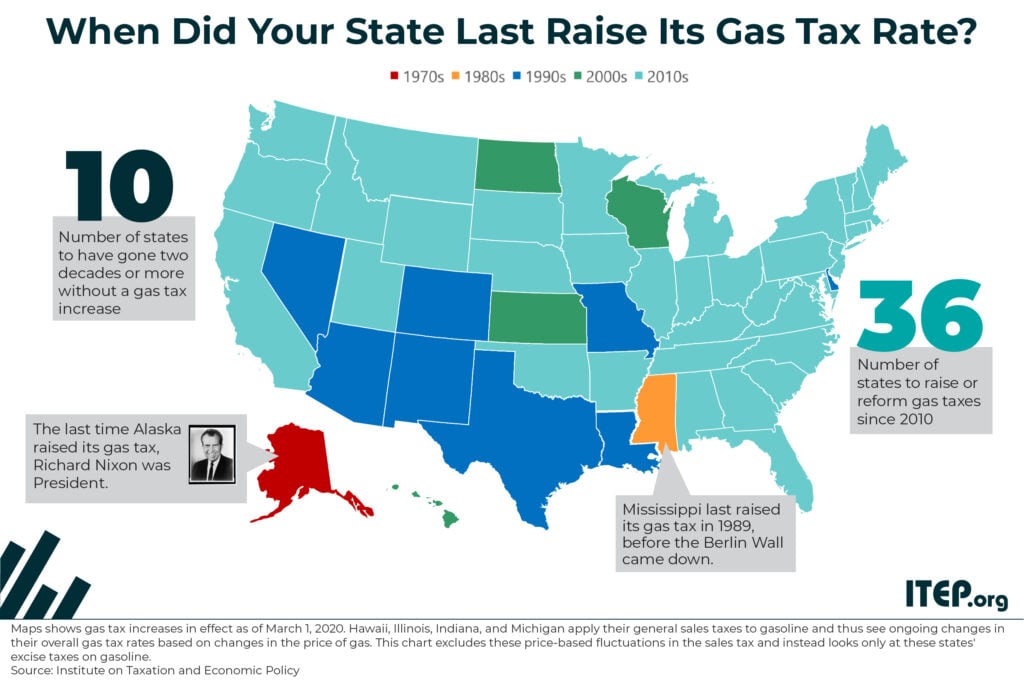

10 states to have gone two decades or more without a gas tax increase.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Bloomberg Tax: Mega-Rich and Plans to Tax Them Abound in Washington State

March 4, 2021

According to a Dec. 31 report from the bipartisan Tax Structure Work Group, the state’s system creates average tax burdens at 8.2% of total income for households with income between $17,000 and $30,000 a year, but the burden drops as incomes rise and is only 1.8% for households making more than $208,000. The Institute for […]

Florida Policy Institute: Florida Policymakers Need to Reassess How the Minimum Wage is Enforced

March 4, 2021

Finally, the state budget could take a hit if wage theft persists. Sales tax revenue as an effect of higher minimum wages is particularly relevant to highlight in Florida. The state lacks a personal income tax and over 75 percent of its general revenue fund is comprised of sales tax revenue. General revenue supports critical […]

As the Senate takes up the COVID relief bill passed by the House last week, Senate Democrats have proposed to lower the income level at which the $1,400 cash payments would be phased out. New estimates from ITEP demonstrate that, for most people, the change would make no difference.

Florida Policy Institute: State Resolution Could Result in $1.47 Billion in Lost Wages for Young Workers and Foregone Sales Tax Revenue for Florida

March 3, 2021

Florida, lacking a personal income tax, relies on sales tax revenue to support critical areas like education and health and human services. More than 75 percent of Florida’s General Revenue Fund, which finances most of these vital services, is comprised of sales tax revenue. Furthermore, Florida households are the highest contributors to sales tax collections, […]

Montana Budget & Policy Center: Policy Basics: Who Pays Taxes in Montana

March 3, 2021

Our tax dollars serve as shared investments in the programs and services that make our state a great place to live, work, and play. Tax dollars enable Montanans to work together for things we cannot achieve alone like a quality education for our children, the development and maintenance of infrastructure, public safety through police and […]

Senators and representatives can look to recent history—the 2007-2009 recession—for lessons on how to best address the current economic crisis. If we do too little, the economy will stay weak much longer, hurting all of us.